INTEREST RATE The following graph shows the loanable funds market in the United States. It plots both the demand (D) for loanable funds and the supply (S) of loanable funds. At the current equilibrium, the government is operating with a balanced budget. Assume now that concerns regarding resources available to public educators lead the government to increase education spending without raising taxes, causing a budget deficit. Show the effect of the budget deficit on the market for loanable funds by shifting the demand (D) curve, the supply (S) curve, or both. LOANABLE FUNDS Based on this model, the budget deficit leads to D S 1 D S in the level of investment and in the interest rate. Which of the following arguments might a supporter of a balanced budget make in defense of their position? Check all that apply. Budget deficits crowd out private investment. ☐ Budget deficits place a burden on future taxpayers. ☐ Budget deficits decrease national saving. ☐ A decrease in spending today, such as funding cuts in education, may hurt future generations more. Supporters of a balanced budget claim that the government's budget deficit cannot grow forever, but critics believe that this is not necessarily true. They argue that what matters is the size of debt relative to national income. For example, suppose that real output in the United States grows at approximately 6%. If the inflation rate is 3% per year, this means that nominal income must be growing at a rate of % per year. Because nominal income grows over time, the nation's ability to pay back the national debt also rises. Therefore, as long as the nation's income grows than the government debt, the level of debt can continue to increase without harming the economy. In this case, the nominal government debt can rise by % each year without increasing the debt-to-income ratio.

INTEREST RATE The following graph shows the loanable funds market in the United States. It plots both the demand (D) for loanable funds and the supply (S) of loanable funds. At the current equilibrium, the government is operating with a balanced budget. Assume now that concerns regarding resources available to public educators lead the government to increase education spending without raising taxes, causing a budget deficit. Show the effect of the budget deficit on the market for loanable funds by shifting the demand (D) curve, the supply (S) curve, or both. LOANABLE FUNDS Based on this model, the budget deficit leads to D S 1 D S in the level of investment and in the interest rate. Which of the following arguments might a supporter of a balanced budget make in defense of their position? Check all that apply. Budget deficits crowd out private investment. ☐ Budget deficits place a burden on future taxpayers. ☐ Budget deficits decrease national saving. ☐ A decrease in spending today, such as funding cuts in education, may hurt future generations more. Supporters of a balanced budget claim that the government's budget deficit cannot grow forever, but critics believe that this is not necessarily true. They argue that what matters is the size of debt relative to national income. For example, suppose that real output in the United States grows at approximately 6%. If the inflation rate is 3% per year, this means that nominal income must be growing at a rate of % per year. Because nominal income grows over time, the nation's ability to pay back the national debt also rises. Therefore, as long as the nation's income grows than the government debt, the level of debt can continue to increase without harming the economy. In this case, the nominal government debt can rise by % each year without increasing the debt-to-income ratio.

Chapter20: Exchange Rates And The Macroeconomy

Section: Chapter Questions

Problem 3TY

Related questions

Question

please answer in text form and in proper format answer with must explanation , calculation for each part and steps clearly

Transcribed Image Text:INTEREST RATE

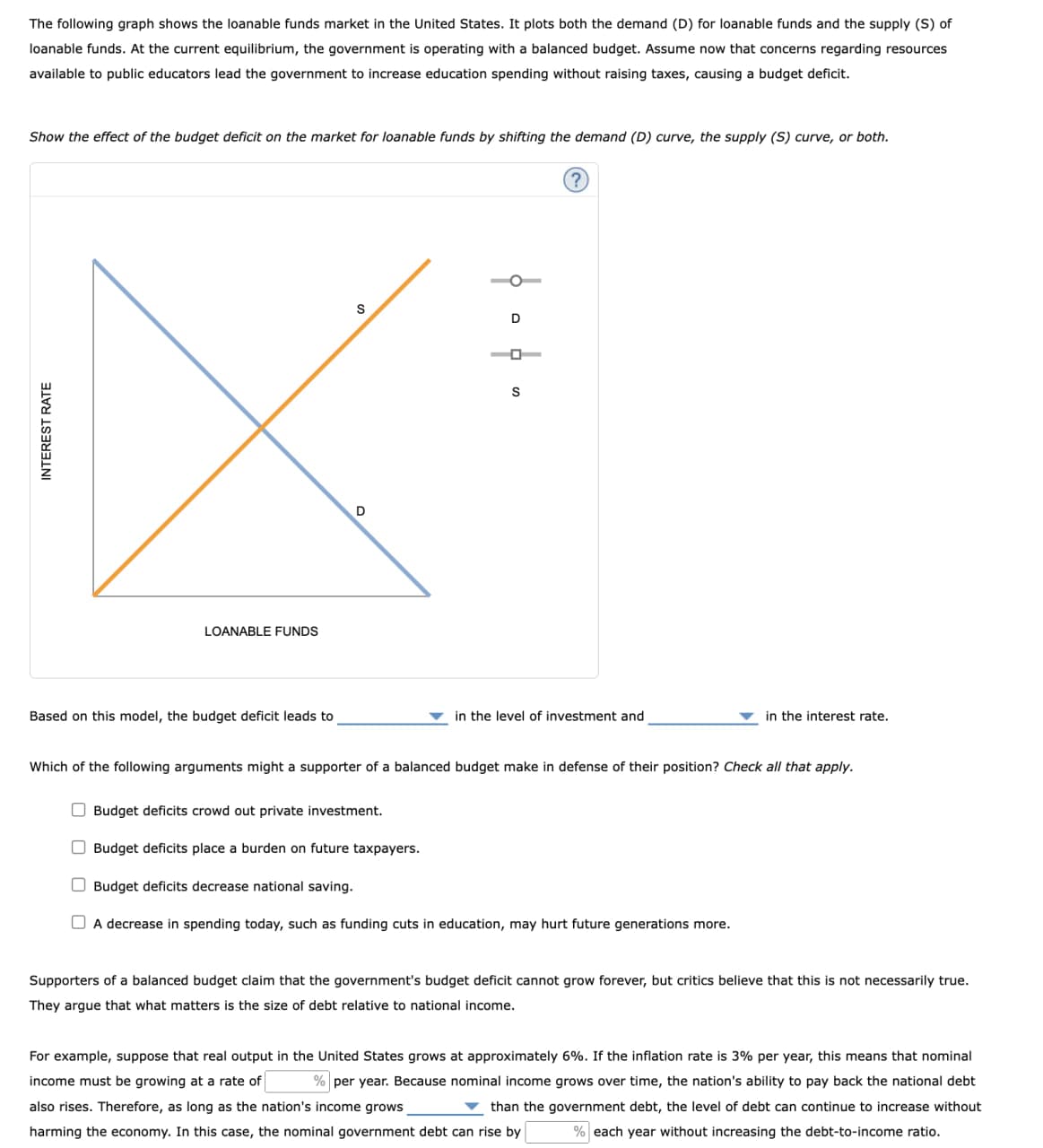

The following graph shows the loanable funds market in the United States. It plots both the demand (D) for loanable funds and the supply (S) of

loanable funds. At the current equilibrium, the government is operating with a balanced budget. Assume now that concerns regarding resources

available to public educators lead the government to increase education spending without raising taxes, causing a budget deficit.

Show the effect of the budget deficit on the market for loanable funds by shifting the demand (D) curve, the supply (S) curve, or both.

LOANABLE FUNDS

Based on this model, the budget deficit leads to

D

S

1

D

S

in the level of investment and

in the interest rate.

Which of the following arguments might a supporter of a balanced budget make in defense of their position? Check all that apply.

Budget deficits crowd out private investment.

☐ Budget deficits place a burden on future taxpayers.

☐ Budget deficits decrease national saving.

☐ A decrease in spending today, such as funding cuts in education, may hurt future generations more.

Supporters of a balanced budget claim that the government's budget deficit cannot grow forever, but critics believe that this is not necessarily true.

They argue that what matters is the size of debt relative to national income.

For example, suppose that real output in the United States grows at approximately 6%. If the inflation rate is 3% per year, this means that nominal

income must be growing at a rate of % per year. Because nominal income grows over time, the nation's ability to pay back the national debt

also rises. Therefore, as long as the nation's income grows

than the government debt, the level of debt can continue to increase without

harming the economy. In this case, the nominal government debt can rise by

% each year without increasing the debt-to-income ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning