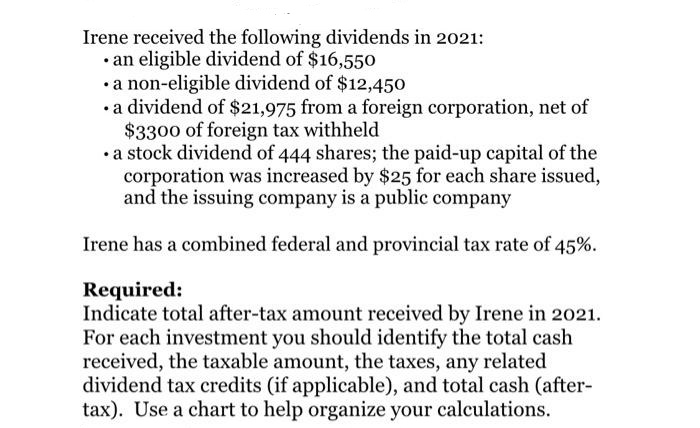

Irene received the following dividends in 2021: • an eligible dividend of $16,550 a non-eligible dividend of $12,450 a dividend of $21,975 from a foreign corporation, net of $3300 of foreign tax withheld • a stock dividend of 444 shares; the paid-up capital of the corporation was increased by $25 for each share issued, and the issuing company is a public company Irene has a combined federal and provincial tax rate of 45%. Required: Indicate total after-tax amount received by Irene in 2021. For each investment you should identify the total cash received, the taxable amount, the taxes, any related dividend tax credits (if applicable), and total cash (after- tax). Use a chart to help organize your calculations.

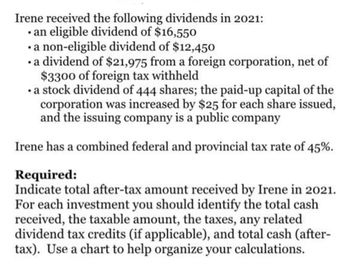

Irene received the following dividends in 2021: • an eligible dividend of $16,550 a non-eligible dividend of $12,450 a dividend of $21,975 from a foreign corporation, net of $3300 of foreign tax withheld • a stock dividend of 444 shares; the paid-up capital of the corporation was increased by $25 for each share issued, and the issuing company is a public company Irene has a combined federal and provincial tax rate of 45%. Required: Indicate total after-tax amount received by Irene in 2021. For each investment you should identify the total cash received, the taxable amount, the taxes, any related dividend tax credits (if applicable), and total cash (after- tax). Use a chart to help organize your calculations.

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:Irene received the following dividends in 2021:

• an eligible dividend of $16,550

•a non-eligible dividend of $12,450

•a dividend of $21,975 from a foreign corporation, net of

$3300 of foreign tax withheld

•a stock dividend of 444 shares; the paid-up capital of the

corporation was increased by $25 for each share issued,

and the issuing company is a public company

Irene has a combined federal and provincial tax rate of 45%.

Required:

Indicate total after-tax amount received by Irene in 2021.

For each investment you should identify the total cash

received, the taxable amount, the taxes, any related

dividend tax credits (if applicable), and total cash (after-

tax). Use a chart to help organize your calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Irene received the following dividends in 2021:

• an eligible dividend of $16,550

a non-eligible dividend of $12,450

a dividend of $21,975 from a foreign corporation, net of

$3300 of foreign tax withheld

• a stock dividend of 444 shares; the paid-up capital of the

corporation was increased by $25 for each share issued,

and the issuing company is a public company

Irene has a combined federal and provincial tax rate of 45%.

Required:

Indicate total after-tax amount received by Irene in 2021.

For each investment you should identify the total cash

received, the taxable amount, the taxes, any related

dividend tax credits (if applicable), and total cash (after-

tax). Use a chart to help organize your calculations.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT