Initial Rate of Investment Return ($) Rate of Return on Incrementul Investment (%) When Compured with Alternative Investment Alternative (%) A 35,000 12 20 36 27 B 45,000 15 12 40 22 C 50,000 13 42 25 D 65,000 20 -5 E 80,000 18 28

Initial Rate of Investment Return ($) Rate of Return on Incrementul Investment (%) When Compured with Alternative Investment Alternative (%) A 35,000 12 20 36 27 B 45,000 15 12 40 22 C 50,000 13 42 25 D 65,000 20 -5 E 80,000 18 28

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.1.1MBA

Related questions

Question

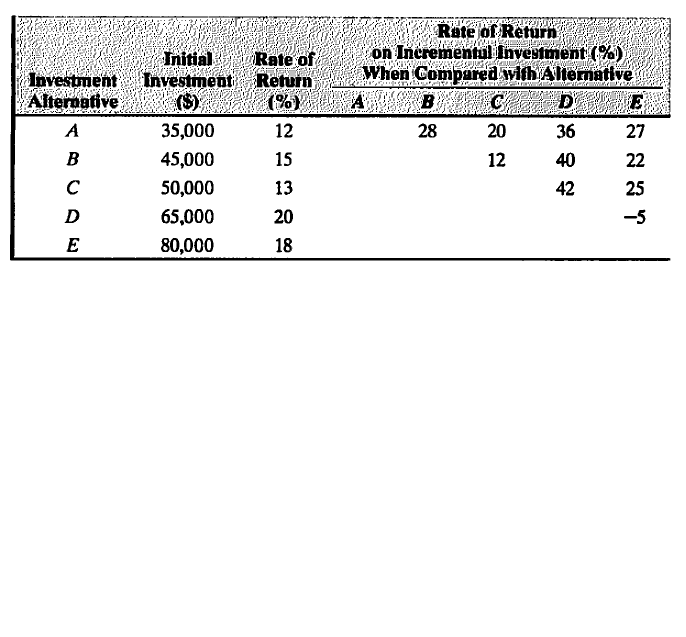

You are evaluating five investment projects. You have already calculated the

If all investment alternatives are mutually exclusive and the MARR is 12%,

which alternative should be chosen?

(a) D

(b)E

(c) B

(d) Do nothing

Transcribed Image Text:Initial Rate of

Investment Return

($)

Rate of Return

on Incrementul Investment (%)

When Compured with Alternative

Investment

Alternative

(%)

A

35,000

12

20

36

27

B

45,000

15

12

40

22

C

50,000

13

42

25

D

65,000

20

-5

E

80,000

18

28

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning