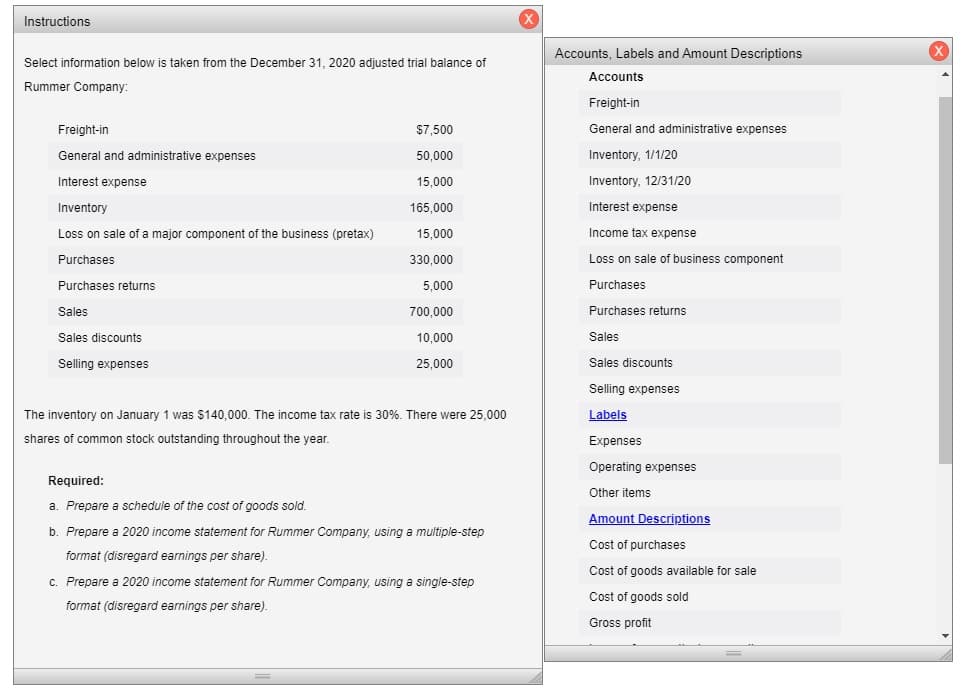

Instructions Accounts, Labels and Amount Descriptions Select information below is taken from the December 31, 2020 adjusted trial balance of Accounts Rummer Company: Freight-in Freight-in $7,500 General and administrative expenses General and administrative expenses 50,000 Inventory, 1/1/20 Interest expense 15,000 Inventory, 12/31/20 Inventory 165,000 Interest expense Loss on sale of a major component of the business (pretax) 15,000 Income tax expense Purchases 330,000 Loss on sale of business component Purchases returns 5,000 Purchases Sales 700,000 Purchases returns Sales discounts 10,000 Sales Selling expenses 25,000 Sales discounts Selling expenses The inventory on January 1 was $140,000. The income tax rate is 30%. There were 25,000 Labels shares of common stock outstanding throughout the year. Expenses Operating expenses Required: Other items a. Prepare a schedule of the cost of goods sold. Amount Descriptions b. Prepare a 2020 income statement for Rummer Company, using a multiple-step Cost of purchases format (disregard earnings per share). Cost of goods available for sale c. Prepare a 2020 income statement for Rummer Company, using a single-step Cost of goods sold format (disregard earnings per share). Gross profit

Instructions Accounts, Labels and Amount Descriptions Select information below is taken from the December 31, 2020 adjusted trial balance of Accounts Rummer Company: Freight-in Freight-in $7,500 General and administrative expenses General and administrative expenses 50,000 Inventory, 1/1/20 Interest expense 15,000 Inventory, 12/31/20 Inventory 165,000 Interest expense Loss on sale of a major component of the business (pretax) 15,000 Income tax expense Purchases 330,000 Loss on sale of business component Purchases returns 5,000 Purchases Sales 700,000 Purchases returns Sales discounts 10,000 Sales Selling expenses 25,000 Sales discounts Selling expenses The inventory on January 1 was $140,000. The income tax rate is 30%. There were 25,000 Labels shares of common stock outstanding throughout the year. Expenses Operating expenses Required: Other items a. Prepare a schedule of the cost of goods sold. Amount Descriptions b. Prepare a 2020 income statement for Rummer Company, using a multiple-step Cost of purchases format (disregard earnings per share). Cost of goods available for sale c. Prepare a 2020 income statement for Rummer Company, using a single-step Cost of goods sold format (disregard earnings per share). Gross profit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 8E: Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives...

Related questions

Question

Transcribed Image Text:Instructions

Accounts, Labels and Amount Descriptions

Select information below is taken from the December 31, 2020 adjusted trial balance of

Accounts

Rummer Company:

Freight-in

Freight-in

$7,500

General and administrative expenses

General and administrative expenses

50,000

Inventory, 1/1/20

Interest expense

15,000

Inventory, 12/31/20

Inventory

165,000

Interest expense

Loss on sale of a major component of the business (pretax)

15,000

Income tax expense

Purchases

330,000

Loss on sale of business component

Purchases returns

5,000

Purchases

Sales

700,000

Purchases returns

Sales discounts

10,000

Sales

Selling expenses

25,000

Sales discounts

Selling expenses

The inventory on January 1 was $140,000. The income tax rate is 30%. There were 25,000

Labels

shares of common stock outstanding throughout the year.

Expenses

Operating expenses

Required:

Other items

a. Prepare a schedule of the cost of goods sold.

Amount Descriptions

b. Prepare a 2020 income statement for Rummer Company, using a multiple-step

Cost of purchases

format (disregard earnings per share).

Cost of goods available for sale

c. Prepare a 2020 income statement for Rummer Company, using a single-step

Cost of goods sold

format (disregard earnings per share).

Gross profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning