Is 19%, banks hold no excess reserves, and there are no additional currency holdings. For each of the following scenarios, find the change in deposits, reserves, and loans for each bank. Instructions: Round your answers to two decimal places. a. Mickey receives his paycheck of $2,400 for the week and deposits the check at First Bank. Use the table below to show the change In assets and liabilities at First Bank resulting from this transaction. Assets Change in Reserves: $ Change in Loans: $ B b. Suppose that Austin gets a loan from First Bank in the amount from the "Loans" cell in the table in part a, and uses it to buy some jewelry from Jenny. Jenny takes the money from Austin and deposits it at Second Bank. Use the table below to show the change in assets and liabilities at Second Bank resulting from this transaction. Assets Change in Reserves: $ Change in Loans: $ Liabilities Change in Deposits: $ mum Assets Change in Reserves: $ Change in Loans: $ c. Now suppose that Mary gets a loan from Second Bank in the amount from the "Loans" cell in the table in part b, and purchases a television from Jasper with the money. Jasper takes the money from the sale of the television and deposits It Into Third Bank. Use the table below to show the change in assets and liabilities at Third Bank resulting from this transaction. WHE Liabilities Change in Deposits: $ Liabilities Change in Deposits: $ d. This process. continues with each additional

Is 19%, banks hold no excess reserves, and there are no additional currency holdings. For each of the following scenarios, find the change in deposits, reserves, and loans for each bank. Instructions: Round your answers to two decimal places. a. Mickey receives his paycheck of $2,400 for the week and deposits the check at First Bank. Use the table below to show the change In assets and liabilities at First Bank resulting from this transaction. Assets Change in Reserves: $ Change in Loans: $ B b. Suppose that Austin gets a loan from First Bank in the amount from the "Loans" cell in the table in part a, and uses it to buy some jewelry from Jenny. Jenny takes the money from Austin and deposits it at Second Bank. Use the table below to show the change in assets and liabilities at Second Bank resulting from this transaction. Assets Change in Reserves: $ Change in Loans: $ Liabilities Change in Deposits: $ mum Assets Change in Reserves: $ Change in Loans: $ c. Now suppose that Mary gets a loan from Second Bank in the amount from the "Loans" cell in the table in part b, and purchases a television from Jasper with the money. Jasper takes the money from the sale of the television and deposits It Into Third Bank. Use the table below to show the change in assets and liabilities at Third Bank resulting from this transaction. WHE Liabilities Change in Deposits: $ Liabilities Change in Deposits: $ d. This process. continues with each additional

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter13: Money And The Banking System

Section: Chapter Questions

Problem 18CQ

Related questions

Question

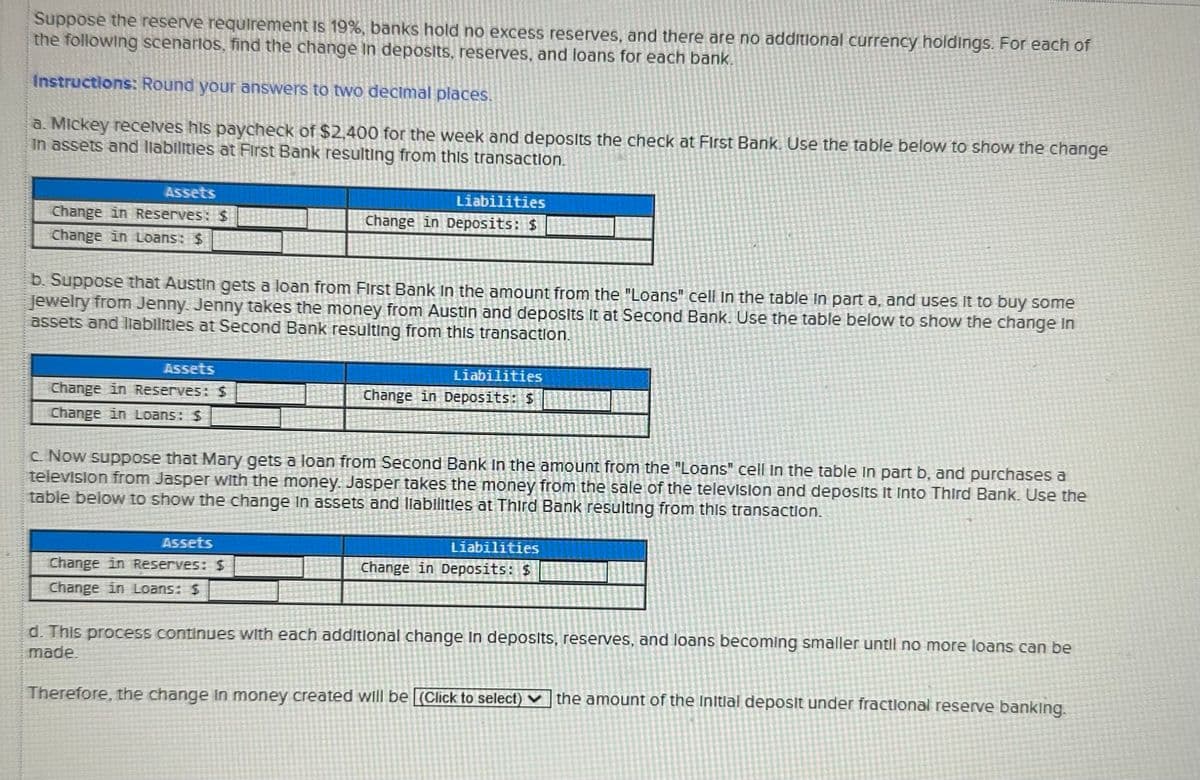

Transcribed Image Text:Suppose the reserve requirement is 19%, banks hold no excess reserves, and there are no additional currency holdings. For each of

the following scenarios, find the change in deposits, reserves, and loans for each bank.

Instructions: Round your answers to two decimal places.

a. Mickey receives his paycheck of $2,400 for the week and deposits the check at First Bank. Use the table below to show the change

in assets and liabilities at First Bank resulting from this transaction.

Assets

Change in Reserves: $

Change in Loans: $

b. Suppose that Austin gets a loan from First Bank in the amount from the "Loans" cell in the table in part a, and uses it to buy some

Jewelry from Jenny. Jenny takes the money from Austin and deposits it at Second Bank. Use the table below to show the change in

assets and liabilities at Second Bank resulting from this transaction.

Assets

Change in Reserves: $

Change in Loans: $

Liabilities

Change in Deposits: $

Assets

Change in Reserves: $

Change in Loans: $

Liabilities

Change in Deposits: $

c. Now suppose that Mary gets a loan from Second Bank In the amount from the "Loans" cell in the table in part b, and purchases a

television from Jasper with the money. Jasper takes the money from the sale of the television and deposits It Into Third Bank. Use the

table below to show the change in assets and liabilities at Third Bank resulting from this transaction.

Liabilities

Change in Deposits: $

d. This process continues with each additional change in deposits, reserves, and loans becoming smaller until no more loans can be

made.

Therefore, the change in money created will be (Click to select) the amount of the Initial deposit under fractional reserve banking.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning