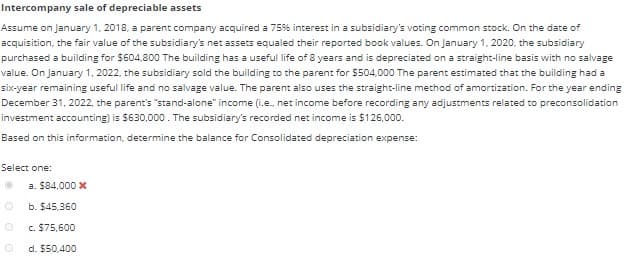

Intercompany sale of depreciable assets Assume on January 1, 2018, a parent company acquired a 75% interest in a subsidiary's voting common stock. On the date of acquisition, the fair value of the subsidiary's net assets equaled their reported book values. On January 1, 2020, the subsidiary purchased a building for $604,800 The building has a useful life of 8 years and is depreciated on a straight-line basis with no salvage value. On January 1, 2022, the subsidiary sold the building to the parent for $504,000 The parent estimated that the building had a six-year remaining useful life and no salvage value. The parent also uses the straight-line method of amortization. For the year ending December 31, 2022, the parent's "stand-alone" income (i.e., net income before recording any adjustments related to preconsolidation investment accounting) is $630,000. The subsidiary's recorded net income is $126,000. Based on this information, determine the balance for Consolidated depreciation expense: Select one: 0 0 a. $84,000 x b. $45,360 c. $75,600 d. $50,400

Intercompany sale of depreciable assets Assume on January 1, 2018, a parent company acquired a 75% interest in a subsidiary's voting common stock. On the date of acquisition, the fair value of the subsidiary's net assets equaled their reported book values. On January 1, 2020, the subsidiary purchased a building for $604,800 The building has a useful life of 8 years and is depreciated on a straight-line basis with no salvage value. On January 1, 2022, the subsidiary sold the building to the parent for $504,000 The parent estimated that the building had a six-year remaining useful life and no salvage value. The parent also uses the straight-line method of amortization. For the year ending December 31, 2022, the parent's "stand-alone" income (i.e., net income before recording any adjustments related to preconsolidation investment accounting) is $630,000. The subsidiary's recorded net income is $126,000. Based on this information, determine the balance for Consolidated depreciation expense: Select one: 0 0 a. $84,000 x b. $45,360 c. $75,600 d. $50,400

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

Transcribed Image Text:Intercompany sale of depreciable assets

Assume on January 1, 2018, a parent company acquired a 75% interest in a subsidiary's voting common stock. On the date of

acquisition, the fair value of the subsidiary's net assets equaled their reported book values. On January 1, 2020, the subsidiary

purchased a building for $604,800 The building has a useful life of 8 years and is depreciated on a straight-line basis with no salvage

value. On January 1, 2022, the subsidiary sold the building to the parent for $504,000 The parent estimated that the building had a

six-year remaining useful life and no salvage value. The parent also uses the straight-line method of amortization. For the year ending

December 31, 2022, the parent's "stand-alone" income (i.e., net income before recording any adjustments related to preconsolidation

investment accounting) is $630,000. The subsidiary's recorded net income is $126,000.

Based on this information, determine the balance for Consolidated depreciation expense:

Select one:

0

a. $84,000 x

b. $45,360

c. $75,600

d. $50,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning