Is a se living community that offers a full range of services including independent living, assisted iving, and skilled nursing care. The assisted Iiving division provides residential space, meals, and medical services (MS) to its residents. The cu O Support Dashboard e Bradl osting system adds the cost of all of these services (space, meals, and MS) and divides by total resident days to get a cost per resident day for each month. Recognizing that MS tends to vary significantly among the residents, Grand Haven's accountant ecommended that an ABC system be designed to calculate more accurately the cost of MS provided to residents. She decided that residents should be classified into four categories (A, B, C D) based on the level of services received, with group A representir owest level of service and D representing the highest level of service. Two cost drivers being considered for measuring MS costs are number of assistance calls and number of assistant contacts. A contact is registered each time an assistance professional pre medical services or aid to a resident. The accountant has gathered the following data for the most recent annual period: Resident Classification Annual Resident Days Annual Assistance Hours Number of Assistance Contacts A 8,760 15,000 60.000 6,570 20.000 52.000 4.380 22.500 52.000 2190 32500 52.000 216.000 21.900 90.000 Other data Total cost of medical services for the period S2.000.000 Total cost of meals and residential space $1,142,500 a. Determine the ABC cost of a resident day for each category of residents using assistance hours as the cost driver. Round answer below to the nearest dollar. Medical services cost per assistance hour $0 NOTE: Use your rounded answer above to compute answers below. Round final answers to the nearest dollar. Per Day Costs Medical Services Meals and Residential Total Class AS Class B Class C Class D b. Determine the ABC cost of a resident day for each category of residents using assistance contacts as the cost driver. Round answer below to the nearest dollar. Medical services cost per assistance contacts $ 0 NOTE: Use your rounded answer above to compute answers below. Round final answers to the nearest dollar. Per Day Costs Medical Services Meals and Residential Total Class AS Class B Class C

Is a se living community that offers a full range of services including independent living, assisted iving, and skilled nursing care. The assisted Iiving division provides residential space, meals, and medical services (MS) to its residents. The cu O Support Dashboard e Bradl osting system adds the cost of all of these services (space, meals, and MS) and divides by total resident days to get a cost per resident day for each month. Recognizing that MS tends to vary significantly among the residents, Grand Haven's accountant ecommended that an ABC system be designed to calculate more accurately the cost of MS provided to residents. She decided that residents should be classified into four categories (A, B, C D) based on the level of services received, with group A representir owest level of service and D representing the highest level of service. Two cost drivers being considered for measuring MS costs are number of assistance calls and number of assistant contacts. A contact is registered each time an assistance professional pre medical services or aid to a resident. The accountant has gathered the following data for the most recent annual period: Resident Classification Annual Resident Days Annual Assistance Hours Number of Assistance Contacts A 8,760 15,000 60.000 6,570 20.000 52.000 4.380 22.500 52.000 2190 32500 52.000 216.000 21.900 90.000 Other data Total cost of medical services for the period S2.000.000 Total cost of meals and residential space $1,142,500 a. Determine the ABC cost of a resident day for each category of residents using assistance hours as the cost driver. Round answer below to the nearest dollar. Medical services cost per assistance hour $0 NOTE: Use your rounded answer above to compute answers below. Round final answers to the nearest dollar. Per Day Costs Medical Services Meals and Residential Total Class AS Class B Class C Class D b. Determine the ABC cost of a resident day for each category of residents using assistance contacts as the cost driver. Round answer below to the nearest dollar. Medical services cost per assistance contacts $ 0 NOTE: Use your rounded answer above to compute answers below. Round final answers to the nearest dollar. Per Day Costs Medical Services Meals and Residential Total Class AS Class B Class C

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter10: Standard Costing And Variance Analysis

Section: Chapter Questions

Problem 3MTC

Related questions

Question

How do I determine the ABC cost of a resident for each category of residents using assistance hours as the cost driver?

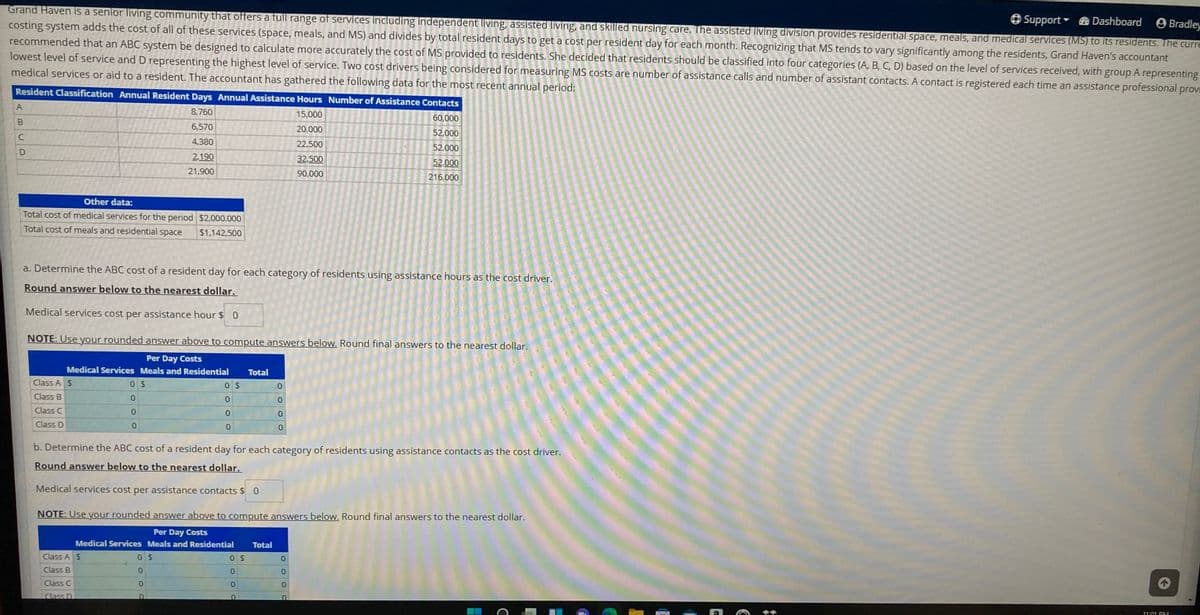

Transcribed Image Text:Grand Haven is a senior living community that offers a full range of services including independent living, assisted living, and skilled nursing care. The assisted living division provides residential space, meals, and medical services (MS) to its residents. The curre

costing system adds the cost of all of these services (space, meals, and MS) and divides by total resident days to get a cost per resident day for each month. Recognizing that MS tends to vary significantly among the residents, Grand Haven's accountant

recommended that an ABC system be designed to calculate more accurately the cost of MS provided to residents. She decided that residents should be classified into four categories (A, B, C, D) based on the level of services received, with group A representing

lowest level of service and D representing the highest level of service. Two cost drivers being considered for measuring MS costs are number of assistance calls and number of assistant contacts. A contact is registered each time an assistance professional provi

medical services or aid to a resident. The accountant has gathered the following data for the most recent annual period:

O Support- & Dashboard

O Bradley,

Resident Classification Annual Resident Days Annual Assistance Hours Number of Assistance Contacts

A

8,760

15,000

60,000

B

6,570

20,000

52,000

4,380

22,500

52,000

2.190

32,500

52,000

21,900

90,000

216,000

Other data:

Total cost of medical services for the period $2,000,000

Total cost of meals and residential space

$1,142,500

a. Determine the ABC cost of a resident day for each category of residents using assistance hours as the cost driver.

Round answer below to the nearest dollar.

Medical services cost per assistance hour $ 0

NOTE: Use your rounded answer above to compute answers below. Round final answers to the nearest dollar.

Per Day Costs

Medical Services Meals and Residential

Total

Class A $

Class B

0.

Class C

0.

Class D

0.

b. Determine the ABC cost of a resident day for each category of residents using assistance contacts as the cost driver.

Round answer below to the nearest dollar.

Medical services cost per assistance contacts $ 0

NOTE: Use your rounded answer above to compute answers below. Round final answers to the nearest dollar.

Per Day Costs

Medical Services Meals and Residential

Total

Class A $

0.

Class B

0.

0.

Class C

0.

Class D

11:01 PM

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning