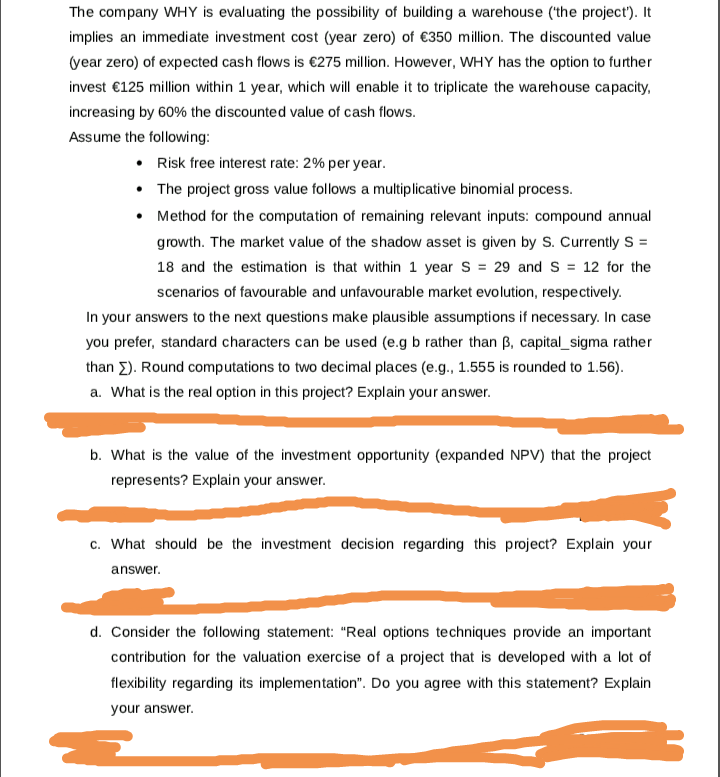

The company WHY is evaluating the possibility of building a warehouse (the project'). It implies an immediate investment cost (year zero) of €350 million. The discounted value (year zero) of expected cash flows is €275 million. However, WHY has the option to further invest €125 million within 1 year, which will enable it to triplicate the warehouse capacity, increasing by 60% the discounted value of cash flows. Assume the following: • Risk free interest rate: 2% per year. • The project gross value follows a multiplicative binomial process. • Method for the computation of remaining relevant inputs: compound annual growth. The market value of the shadow asset is given by S. Currently S = 18 and the estimation is that within 1 year S = 29 and S = 12 for the scenarios of favourable and unfavourable market evolution, respectively. In your answers to the next questions make plausible assumptions if necessary. In case you prefer, standard characters can be used (e.g b rather than B, capital_sigma rather than E). Round computations to two decimal places (e.g., 1.555 is rounded to 1.56). a. What is the real option in this project? Explain your answer. b. What is the value of the investment opportunity (expanded NPV) that the project represents? Explain your answer. c. What should be the investment decision regarding this project? Explain your answer. d. Consider the following statement: "Real options techniques provide an important contribution for the valuation exercise of a project that is developed with a lot of flexibility regarding its implementation". Do you agree with this statement? Explain your answer.

The company WHY is evaluating the possibility of building a warehouse (the project'). It implies an immediate investment cost (year zero) of €350 million. The discounted value (year zero) of expected cash flows is €275 million. However, WHY has the option to further invest €125 million within 1 year, which will enable it to triplicate the warehouse capacity, increasing by 60% the discounted value of cash flows. Assume the following: • Risk free interest rate: 2% per year. • The project gross value follows a multiplicative binomial process. • Method for the computation of remaining relevant inputs: compound annual growth. The market value of the shadow asset is given by S. Currently S = 18 and the estimation is that within 1 year S = 29 and S = 12 for the scenarios of favourable and unfavourable market evolution, respectively. In your answers to the next questions make plausible assumptions if necessary. In case you prefer, standard characters can be used (e.g b rather than B, capital_sigma rather than E). Round computations to two decimal places (e.g., 1.555 is rounded to 1.56). a. What is the real option in this project? Explain your answer. b. What is the value of the investment opportunity (expanded NPV) that the project represents? Explain your answer. c. What should be the investment decision regarding this project? Explain your answer. d. Consider the following statement: "Real options techniques provide an important contribution for the valuation exercise of a project that is developed with a lot of flexibility regarding its implementation". Do you agree with this statement? Explain your answer.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 16P: Shao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of...

Related questions

Question

Transcribed Image Text:The company WHY is evaluating the possibility of building a warehouse (the project'). It

implies an immediate investment cost (year zero) of €350 million. The discounted value

(year zero) of expected cash flows is €275 million. However, WHY has the option to further

invest €125 million within 1 year, which will enable it to triplicate the warehouse capacity,

increasing by 60% the discounted value of cash flows.

Assume the following:

• Risk free interest rate: 2% per year.

• The project gross value follows a multiplicative binomial process.

• Method for the computation of remaining relevant inputs: compound annual

growth. The market value of the shadow asset is given by S. Currently S =

18 and the estimation is that within 1 year S = 29 and S = 12 for the

scenarios of favourable and unfavourable market evolution, respectively.

In your answers to the next questions make plausible assumptions if necessary. In case

you prefer, standard characters can be used (e.g b rather than B, capital_sigma rather

than E). Round computations to two decimal places (e.g., 1.555 is rounded to 1.56).

a. What is the real option in this project? Explain your answer.

b. What is the value of the investment opportunity (expanded NPV) that the project

represents? Explain your answer.

c. What should be the investment decision regarding this project? Explain your

answer.

d. Consider the following statement: "Real options techniques provide an important

contribution for the valuation exercise of a project that is developed with a lot of

flexibility regarding its implementation". Do you agree with this statement? Explain

your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub