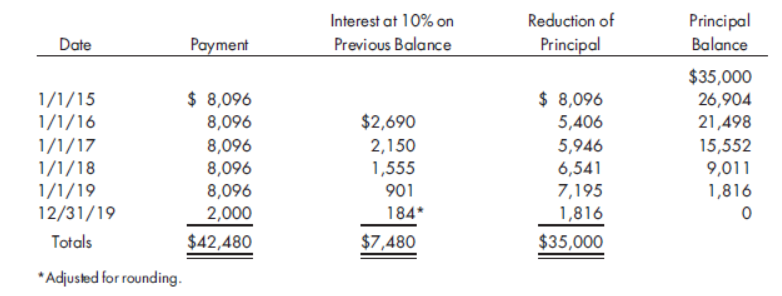

Interest at 10% on Previous Balance Reduction of Principal Balance Date Payment Principal $ 8,096 8,096 $ 8,096 5,406 $35,000 26,904 21,498 1/1/15 1/1/16 1/1/17 1/1/18 1/1/19 12/31/19 $2,690 8,096 2,150 1,555 901 5,946 6,541 7,195 1,816 15,552 8,096 8,096 2,000 9,011 1,816 184* Totals $42,480 $7,480 $35,000 *Adjusted for rounding.

The Auto Clinic is a wholly owned subsidiary of Fast-Check Equipment Company. Fast-Check Equipment sells and leases 4-wheel alignment machines. The usual selling price of each machine is $35,000; it has a cost to Fast- Check Equipment of $25,000. On January 1, 2015, Fast-Check Equipment leased such a machine to Auto Clinic. The lease provided for payments of $9,096 at the start of each year for five years. The payments include $1,000 per year for maintenance to be provided by the seller. There is a bargain purchase price of $2,000 at the end of the fifth year. The implicit interest rate in the lease is 10% per year. The equipment is being

The amortization schedule for the lease prepared by Fast-Check Equipment is as attached:

Prepare the eliminations and

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 8 images