Instructions Prepare the adjusting entry for each of the following for year ended December 31, 2019. 1. Paid Trio Insurance Co. Php33,000 one year car insurance to commence August 1, 2019. The amount of premium was debited to Prepaid Insurance. 2. Borrowed Php200,000 from Metro Bank issuing a one-year note with 12% annual interest on April 30, 2019. 3. Bought Php20,000 equipment with five- year estimated life and a salvage value of Php2,000. Depreciation is computed on a

Instructions Prepare the adjusting entry for each of the following for year ended December 31, 2019. 1. Paid Trio Insurance Co. Php33,000 one year car insurance to commence August 1, 2019. The amount of premium was debited to Prepaid Insurance. 2. Borrowed Php200,000 from Metro Bank issuing a one-year note with 12% annual interest on April 30, 2019. 3. Bought Php20,000 equipment with five- year estimated life and a salvage value of Php2,000. Depreciation is computed on a

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 52E: Adjusting Entries Exercise 3-52 Allentown Services Inc. is preparing adjusting entries for the year...

Related questions

Question

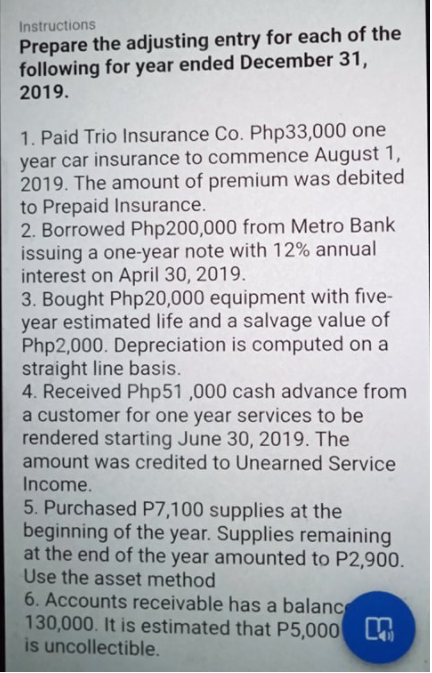

Transcribed Image Text:Instructions

Prepare the adjusting entry for each of the

following for year ended December 31,

2019.

1. Paid Trio Insurance Co. Php33,000 one

year car insurance to commence August 1,

2019. The amount of premium was debited

to Prepaid Insurance.

2. Borrowed Php200,000 from Metro Bank

issuing a one-year note with 12% annual

interest on April 30, 2019.

3. Bought Php20,000 equipment with five-

year estimated life and a salvage value of

Php2,000. Depreciation is computed on a

straight line basis.

4. Received Php51 ,000 cash advance from

a customer for one year services to be

rendered starting June 30, 2019. The

amount was credited to Unearned Service

Income.

5. Purchased P7,100 supplies at the

beginning of the year. Supplies remaining

at the end of the year amounted to P2,900.

Use the asset method

6. Accounts receivable has a balanc

130,000. It is estimated that P5,000

is uncollectible.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning