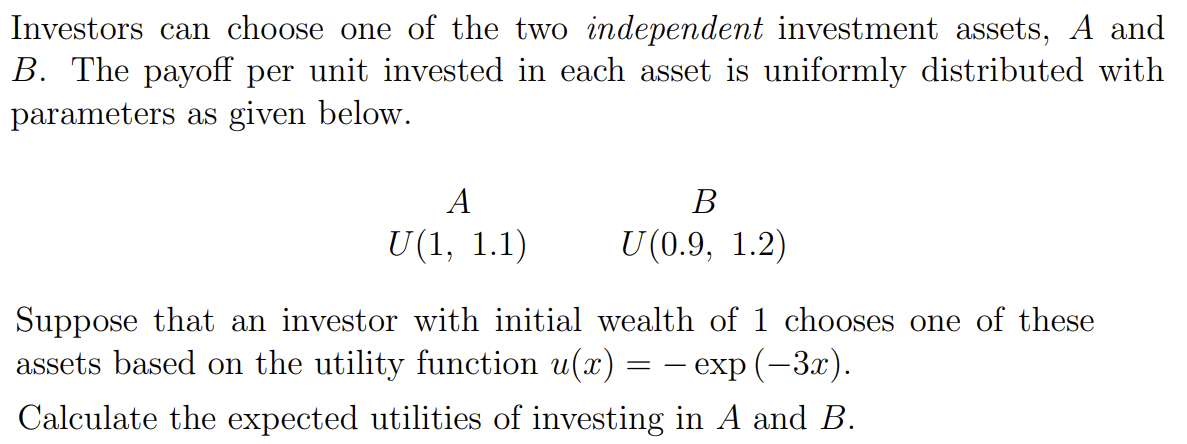

Investors can choose one of the two independent investment assets, A an B. The payoff per unit invested in each asset is uniformly distributed wit parameters as given below. A U(1, 1.1) B U(0.9, 1.2) Suppose that an investor with initial wealth of 1 chooses one of these assets based on the utility function u(x) = - exp(-3x). Calculate the expected utilities of investing in A and B.

Q: 1. What is payback period? Compute the payback period for an investment requiring an initial outlay…

A: Payback period: Payback period is the length of time in which an investment reaches its break-even…

Q: Use the information in the chart to calculate the real exchange rate between the U.S. dollar and the…

A: The real exchange rate means the relative value of one country's currency compared to another,…

Q: What is the price elasticity of demand for a good that experiences a 10% increase in price resulting…

A: The percentage change in the price of the good : 10% increase.The corresponding percentage change in…

Q: for Vendor B, the life years is 9 years.

A: In this case, we have to discuss the term MARR which is minimum acceptable rate of return. So MARR…

Q: Boxer Production, Inc., is in the process of considering a flexible manufacturing system that will…

A: Introduction:Capital investment decisions are also known as capital budgeting decisions as these are…

Q: Consider a local government with preferences represented by U-C0.75 0.25 where C stands for…

A: A federal government grant is a monetary grant made by the federal government to state, municipal,…

Q: The simple economy of Altria shown in the table below has no government or taxes and no…

A: MPC stands for Marginal Propensity to Consume. It calculates the change in consumption resulting…

Q: No AI please 1. List six primary public policy arguments for promoting renewable energy sources…

A: An energy source basically refers to a substance or phenomenon that can be basically changed over…

Q: Don't use chatgpt or any AI A profit-maximising firm in a competitive market is currently producing…

A: A competitive industry refers to a industry in which there are many buyers and sellers dealing a…

Q: What is the profit-maximizing quantity for this monopolist? O 110 75 100 125

A: When only a single firm has a whole market power, a monopoly earns profits as there is no…

Q: In 2014, oil facilities in Iraq were attacked and strong economies in the United States and China…

A: Equilibrium refers to a market situation at which the demand of a good or service is equal to its…

Q: Garrison Boutique, a small novelty store, just spent $4,000 on a new software program that will help…

A: Introduction: A business decision-making is a process applied to each decision carried out by the…

Q: Problem 4 Engineers at Waterworks Ltd have designed a pipeline that provides a throughput of 100,000…

A: This phrase is generally used in economics to refer to an economic theory that describes the rate at…

Q: Suppose a consumer’s utility function is given by U(X,Y) = MIN (5X, Y). Also, the consumer has $60…

A: U=Min(5X,Y)Px=5Py=1M=60

Q: Write a report highlighting how simulation methods can be embraced in banking sector

A: IntroductionThe banking sector is a complex and ever-changing industry. Banks are constantly faced…

Q: Suppose we have the following short-run model. Resource constrain is Y₁ = C₁ + I + G₁ + EX₁ - IM₂…

A: IS curve represents the relationship between the real interest rate and the level of output that…

Q: elow to identify four renewable and four nonrenewabl

A: These are natural resources that can be defined as resources that can be replenished or regenerated…

Q: Review the attached graph. Which of the following movements would illustrate the effect on the…

A: Law of demand states :- Higher the price , lower will be the quantity demandedLower the price ,…

Q: Oligopoly Consider a small town that has only two Sushi restaurants, A and B. Suppose that it costs…

A: qi = 24 - pi + 0.5pj Cost of producing each sushi = 2Therefore , Demand function of A : qa = 24 -…

Q: S R +0 T U At which point is the economy producing inefficiently? doms

A: Production possibility curve or PPC shows the optimal level of goods that can be produced using all…

Q: a. What are the profit-maximizing prices and quantities for the New York and Los Angeles markets?…

A: For profit maximisations, the firms aim to maximise the profits, which are calculated by subtracting…

Q: Download the article: RECENT FINANCIAL FAILURES IN THE CARIBBEAN - WHAT WERE THE CAUSES AND WHAT…

A: The Caribbean economy's main industries include tourist attractions, food production, and worldwide…

Q: What was the Gross Domestic Product ( GDP) of the U.S. from 2017-2022?

A: GDP stand for the gross domestic product which include some of all market value of total goods and…

Q: Question 3 Calculate the marginal revenue for the following: (a) L ii. Total Revenue (Q) = 50³ +…

A: Total Revenue (TR) : The total revenue obtained by a company or companies through product sales is…

Q: Suppose that a perishable item costs $8 and sells for $10. Any item that is not sold by the end of…

A: Disclaimer: - Since you asked multiple question, we are solving the first one as per guidelines. but…

Q: Your company is planning to purchase a new log splitter for is lawn and garden business. The new…

A: The rate of return alludes to the addition or misfortune on an investment comparative with how much…

Q: Calculate Nick's marginal revenue and marginal cost for the first seven shirts he produces, and plot…

A: Marginal revenue is calculated as the ratio of change in total revenue to change in…

Q: Please draw and upload an externality graph for the "Truck Tire" market in the US. Use the data…

A: An externality is a condition in economics, which represent a situation of cost or benefit to the…

Q: Suppose a company sells a product for $50 per unit. The variable cost per unit is $20 and the…

A: The break-even point in business is the point at which total cost (including fixed and variable…

Q: What are some similarities between the employment-population ratio and the labor force participation…

A: Economic metrics can be whatever the government wants, but specific data obtained from authorities…

Q: Robots at Kroger, Walmart, and Whole Foods The grocery industry is stepping up its investment in…

A: The widespread adoption of robot technology in the grocery industry is rapidly reshaping the retail…

Q: Following exercise is requested: (a) Draw a budget line knowing that: nominal income is $100/week,…

A: A budget line provides different combinations of purchasing instances that a consumer can choose to…

Q: In the Solow model with population growth and labor augmenting technological progress, with…

A: Effective Workers: Effective workers refer to the labor force adjusted for changes in population and…

Q: Use the following graph for a monopolistically competitive firm in a constant-cost industry to…

A: Monopolistically competitive market has many firms producing differentiated goods.

Q: Firewood prices in places from northern California to Boston and New Jersey have remained steady…

A: Firewood prices in places from northern California to Boston and New Jersey have remained steady…

Q: The graph shows the demand curve and marginal revenue curve of Java Time, Inc., a producer of…

A: The difference between total revenues less costs and the opportunity cost related to the income…

Q: Manager: If I can reduce my costs by $40,000 during this last quarter, my division will show a…

A: Ethics in business is one of the most important things that is required to implement policies in the…

Q: 1 ook The table below shows the maximum output levels for Here and there. Here There 1 cloth = Cloth…

A: As per new guidelines of Bartleby, I can just do three subparts of the question. For the fourth…

Q: The government sets a minimum price for prof.Ernst's brussel sprouts. This is called a Group of…

A: The price restrictions make guarantee that market prices are not artificially raised or lowered. To…

Q: 4. Consider a classical economy described as follows: 11 Y = LZK², where L is the amount of labor…

A: The money multiplier is the number of times the monetary base is multiplied to create money supply.…

Q: Suppose the country of Lilliput exported $293 billion worth of goods and imported $473 billion worth…

A: A trade deficit occurs when a country' imports of goods and service exceed its exports. It is…

Q: Consider a good for which there is a negative externality generated by production/consumption, with…

A: Externality is the cost of benefit that is borne by the third party. There is negative externality…

Q: The monthly market basket for consumers consists of pizza, t-shirts, and rent. The table below shows…

A: CPI refers to the measure of average price level of basket of goods and services that is paid by…

Q: January 2012, one US dollar was worth 50.0 Indian rupees. Suppose that over the next year the value…

A: The exchange rate is the cost of one unit of foreign currency in the home currency. It is calculated…

Q: The one major Social policy that FDR sought but did not get was a) A federal minimum wage b)…

A: During his presidency, Franklin D. Roosevelt (FDR) implemented numerous social policies to combat…

Q: Your company is planning to purchase a new log splitter for is lawn and garden business. The new…

A:

Q: c. If the two countries specialize in the product in which they have a comparative advantage, show…

A: Comparative advantage is a situation where a country might be specialised in producing one or more…

Q: Home’s demand curve for wheat is D = 200 − 40P Its supply curve is S = 40 + 40P Derive and graph…

A: Since you have posted multiple subparts and it cannot be completed within the given time limit, we…

Q: Stock H has a beta of 1.6, while Stock L has a beta of 0.7. If investors’ aversion to risk…

A: Risk:Risk is taking a chance, when the amount gets invested then there is a risk factor which means…

Q: a) If the central bank sells government bonds in the market how would the real interest rate be…

A: In a closed Keynesian economy, if the central bank sells government bonds in the market, it would…

Expected utility in portfolio theory

Step by step

Solved in 3 steps

- Find the Pratt - Arrow risk - aversion function for a utility function U(W) = log(0.5-W + 500), where W is the amount of wealth in €. Suppose that an investor's wealth is subject to outcomes -800 €, 500 €, 500 € and 1, 000 € which affect the initial amount of 2,500 € with probabilities of their occurrence 40%, 15%, 15% and 30%, respectively. a) Using the Taylor approximation to certainty equivalent, calculate an approximate expected utility value. b) Calculate the certain equivalent of the investor's uncertain wealth. Interpret.An investor with capital x can invest any amount between0 and x; if y is invested then y is eitherwon or lost, with respectiveprobabilities p and 1− p. If p > 1/2, how much should be invested byan investor having a exponential utility function u(x) = 1 − e −bx ,b > 0.You are a risk-averse investor with a CRRA utility function. You are faced with the decision to invest your total wealth W of £1,000,000 into a riskless asset which generates a return of 5% or into a risky asset which either generates a return of 20% or a loss of −4% with equal probability. Find the optimal investment allocation with a coefficient of relative risk aversion η=2, and comment on your results.

- You plan to invest $1,000 in a corporate bond fund or in a common stock fund. The following table represents the annual return (per $1,000) of each of these investments under various economic conditions and the probability that each of those economic conditions will occur. Compute the expected return for the corporate bond and for the common stock fund. Show your calculations on excel for expected returns. Compute the standard deviation for the corporate bond fund and for the common stock fund. Would you invest in the corporate bond fund or the common stock fund? Explain. If choose to invest in the common stock fund and in (c), what do you think about the possibility of losing $999 of every $1,000 invested if there is depression. Explain.You are considering a $500,000 investment in the fast-food industry and have narrowed your choice to either a McDonald’s or a Penn Station East Coast Subs franchise. McDonald’s indicates that, based on the location where you are proposing to open a new restaurant, there is a 25 percent probability that aggregate 10-year profits (net of the initial investment) will be $16 million, a 50 percent probability that profits will be $8 million, and a 25 percent probability that profits will be −$1.6 million. The aggregate 10-year profit projections (net of the initial investment) for a Penn Station East Coast Subs franchise is $48 million with a 2.5 percent probability, $8 million with a 95 percent probability, and −$48 million with a 2.5 percent probability. Considering both the risk and expected profitability of these two investment opportunities, which is the better investment? Explain carefully.Exercise 3: Risky Investment Charlie has von Neumann-Morgenstern utility function u(x) = ln x and has wealth W = 250, 000. She is offered the opportunity to purchase a risky project for price P = 160, 000. 1 1 With probability p = 2 the project will be a success and return V > 160, 000. With probability 1 −p = 2 the project will fail and be worthless (i.e. it returns 0). For simplicity assume there is no interest between the time of the investment and the time of its return, that is r = 0 . How large must V be in order for Charlie to want to purchase the risky project? [Hint: What is Charlie’s expected utility is she does not purchase the project? What is Charlie’s expected utility is she purchases the project?]

- Let U(x)= x^(beta/2) denote an agent's utility function, where Beta > 0 is a parameter that defines the agent's attitude towards risk. Consider a gamble that pays a prize X = 10 with probability 0.2, a price X = 50 with probability 0.4 and a price X = 100 with probability 0.4. Compute the agentís expected utility for such gamble and find the value of Beta such that the agentis risk neutral? Suppose B= 1, what is the certainty equivalent of the gamble described above? What is the Arrow-Pratt measure of absolute risk aversion?Suppose you’re evaluating a new project costing 125 and yielding an expected payoff of 75 for the two subsequent years. You know that the market(portfolio) rate is 0,10 that the covariance of the new investment’s payoff with the market portfolio is 0,2 and that the variance of the market payoff is 0,1. You also know that the risk-free rate is 0,05. Would you accept the project if you do not account for the risk embodied in the new project? Why? What if you probably accounted for risk, by using CAPM?A drug company is considering investing $100 million today to bring a weight loss pill to the market. At the end of one year, the firm will know the payoff; there is a 0.50 probability that the pill will sell at a high price and generate $37 million per year of profit forever and a 0.50 probability that the pill will sell at a low price and generate $I million per year of profit forever. The interest rate is 10%. Suppose the firm decides to wait one year to determine whether the pill will sell at a high or low price. The firm will not invest if it learns that the pill will sell at a low price. What is the net present value of waiting one year to make the investment?O $88 millionO$122.72 millionO $201.22 millionO $64.5 million

- QUESTION 1 Elizabeth has decided to form a portfolio by putting 30% of her money into stock 1 and 70% into stock 2. She assumes that the expected returns will be 10% and 18%, respectively, and that the standard deviations will be 15% and 24%, respectively. Compute the standard deviation of the returns on the portfolio assuming that the two stocks' returns are uncorrelated. 17.4%. 27.4%. 7.4%. 11.4%. QUESTION 2 Elizabeth has decided to form a portfolio by putting 30% of her money into stock 1 and 70% into stock 2. She assumes that the expected returns will be 10% and 18%, respectively, and that the standard deviations will be 15% and 24%, respectively. Describe what happens to the standard deviation of the portfolio returns when the coefficient of correlation ρ decreases. The standard deviation of the portfolio returns decreases as the coefficient of correlation decreases. The standard deviation of the portfolio returns increases as the coefficient…Suppose Alex’s utility function is u ($x) = √x. Assume her initial wealth is 0. Is it possible that Alex’s expected utility from the prospect equals $5, why? What is the possible range of Alex’s expected utility?A woman with current wealth X has the opportunity to bet an amount on the occurrence of an event that she knows will occur with probability P. If she wagers W, she will received 2W, if the event occur and if it does not. Assume that the Bernoulli utility function takes the form u(x) = with r > 0. How much should she wager? Does her utility function exhibit CARA, DARA, IARA? Alex plays football for a local club in Kumasi. If he does not suffer any injury by the end of the season, he will get a professional contract with Kotoko, which is worth $10,000. If he is injured though, he will get a contract as a fitness coach worth $100. The probability of the injury is 10%. Describe the lottery What is the expected value of this lottery? What is the expected utility of this lottery if u(x) = Assume he could buy insurance at price P that could pay $9,900 in case of injury. What is the highest value of P that makes it worthwhile for Alex to purchase insurance? What is the certainty…