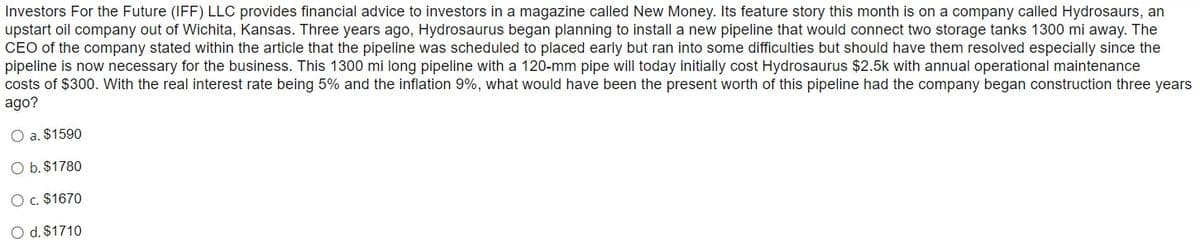

Investors For the Future (IFF) LLC provides financial advice to investors in a magazine called New Money. Its feature story this month is on a company called Hydrosaurs, an upstart oil company out of Wichita, Kansas. Three years ago, Hydrosaurus began planning to install a new pipeline that would connect two storage tanks 1300 mi away. The CEO of the company stated within the article that the pipeline was scheduled to placed early but ran into some difficulties but should have them resolved especially since the pipeline is now necessary for the business. This 1300 mi long pipeline with a 120-mm pipe will today initially cost Hydrosaurus $2.5k with annual operational maintenance costs of $300. With the real interest rate being 5% and the inflation 9%, what would have been the present worth of this pipeline had the company began construction three year ago? O a. $1590 O b. $1780 O c. $1670

Investors For the Future (IFF) LLC provides financial advice to investors in a magazine called New Money. Its feature story this month is on a company called Hydrosaurs, an upstart oil company out of Wichita, Kansas. Three years ago, Hydrosaurus began planning to install a new pipeline that would connect two storage tanks 1300 mi away. The CEO of the company stated within the article that the pipeline was scheduled to placed early but ran into some difficulties but should have them resolved especially since the pipeline is now necessary for the business. This 1300 mi long pipeline with a 120-mm pipe will today initially cost Hydrosaurus $2.5k with annual operational maintenance costs of $300. With the real interest rate being 5% and the inflation 9%, what would have been the present worth of this pipeline had the company began construction three year ago? O a. $1590 O b. $1780 O c. $1670

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter1: Introduction: What This Book Is About

Section: Chapter Questions

Problem 1.1IP

Related questions

Question

3

Transcribed Image Text:Investors For the Future (IFF) LLC provides financial advice to investors in a magazine called New Money. Its feature story this month is on a company called Hydrosaurs, an

upstart oil company out of Wichita, Kansas. Three years ago, Hydrosaurus began planning to install a new pipeline that would connect two storage tanks 1300 mi away. The

CEO of the company stated within the article that the pipeline was scheduled to placed early but ran into some difficulties but should have them resolved especially since the

pipeline is now necessary for the business. This 1300 mi long pipeline with a 120-mm pipe will today initially cost Hydrosaurus $2.5k with annual operational maintenance

costs of $300. With the real interest rate being 5% and the inflation 9%, what would have been the present worth of this pipeline had the company began construction three years

ago?

O a. $1590

O b. $1780

O c. $1670

O d. $1710

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning