College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 10SPA

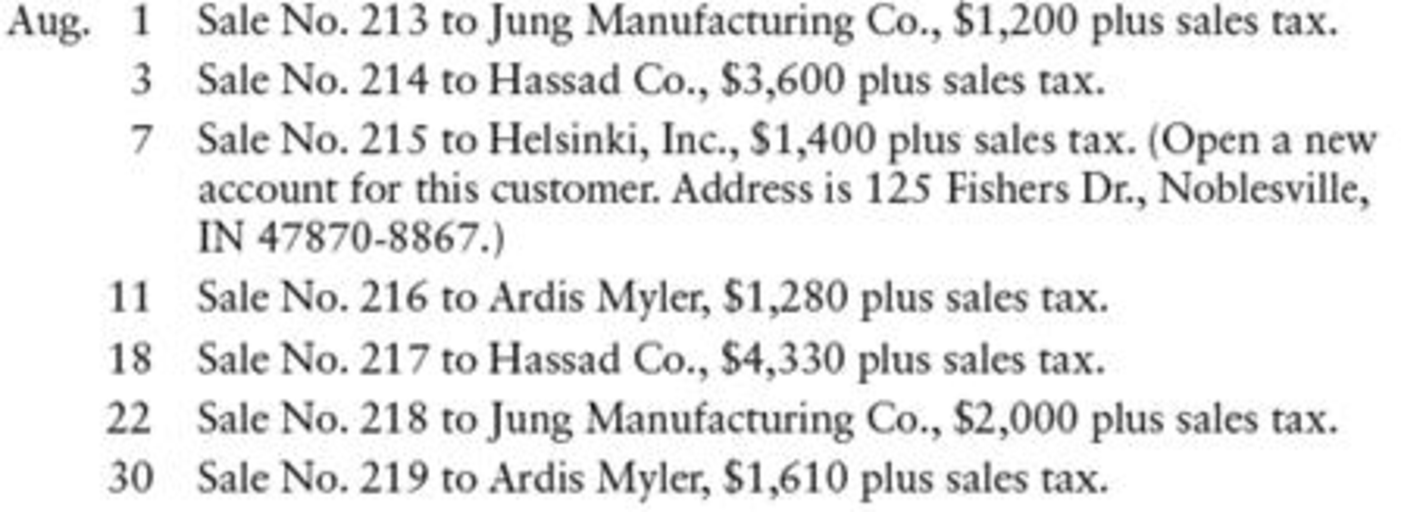

SALES TRANSACTIONS J. K. Bijan owns a retail business and made the following sales on account during the month of August 20--. There is a 6% sales tax on all sales.

REQUIRED

- 1. Record the transactions starting on page 15 of a general journal.

- 2. Post from the journal to the general ledger and

accounts receivable ledger accounts. Use account numbers as shown in the chapter.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 10 Solutions

College Accounting, Chapters 1-27

Ch. 10 - Prob. 1TFCh. 10 - All sales, for cash or on credit, can be recorded...Ch. 10 - Sales Tax Payable is a liability account that is...Ch. 10 - Prob. 4TFCh. 10 - Prob. 5TFCh. 10 - A credit sale of 250 plus a 6% sales tax would...Ch. 10 - When 25 of merchandise is returned for a credit on...Ch. 10 - Prob. 3MCCh. 10 - Prob. 4MCCh. 10 - Prob. 5MC

Ch. 10 - Prob. 1CECh. 10 - Prepare journal entries for the following sales...Ch. 10 - Prob. 3CECh. 10 - On March 24, MS Companys Accounts Receivable...Ch. 10 - Prob. 1RQCh. 10 - What is the purpose of a credit memo?Ch. 10 - Prob. 3RQCh. 10 - Prob. 4RQCh. 10 - Prob. 5RQCh. 10 - Prob. 6RQCh. 10 - What steps are followed in posting cash receipts...Ch. 10 - What steps are followed in posting cash receipts...Ch. 10 - Prob. 9RQCh. 10 - Prob. 1SEACh. 10 - SALES TRANSACTIONS AND T ACCOUNTS Using T accounts...Ch. 10 - Prob. 3SEACh. 10 - SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end...Ch. 10 - Prob. 5SEACh. 10 - JOURNALIZING SALES TRANSACTIONS Enter the...Ch. 10 - Prob. 7SEACh. 10 - JOURNALIZING CASH RECEIPTS Enter the following...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE From the accounts...Ch. 10 - SALES TRANSACTIONS J. K. Bijan owns a retail...Ch. 10 - Prob. 11SPACh. 10 - SALES AND CASH RECEIPTS TRANSACTIONS Sourk...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE Based on the...Ch. 10 - Prob. 1SEBCh. 10 - SALES TRANSACTIONS AND T ACCOUNTS Using T accounts...Ch. 10 - Prob. 3SEBCh. 10 - SALES RETURNS AND ALLOWANCES ADJUSTMENT At the end...Ch. 10 - Prob. 5SEBCh. 10 - JOURNALIZING SALES TRANSACTIONS Enter the...Ch. 10 - JOURNALIZING SALES RETURNS AND ALLOWANCES Enter...Ch. 10 - JOURNALIZING CASH RECEIPTS Enter the following...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE From the accounts...Ch. 10 - SALES TRANSACTIONS T. M. Maxwell owns a retail...Ch. 10 - CASH RECEIPTS TRANSACTIONS Color Florists, a...Ch. 10 - SALES AND CASH RECEIPTS TRANSACTIONS Paul Jackson...Ch. 10 - SCHEDULE OF ACCOUNTS RECEIVABLE Based on the...Ch. 10 - You and your spouse have separate charge accounts...Ch. 10 - Prob. 1ECCh. 10 - Geoff and Sandy Harland own and operate Wayward...Ch. 10 - Enter the following transactions in a general...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SALES TRANSACTIONS T. M. Maxwell owns a retail business and made the following sales on account during the month of July 20--. There is a 5% sales tax on all sales. REQUIRED 1. Record the transactions starting on page 15 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardSALES AND CASH RECEIPTS TRANSACTIONS Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax. REQUIRED 1. Record the transactions starring on page 7 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardSALES JOURNAL Futi Ishanyan owns a retail business and made the following sales during the month of August 20--. There is a 6% sales tax on all sales. Aug. 1Sale No. 213 to Jeter Manufacturing Co., 1,300, plus sales tax. 3Sale No. 214 to Hassan Co., 2,600, plus sales tax. 7Sale No. 215 to Habrock, Inc., 1,700, plus sales tax. (Open a new account for this customer. Address is 125 Fishers Dr., Noblesville, IN 478708867.) 11Sale No. 216 to Seth Mowbray, 1,400, plus sales tax. 18Sale No. 217 to Hassan Co., 3,960, plus sales tax. 22Sale No. 218 to Jeter Manufacturing Co., 2,800, plus sales tax. 30Sale No. 219 to Seth Mowbray, 1,900, plus sales tax. Required 1. Record the transactions in the sales journal starting with page 8. Total and verify the column totals and rule the columns. 2. Post from the sales journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forward

- CASH RECEIPTS TRANSACTIONS Color Florists, a retail business, had the following cash receipts during January 20--. The sales tax is 5%. REQUIRED 1. Record the transactions starting on page 20 of a general journal. 2. Post from the journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardSALES JOURNAL T. M. Maxwell owns a retail business and made the following sales during the month of July 20--. There is a 5% sales tax on all sales. July 1Sale No. 101 to Saga, Inc., 1,200, plus sales tax. 8Sale No. 102 to Vinnie Ward, 2,100, plus sales tax. 15Sale No. 103 to Dvorak Manufacturing, 4,300, plus sales tax. 21Sale No. 104 to Vinnie Ward, 1,800, plus sales tax. 24Sale No. 105 to Zapata Co., 1,600, plus sales tax. (Open a new account for this customer. Address is 789 N. Stafford Dr., Bloomington, IN 474016201.) 29Sale No. 106 to Saga, Inc., 1,450, plus sales tax. Required 1. Record the transactions in the sales journal. Total and verify the column totals and rule the columns. 2. Post the sales journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter.arrow_forwardSCHEDULE OF ACCOUNTS PAYABLE Crystals Candles, a retail business, had the following balances and purchases and payments activity in its accounts payable ledger during November. Prepare a schedule of accounts payable for Crystals Candles as of November 30, 20--.arrow_forward

- Smith Company is required to charge customers an 8% sales tax on all goods it sells. At the time of sale, Smith includes the combined amount of both sales and sales tax in the sales account. At the end of May, Smiths sales account for May has a credit balance of 540,000. Prepare the sales tax adjusting journal entry for the end of May.arrow_forwardOn January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. Which journal would the company use to record this transaction on the 18th? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalarrow_forwardCatherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forward

- Review the following transactions and prepare any necessary journal entries for Lands Inc. A. On December 10, Lands Inc. contracts with a supplier to purchase 450 plants for its merchandise inventory, on credit, for $12.50 each. Credit terms are 4/15, n/30 from the invoice date of December 10. B. On December 28, Lands pays the amount due in cash to the supplier.arrow_forwardOn March 24, MS Companys Accounts Receivable consisted of the following customer balances: S. Burton 310 A. Tangier 240 J. Holmes 504 F. Fullman 110 P. Molty 90 During the following week, MS made a sale of 104 to Molty and collected cash on account of 207 from Burton and 360 from Holmes. Prepare a schedule of accounts receivable for MS at March 31, 20--.arrow_forwardAmerican Signs allows customers to pay with their Jones credit card and cash. Jones charges American Signs a 3.5% service fee for each credit sale using its card. Credit sales for the month of June total $328,430, where 40% of those sales were made using the Jones credit card. Based on this information, what will be the total in Credit Card Expense at the end of June?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License