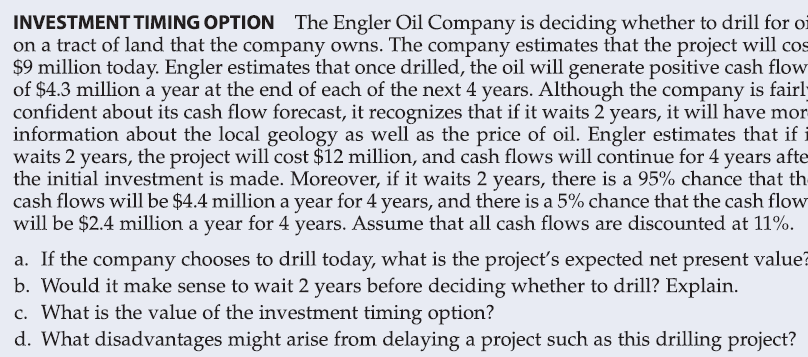

INVESTMENT TIMING OPTION The Engler Oil Company is deciding whether to drill for oi on a tract of land that the company owns. The company estimates that the project will cos $9 million today. Engler estimates that once drilled, the oil will generate positive cash flow of $4.3 million a year at the end of each of the next 4 years. Although the company is fairl confident about its cash flow forecast, it recognizes that if it waits 2 years, it will have mor information about the local geology as well as the price of oil. Engler estimates that if waits 2 years, the project will cost $12 million, and cash flows will continue for 4 years afte the initial investment is made. Moreover, if it waits 2 years, there is a 95% chance that th cash flows will be $4.4 million a year for 4 years, and there is a 5% chance that the cash flow will be $2.4 million a year for 4 years. Assume that all cash flows are discounted at 11%. a. If the company chooses to drill today, what is the project's expected net present value? b. Would it make sense to wait 2 years before deciding whether to drill? Explain. c. What is the value of the investment timing option? d. What disadvantages might arise from delaying a project such as this drilling project?

INVESTMENT TIMING OPTION The Engler Oil Company is deciding whether to drill for oi on a tract of land that the company owns. The company estimates that the project will cos $9 million today. Engler estimates that once drilled, the oil will generate positive cash flow of $4.3 million a year at the end of each of the next 4 years. Although the company is fairl confident about its cash flow forecast, it recognizes that if it waits 2 years, it will have mor information about the local geology as well as the price of oil. Engler estimates that if waits 2 years, the project will cost $12 million, and cash flows will continue for 4 years afte the initial investment is made. Moreover, if it waits 2 years, there is a 95% chance that th cash flows will be $4.4 million a year for 4 years, and there is a 5% chance that the cash flow will be $2.4 million a year for 4 years. Assume that all cash flows are discounted at 11%. a. If the company chooses to drill today, what is the project's expected net present value? b. Would it make sense to wait 2 years before deciding whether to drill? Explain. c. What is the value of the investment timing option? d. What disadvantages might arise from delaying a project such as this drilling project?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 21E: Net present value-unequal lives Bunker Hill Mining Company has two competing proposals: a processing...

Related questions

Question

100%

Can I have a detailed solution on letter c and d?

Transcribed Image Text:INVESTMENT TIMING OPTION The Engler Oil Company is deciding whether to drill for oi

on a tract of land that the company owns. The company estimates that the project will cos

$9 million today. Engler estimates that once drilled, the oil will generate positive cash flow

of $4.3 million a year at the end of each of the next 4 years. Although the company is fairly

confident about its cash flow forecast, it recognizes that if it waits 2 years, it will have mor

information about the local geology as well as the price of oil. Engler estimates that if

waits 2 years, the project will cost $12 million, and cash flows will continue for 4 years afte

the initial investment is made. Moreover, if it waits 2 years, there is a 95% chance that th

cash flows will be $4.4 million a year for 4 years, and there is a 5% chance that the cash flow

will be $2.4 million a year for 4 years. Assume that all cash flows are discounted at 11%.

a. If the company chooses to drill today, what is the project's expected net present value?

b. Would it make sense to wait 2 years before deciding whether to drill? Explain.

c. What is the value of the investment timing option?

d. What disadvantages might arise from delaying a project such as this drilling project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning