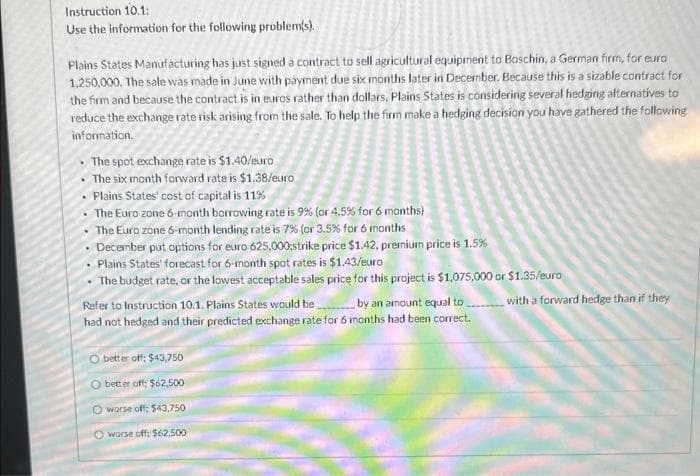

Instruction 10.1: Use the information for the following problem(s). Plains States Manufacturing has just signed a contract to sell agricultural equipment to Boschin, a German firm, for euro 1,250,000. The sale was made in June with payment due six months later in December. Because this is a sizable contract fo the firm and because the contract is in euros rather than dollars, Plains States is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help the firm make a hedging decision you have gathered the followin information. The spot exchange rate is $1.40/euro • The six month forward rate is $1.38/euro • Plains States' cost of capital is 11% • The Euro zone 6-month borrowing rate is 9% (or 4.5% for 6 months) The Euro zone 6-month lending rate is 7% (or 3.5% for 6 months December put options for euro 625,000;strike price $1.42, premium price is 1.5% Plains States' forecast for 6-month spot rates is $1.43/euro The budget rate, or the lowest acceptable sales price for this project is $1,075,000 or $1.35/euro Refer to Instruction 10.1. Plains States would be by an amount equal to had not hedged and their predicted exchange rate for 6 months had been correct. O better off: $43,750 O better off; $62,500 O worse off; $43,750 O worse off: $62,500 with a forward hedge than if they

Instruction 10.1: Use the information for the following problem(s). Plains States Manufacturing has just signed a contract to sell agricultural equipment to Boschin, a German firm, for euro 1,250,000. The sale was made in June with payment due six months later in December. Because this is a sizable contract fo the firm and because the contract is in euros rather than dollars, Plains States is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help the firm make a hedging decision you have gathered the followin information. The spot exchange rate is $1.40/euro • The six month forward rate is $1.38/euro • Plains States' cost of capital is 11% • The Euro zone 6-month borrowing rate is 9% (or 4.5% for 6 months) The Euro zone 6-month lending rate is 7% (or 3.5% for 6 months December put options for euro 625,000;strike price $1.42, premium price is 1.5% Plains States' forecast for 6-month spot rates is $1.43/euro The budget rate, or the lowest acceptable sales price for this project is $1,075,000 or $1.35/euro Refer to Instruction 10.1. Plains States would be by an amount equal to had not hedged and their predicted exchange rate for 6 months had been correct. O better off: $43,750 O better off; $62,500 O worse off; $43,750 O worse off: $62,500 with a forward hedge than if they

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 54QA

Related questions

Question

9

Transcribed Image Text:Instruction 10.1:

Use the information for the following problem(s).

Plains States Manufacturing has just signed a contract to sell agricultural equipment to Boschin, a German firm, for euro

1,250,000. The sale was made in June with payment due six months later in December. Because this is a sizable contract for

the firm and because the contract is in euros rather than dollars, Plains States is considering several hedging alternatives to

reduce the exchange rate risk arising from the sale. To help the firm make a hedging decision you have gathered the following

information.

The spot exchange rate is $1.40/euro

The six month forward rate is $1.38/euro

Plains States' cost of capital is 11%

• The Euro zone 6-month borrowing rate is 9% (or 4.5% for 6 months)

The Euro zone 6-month lending rate is 7% (or 3.5% for 6 months

December put options for euro 625,000;strike price $1.42, premium price is 1.5%

• Plains States' forecast for 6-month spot rates is $1.43/euro

• The budget rate, or the lowest acceptable sales price for this project is $1,075,000 or $1.35/euro

Refer to Instruction 10.1. Plains States would be

by an amount equal to

had not hedged and their predicted exchange rate for 6 months had been correct.

O better off: $43,750

better off; $62,500

O worse off; $43,750

O worse off; $62,500

with a forward hedge than if they

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning