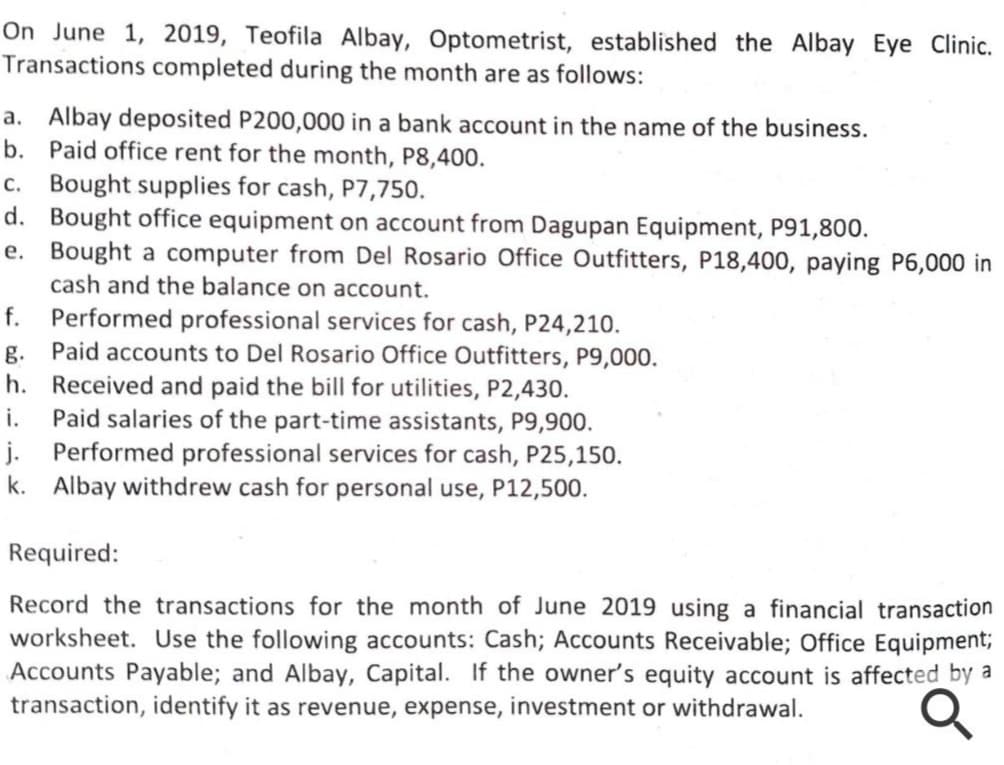

On June 1, 2019, Teofila Albay, Optometrist, established the Albay Eye Clinic. Transactions completed during the month are as follows: a. Albay deposited P200,000 in a bank account in the name of the business. b. Paid office rent for the month, P8,400. c. Bought supplies for cash, P7,750. d. Bought office equipment on account from Dagupan Equipment, P91,800. e. Bought a computer from Del Rosario Office Outfitters, P18,400, paying P6,000 in cash and the balance on account. f. Performed professional services for cash, P24,210. Paid accounts to Del Rosario Office Outfitters, P9,000. h. Received and paid the bill for utilities, P2,430. Paid salaries of the part-time assistants, P9,900. j. Performed professional services for cash, P25,150. k. Albay withdrew cash for personal use, P12,500. g. i. Required: Record the transactions for the month of June 2019 using a financial transaction worksheet. Use the following accounts: Cash; Accounts Receivable; Office Equipment; Accounts Payable; and Albay, Capital. If the owner's equity account is affected by a transaction, identify it as revenue, expense, investment or withdrawal.

On June 1, 2019, Teofila Albay, Optometrist, established the Albay Eye Clinic. Transactions completed during the month are as follows: a. Albay deposited P200,000 in a bank account in the name of the business. b. Paid office rent for the month, P8,400. c. Bought supplies for cash, P7,750. d. Bought office equipment on account from Dagupan Equipment, P91,800. e. Bought a computer from Del Rosario Office Outfitters, P18,400, paying P6,000 in cash and the balance on account. f. Performed professional services for cash, P24,210. Paid accounts to Del Rosario Office Outfitters, P9,000. h. Received and paid the bill for utilities, P2,430. Paid salaries of the part-time assistants, P9,900. j. Performed professional services for cash, P25,150. k. Albay withdrew cash for personal use, P12,500. g. i. Required: Record the transactions for the month of June 2019 using a financial transaction worksheet. Use the following accounts: Cash; Accounts Receivable; Office Equipment; Accounts Payable; and Albay, Capital. If the owner's equity account is affected by a transaction, identify it as revenue, expense, investment or withdrawal.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter1: Asset, Liability, Owner’s Equity, Revenue, And Expense Accounts

Section: Chapter Questions

Problem 1PA: On June 1 of this year, J. Larkin, Optometrist, established the Larkin Eye Clinic. The clinics...

Related questions

Question

Follow the instructions and do it nicely.

Transcribed Image Text:On June 1, 2019, Teofila Albay, Optometrist, established the Albay Eye Clinic.

Transactions completed during the month are as follows:

a. Albay deposited P200,000 in a bank account in the name of the business.

b. Paid office rent for the month, P8,400.

c. Bought supplies for cash, P7,750.

d. Bought office equipment on account from Dagupan Equipment, P91,800.

e. Bought a computer from Del Rosario Office Outfitters, P18,400, paying P6,000 in

cash and the balance on account.

Performed professional services for cash, P24,210.

g. Paid accounts to Del Rosario Office Outfitters, P9,000.

h. Received and paid the bill for utilities, P2,430.

Paid salaries of the part-time assistants, P9,900.

j. Performed professional services for cash, P25,150.

k. Albay withdrew cash for personal use, P12,500.

f.

i.

Required:

Record the transactions for the month of June 2019 using a financial transaction

worksheet. Use the following accounts: Cash; Accounts Receivable; Office Equipment;

Accounts Payable; and Albay, Capital. If the owner's equity account is affected by a

transaction, identify it as revenue, expense, investment or withdrawal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,