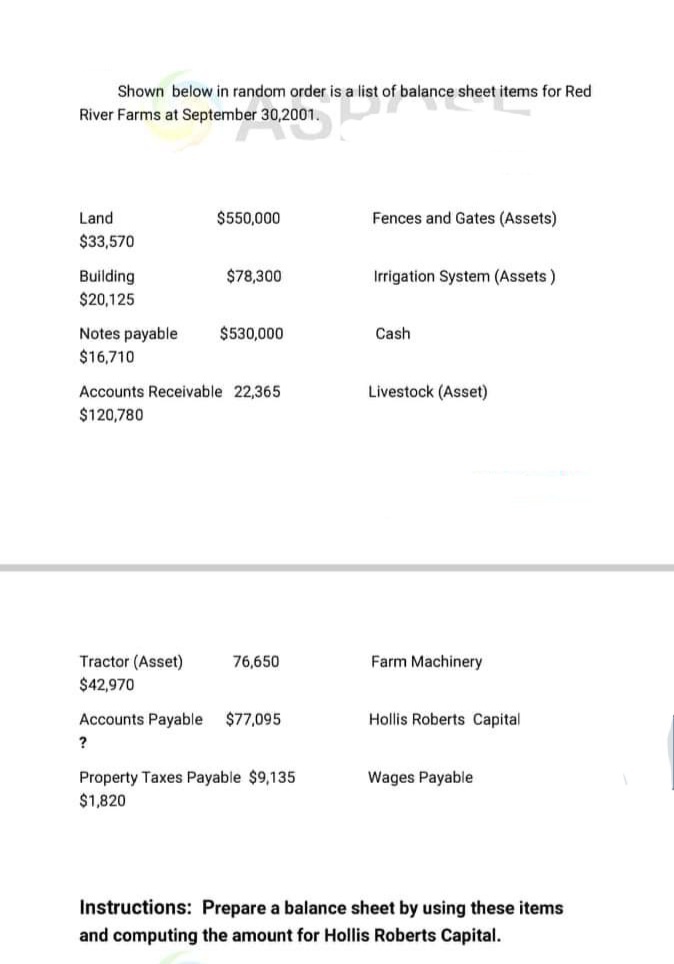

Instructions: Prepare a balance sheet by using these items and computing the amount for Hollis Roberts Capital.

Q: /hen an accountant calculates different parts of a financial statement in terr fa percentage of the…

A: Solution: Vertical analysis is a method of analyzing the financial statements of a company. Under…

Q: In performing vertical analysis, we express each item in a financial statement as a percentage of a…

A: Vertical Analysis: Vertical analysis is prepared to analyze the relationship among various financial…

Q: List the categories that are on the balance sheet for a business.

A: Definition: Balance sheet: This financial statement reports a company’s resources (assets) and…

Q: I understand th accounting equation is: Liabilities + Stock Holders’ Equity = Assets How do you…

A: Transaction: A transaction is a business event which has a monetary value that creates an impact on…

Q: Give its worksheet, balance sheet, income statement

A: Financial statement means the statement including income statement , balance sheet , cash flow…

Q: repare a balance sheet, income statement, a

A: The balance sheet is a statement prepared to determine the true position of assets and liabilities…

Q: The basic financial statements are listed below: (1) Balance sheet (2) Statement of changes in…

A: Solution; Generally the financial statements are prepared in the following sequence

Q: Show the details in Statement of financial position.

A: Introduction: Balance sheet: All Assets and liabilities are shown in Balance sheet. It tells the net…

Q: Analyze routine economic events—transactions—and record their effects on acompany’s financial…

A: Financial accounting: Financial accounting is the process of recording, summarizing, and reporting…

Q: How does information from the balance sheet help users of the financial statements?

A: The balance sheet provides an overview of assets, liabilities, and stockholders' equity as a…

Q: Prepare the companies financial statements including income statement, equity statement, balance…

A: Financial Statements: Financial Statements are the summary Reports that shows the financial results…

Q: Which of the following is a proper listing of the four general-purpose financial statements?…

A: Introduction:- The main aim of General purpose financial statements gives an idea of overall…

Q: I understand the accounting equation is: Liabilities + Stock Holders’ Equity = Assets How do you…

A: The basic Accounting Equation is Assets = Equity + LiabilitiesAssets are the resources owned by the…

Q: can you fill out the income statement and equity statement

A: Income Statement The purpose of preparing the income statement is to know the net income which are…

Q: What is the relationship between net income on the income statement and the equity section on the…

A: There is a direct and tangible relationship between net income in the income statement and the…

Q: can you help fill out the income statement and statement of equity based on this chart

A: Income statement is one of the financial statement which shows all incomes and all expenses and at…

Q: What is the financial statements (income statement, balance sheet, statement of changes in equity)?

A: Financial statements seem to be reports issued by the management of the company to demonstrate the…

Q: Given the following information for Smashville, Inc., construct a balance sheet:

A: In layman’s words, financial management is the management of the finance or funds in an…

Q: Prepare a Horizontal and Vertical Analysis for the Statement of Financial Position and Statement of…

A: Under horizontal analysis, last year figures are compared with current year figures in order to see…

Q: Prepare the income statement, statement of changes in equity and balance sheet

A: Income statement is one of the financial statement which shows all incomes, expenses of the…

Q: From the following, calculate what would be the total of assets on the balance sheet.

A: Asset: Assets are tangible or intangible items that are used and controlled by the company for…

Q: Total assets on a balance sheet prepared on any date mustagree with which of the following?a. The…

A: Balance sheet is a financial statement that shows the companies assets, liabilities and Shareholders…

Q: The balance sheet is a summary of the firm's financial position at a given point in time Select one:…

A: Financial statements such as balance sheet and income statement portray the financial and accounting…

Q: Consider the following company’s balance sheet and income statement Return on assets. Return on…

A: We need to compute the profitability ratios using the given financial statements.

Q: Provide an excel example showing the relationship between changes in the balance sheet, income…

A: balance sheet - balance sheet shows the statement of assets and liabilities of the company as on a…

Q: Identify the items or data that appear on multiple financial statements (income statement, statement…

A: Financial statements are the reports that provide the financial information of the business. The…

Q: How do I make an income statement and balance sheet and equity statements

A: Income statement: Income statement is also called profit and loss statement. Every business prepares…

Q: component of financial statement

A: Financial statement is the final result of recording accounting transactions into records. It…

Q: relationship among the income statement,

A: The income statement format is , revenue , expenses , and profits ( or losses) of an entity over a…

Q: What information is made available about the business in the following financial statements: a.…

A: Financial statements are a set of summaries of an organization's financial results, financial…

Q: How to read the balance sheet statement

A: Balance sheet is a summary statement which is prepared to know about total asset and total liability…

Q: PREPARE BALANCE SHEET FOR THE FOLLOWING TRANSACTIONS

A: Balance Sheet: Balance sheet is a financial statement which helps to know financial position of…

Q: A listing of a business entity’s assets, liabilities, and stockholders’ equity as of a specific date…

A: The financial statements of the business are prepared to find the profitability of the business.

Q: The income statement reflects which of the following? Choose one answer. Liabilities and revenue…

A: An income statement is a financial statement that shows you the company’s income and expenditures.…

Q: calculate the balance sheet

A: Balance sheet is a part of financial statements which shows exact financial position of the entity…

Q: Complete the Balance Sheet for O’Keefe Industries using the information that follows it.

A: 1. Average collection period = No. of working days * (Accounts receivable ÷ Sales) 40 = 360 *…

Q: Which of the following is the correct order of preparing the financial statements?A. income…

A: Financial Statement - Financial Statements are the statement that shows the overall performance and…

Step by step

Solved in 2 steps with 1 images

- Jada Company had the following transactions during the year: Purchased a machine for $500,000 using a long-term note to finance it Paid $500 for ordinary repair Purchased a patent for $45,000 cash Paid $200,000 cash for addition to an existing building Paid $60,000 for monthly salaries Paid $250 for routine maintenance on equipment Paid $10,000 for major repairs Depreciation expense recorded for the year is $25,000 If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Jadas balance sheet resulting from this years transactions? What amount did Jada report on the income statement for expenses for the year?Johnson, Incorporated, had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for extraordinary repairs Depreciation expense recorded for the year is $15,000. If all transactions were recorded properly, what is the amount of increase to the Property, Plant, and Equipment section of Johnsons balance sheet resulting from this years transactions? What amount did Johnson report on the income statement for expenses for the year?Johnson, Incorporated had the following transactions during the year: Purchased a building for $5,000,000 using a mortgage for financing Paid $2,000 for ordinary repair on a piece of equipment Sold product on account to customers for $1,500,600 Purchased a copyright for $5,000 cash Paid $20,000 cash to add a storage shed in the corner of an existing building Paid $360,000 in monthly salaries Paid $25,000 for routine maintenance on equipment Paid $110,000 for major repairs If all transactions were recorded properly, what amount did Johnson capitalize for the year, and what amount did Johnson expense for the year?

- The following financial information is from Cook Company: Accounts Payable $ 55,000 Land $ 90,000 Inventory $ 10,500 Accounts Receivable $ 7,500 Equipment $ 8,000 Deferred Revenue $ 58,500 Short-Term Investments $ 20,000 Notes Receivable (due in 8 months) $ 45,500 Interest Payable $ 2,000 Patents $ 75,000 What is the total amount of property, plant, and equipment assuming the accounts above reflect normal activity?The following data has been taken from the Shine Machinery Inc., income statement and balance sheet: Dec. 31, Jan. Jan. 1,2013 “Income statement: Net Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ... . .$375,000 Depreciation Expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 115,000 Amortization of Intangible Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41,000 Gain on Sale of Plant Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ….. 91,000 Loss on Sale of Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . …. . 34,000 Balance sheet: Accounts Receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...$345,000…The following data are taken from the income statement and balance sheet of Freeman Machinery, Inc. Dec. 31, 2018 Jan. 1, 2018 Income statement: Net Income $385,000 Depreciation Expense 135,000 Amortization of Intangible Assets 40,000 Gain on Sale of Plant Assets 90,000 Loss on Sale of Investments 35,000 Balance sheet: Accounts Receivable $335,000 $380,000 Inventory 503,000 575,000 Prepaid Expenses 22,000 13,000 Accounts Payable (to merchandise suppliers) 379,000 410,000 Accrued Expenses Payable 180,000 155,000 page 603 Using this information, prepare a partial statement of cash flows for the year ended December 31, 2018, showing the computation of net cash flows from operating activities by the indirect method.

- The following data has been taken from the Shine Machinery Inc., income statement and balance sheet: Dec. 31, Jan. 2012 Jan. 1, 2013 Income statement: Net Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ... . .$375,000 Depreciation Expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. 115,000 Amortization of Intangible Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41,000 Gain on Sale of Plant Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ….. 91,000 Loss on Sale of Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . …. . 34,000 Balance sheet: Accounts Receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...$345,000…The following items are taken from the financial statements of Oriole Company at December 31, 2022. Land $195,800 Accounts receivable 22,500 Supplies 9,000 Cash 12,050 Equipment 83,200 Buildings 262,600 Land improvements 46,450 Notes receivable (due in 2023) 6,100 Accumulated depreciation—land improvements 13,200 Common stock 78,500 Retained earnings (December 31, 2022) 497,000 Accumulated depreciation—buildings 33,200 Accounts payable 10,200 Mortgage payable 91,950 Accumulated depreciation—equipment 18,950 Interest payable 3,100 Income taxes payable 14,600 Patents 46,800 Investments in stock (long-term) 71,300 Debt investments (short-term) 4,900 Prepare a classified balance sheet. Assume that $9,200 of the mortgage payable will be paid in 2023. (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Land, Buildings, Equipment…Selected accounts from Phipps Corporation’s trial balance are as follows. Phipps Corporation Trial Balance December 31 (Selected Accounts) Debit Credit Cash $50,000 Short-Term Marketable Securities 27,000 Accounts Receivable 13,000 Inventories 48,000 Other Current Assets 10,000 Land 100,000 Equipment 45,000 Accumulated Depreciation-Equipment $5,000 Goodwill 30,000 Other Intangible Assets 15,000 Prepare the assets section of the company’s balance sheet. Phipps CorporationBalance SheetDecember 31 Assets Current Assets: $Cash Property, Plant, and Equipment, Net Accounts Receivable Inventories Other Current Assets Total Current Assets $fill in the blank 11 Short-Term Marketable Securities Goodwill Other Intangible Assets Total Assets $fill in the blank 18

- The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2, is shown as follows: Dec. 31, 20Y3 Dec. 31, 20Y2 Assets Cash 155,000 150,000 Accounts Receivable (net) 450,000 400,000 Inventories 770,000 750,000 Investments 0 100,000 Land 500,000 0 Equipment 1,400,000 1,200,000 Accumulated Depreciation-equipment (600,000) (500,000) Total Assets 2,675,000 2,100,000 Liabilities and Stockholders’ Equity Accounts Payable 340,000 300,000 Accrued Expenses Payable 45,000 50,000 Dividends payable 30,000 25,000 Common Stock, $4 par 700,000 600,000 Paid-in Capital in Excess of par-Common Stock 200,000 175,000 Retained Earnings 1,360,000 950,000 Total Liabilities and stockholders’ equity 2,675,000 2,100,000 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: The investments were…The following were extracted from the books of A. Ltd: Equipment $40,000, a Land and Building $150,000 , Cash $3, 000, Stock $2,000, Mortgage $60,000, and creditors $10,000, accruals $5,000 : a) The correct fixed assets amounts to: $190,000 $195,000 $100,000 $5,000 b) The correct current assets amounts to: $190,000 $195,000 $100,000 $5,000 c) The correct current liabilities amounts to: $75,000 $10,000 $65,000 $15,000 d) The correct long-term liability amounts to: $75,000 $10,000 $65,000 $60,000 e) The total assets amounts to: $190,000 $195,000 $250,0000 $5,000 f) The total liabilities amounts to: $60,000 $70,000 $75,000 $65,000From the data below please complete a Balance Sheet with the appropriate sections including Fixed Assets, Current Assets, Other Assets, Long Term Liabilities, short term liabilities and Equity. Land - £ 44,300 Equipment - £45,000 Intangible asset - £3,800 Accounts Payable - £30,000 Notes Payable - £30,000 Building and Improvements - £250,000 Account Expenses - £7,100 Additional Paid in capital - £20,000 Common Stock - £10,000 Long term Liabilities - £200,000 Inventory - £15,000 Investments - £14,000 Long Term Loan - £195,000 Cash and cash - £100,000 Accounts receivable - £20,000