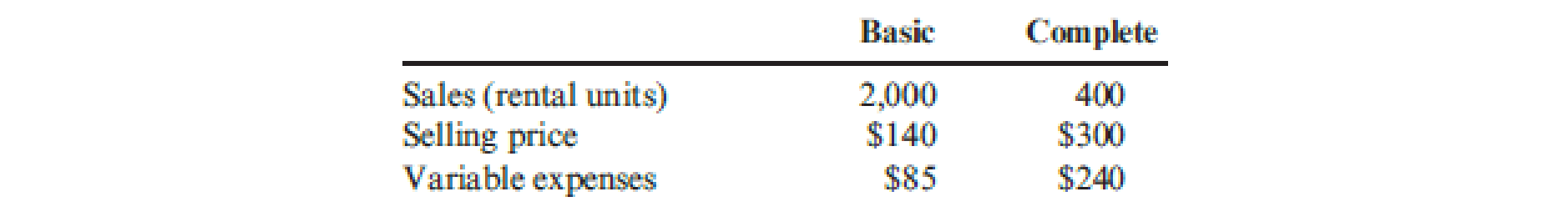

Haysbert Company provides management services for apartments and rental units. In general, Haysbert packages its services into two groups: basic and complete. The basic package includes advertising vacant units, showing potential renters through them, and collecting monthly rent and remitting it to the owner. The complete package adds maintenance of units and bookkeeping to the basic package. Packages are priced on a per-rental unit basis. Actual results from last year are as follows:

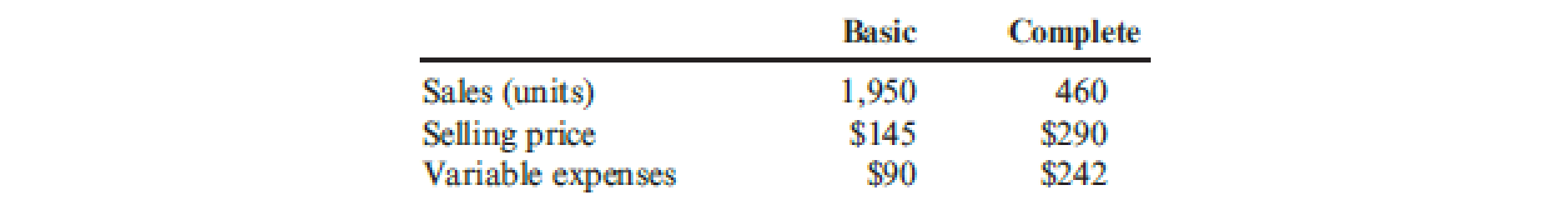

Haysbert had budgeted the following amounts:

Required:

- 1. Calculate the contribution margin variance.

- 2. Calculate the contribution margin volume variance.

- 3. Calculate the sales mix variance.

1.

Compute the contribution margin variance.

Explanation of Solution

Contribution margin variance: Contribution margin variance reflects difference between the actual contribution margin and budgeted contribution margin. It is computed using the given formula:

Compute the contribution margin variance:

| Particulars | Basic | Complete | Total |

| Actual results: | |||

|

Sales: | $280,000 | $120,000 | $400,000 |

|

Less: Variable expenses: | ($170,000) | ($96,000) | ($226,000) |

| Actual Contribution margin | $110,000 | $24,000 | $134,000 |

| Budgeted results: | |||

|

Sales: | $282,750 | $133,400 | $416,150 |

|

Less: Variable expenses: | ($175,500) | ($111,320) | ($286,820) |

| Budgeted Contribution margin | $107,250 | $22,080 | $129,030 |

| Computation of variance | |||

| Actual Contribution margin (A) | $134,000 | ||

| Budgeted Contribution margin (B) | $129,030 | ||

| Contribution margin variance | $4,670 (F) | ||

Table (1)

Since, the actual contribution margin is more than the budgeted contribution margin; the contribution margin variance of $4,670 is favorable (F).

2.

Compute the contribution margin volume variance.

Explanation of Solution

Contribution margin volume variance: Contribution margin volume variance reflects difference between the actual quantity sold and the budgeted quantity sold multiplied by the budgeted average unit contribution margin. It is computed using the given formula:

Compute the contribution margin volume variance:

Therefore, the contribution margin volume variance is $536.64(Unfavorable).

Working note 1: Calculate the budgeted average unit contribution margin:

3.

Compute the sales mix variance.

Explanation of Solution

Sales mix variance: The sales mix represents the part of total sales generated by each product. Sales mix variance is the summation of change in units for each product multiplied by the difference between the budgeted contribution margin and the budgeted average unit contribution margin. It is computed using the given formula:

Compute the basic sales mix:

Compute the complete sales mix:

Compute the sales mix variance:

Want to see more full solutions like this?

Chapter 18 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Friendly Bank is attempting to determine the cost behavior of its small business lending operations. One of the major activities is the application activity. Two possible activity drivers have been mentioned: application hours (number of hours to complete the application) and number of applications. The bank controller has accumulated the following data for the setup activity: Required: 1. Estimate a regression equation with application hours as the activity driver and the only independent variable. If the bank forecasts 2,600 application hours for the next month, what will be the budgeted application cost? 2. Estimate a regression equation with number of applications as the activity driver and the only independent variable. If the bank forecasts 80 applications for the next month, what will be the budgeted application cost? 3. Which of the two regression equations do you think does a better job of predicting application costs? Explain. 4. Run a multiple regression to determine the cost equation using both activity drivers. What are the budgeted application costs for 2,600 application hours and 80 applications?arrow_forwardThe Lockit Company manufactures door knobs for residential homes and apartments. Lockit is considering the use of simple (single-driver) and multiple regression analyses to forecast annual sales because previous forecasts have been inaccurate. The new sales forecast will be used to initiate the budgeting process and to identify more completely the underlying process that generates sales. Larry Husky, the controller of Lockit, has considered many possible independent variables and equations to predict sales and has narrowed his choices to four equations. Husky used annual observations from 20 prior years to estimate each of the four equations. Following are definitions of the variables used in the four equations and a statistical summary of these equations: St=ForecastedsalesindollarsforLockitinperiodtSt1=ActualsalesindollarsforLockitinperiodt1Gt=ForecastedU.S.grossdomesticproductinperiodtGt1=ActualU.S.grossdomesticproductinperiodt1Nt1=Lockitsnetincomeinperiodt1 Required: 1. Write Equations 2 and 4 in the form Y = a + bx. 2. If actual sales are 1,500,000 in the current year, what would be the forecasted sales for Lockit in the coming year? 3. Explain why Larry Husky might prefer Equation 3 to Equation 2. 4. Explain the advantages and disadvantages of using Equation 4 to forecast sales.arrow_forwardIona Company, a large printing company, is in its fourth year of a five-year, quality improvement program. The program began in 20x0 with an internal study that revealed the quality costs being incurred. In that year, a five-year plan was developed to lower quality costs to 10 percent of sales by the end of 20x5. Sales and quality costs for each year are as follows: Budgeted figures. Quality costs by category are expressed as a percentage of sales as follows: The detail of the 20x5 budget for quality costs is also provided. All prevention costs are fixed; all other quality costs are variable. During 20x5, the company had 12 million in sales. Actual quality costs for 20x4 and 20x5 are as follows: Required: 1. Prepare an interim quality cost performance report for 20x5 that compares actual quality costs with budgeted quality costs. Comment on the firms ability to achieve its quality goals for the year. 2. Prepare a one-period quality performance report for 20x5 that compares the actual quality costs of 20x4 with the actual costs of 20x5. How much did profits change because of improved quality? 3. Prepare a graph that shows the trend in total quality costs as a percentage of sales since the inception of the quality improvement program. 4. Prepare a graph that shows the trend for all four quality cost categories for 20x1 through 20x5. How does this graph help management know that the reduction in total quality costs is attributable to quality improvements? 5. Assume that the company is preparing a second five-year plan to reduce quality costs to 2.5 percent of sales. Prepare a long-range quality cost performance report assuming sales of 15 million at the end of five years. Assume that the final planned relative distribution of quality costs is as follows: proofreading, 50 percent; other inspection, 13 percent; quality training, 30 percent; and quality reporting, 7 percent.arrow_forward

- Biotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and the other in Bernalillo, New Mexico. The owner of Biotechtron centralized the legal services function in the Yuma office and had both laboratories send any legal questions or issues to the Yuma office. The legal services support center has budgeted fixed costs of 160,000 per year and a budgeted variable rate of 65 per hour of professional time. The normal usage of the legal services center is 2,600 hours per year for the Yuma office and 1,400 hours per year for the Bernalillo office. This corresponds to the expected usage for the coming year. Required: 1. Determine the amount of legal services support center costs that should be assigned to each office. 2. Since the offices produce services, not tangible products, what purpose is served by allocating the budgeted costs? 3. Now, assume that during the year, the legal services center incurred actual fixed costs of 163,000 and actual variable costs of 272,400. It delivered 4,180 hours of professional time2,580 hours to Yuma and 1,600 hours to Bernalillo. Determine the amount of the legal services centers costs that should be allocated to each office. Explain the purposes of this allocation. 4. Did the costs allocated differ from the costs incurred by the legal services center? If so, why?arrow_forwardCorazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?arrow_forwardThe Sea Wharf Restaurant would like to determine the best way to allocate a monthly advertising budget of 1,000 between newspaper advertising and radio advertising. Management decided that at least 25% of the budget must be spent on each type of media and that the amount of money spent on local newspaper advertising must be at least twice the amount spent on radio advertising. A marketing consultant developed an index that measures audience exposure per dollar of advertising on a scale from 0 to 100, with higher values implying greater audience exposure. If the value of the index for local newspaper advertising is 50 and the value of the index for spot radio advertising is 80, how should the restaurant allocate its advertising budget to maximize the value of total audience exposure? a. Formulate a linear programming model that can be used to determine how the restaurant should allocate its advertising budget in order to maximize the value of total audience exposure. b. Develop a spreadsheet model and solve the problem using Excel Solver.arrow_forward

- Norton Company, a manufacturer of infant furniture and carriages, is in the initial stages of preparing the annual budget for the coming year. Scott Ford has recently joined Nortons accounting staff and is interested in learning as much as possible about the companys budgeting process. During a recent lunch with Marge Atkins, sales manager, and Pete Granger, production manager, Ford initiated the following conversation. FORD: Since Im new around here and am going to be involved with the preparation of the annual budget, Id be interested in learning how the two of you estimate sales and production numbers. ATKINS: We start out very methodically by looking at recent history, discussing what we know about current accounts, potential customers, and the general state of consumer spending. Then, we add that usual dose of intuition to come up with the best forecast we can. GRANGER: I usually take the sales projections as the basis for my projections. Of course, we have to make an estimate of what this years closing inventories will be, which is sometimes difficult. FORD: Why does that present a problem? There must have been an estimate of closing inventories in the budget for the current year. GRANGER: Those numbers arent always reliable since Marge makes some adjustments to the sales numbers before passing them on to me. FORD: What kind of adjustments? ATKINS: Well, we dont want to fall short of the sales projections so we generally give ourselves a little breathing room by lowering the initial sales projection anywhere from 5 to 10 percent. GRANGER: So, you can see why this years budget is not a very reliable starting point. We always have to adjust the projected production rates as the year progresses, and of course, this changes the ending inventory estimates. By the way, we make similar adjustments to expenses by adding at least 10 percent to the estimates; I think everyone around here does the same thing. Required: 1. Marge Atkins and Pete Granger have described the use of budgetary slack. a. Explain why Atkins and Granger behave in this manner, and describe the benefits they expect to realize from the use of budgetary slack. b. Explain how the use of budgetary slack can adversely affect Atkins and Granger. 2. As a management accountant, Scott Ford believes that the behavior described by Marge Atkins and Pete Granger may be unethical and that he may have an obligation not to support this behavior. By citing the specific standards of competence, confidentiality, integrity, and/or credibility from the Statement of Ethical Professional Practice (in Chapter 1), explain why the use of budgetary slack may be unethical. (CMA adapted)arrow_forwardGreiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiners master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employers share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the companys union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 35 percent of the following month's projected sales in inventory. Information on the first four months of the coming year is as follows: Required: 1. Prepare the following monthly budgets for Greiner Company for the first quarter of the coming year. Be sure to show supporting calculations. a. Production budget in units b. Direct labor budget in hours c. Direct materials cost budget d. Sales budget 2. Calculate the total budgeted contribution margin for Greiner Company by month and in total for the first quarter of the coming year. Be sure to show supporting calculations. (CMA adapted)arrow_forwardAdam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forward

- Novo, Inc., wants to develop an activity flexible budget for the activity of moving materials. Novo uses eight forklifts to move materials from receiving to stores. The forklifts are also used to move materials from stores to the production area. The forklifts are obtained through an operating lease that costs 18,000 per year per forklift. Novo employs 25 forklift operators who receive an average salary of 50,000 per year, including benefits. Each move requires the use of a crate. The crates are used to store the parts and are emptied only when used in production. Crates are disposed of after one cycle (two moves), where a cycle is defined as a move from receiving to stores to production. Each crate costs 1.80. Fuel for a forklift costs 3.60 per gallon. A gallon of gas is used every 20 moves. Forklifts can make three moves per hour and are available for 280 days per year, 24 hours per day (the remaining time is downtime for various reasons). Each operator works 40 hours per week and 50 weeks per year. Required: 1. Prepare a flexible budget for the activity of moving materials, using the number of cycles as the activity driver. 2. Calculate the activity capacity for moving materials. Suppose Novo works at 80 percent of activity capacity and incurs the following costs: Prepare the budget for the 80 percent level and then prepare a performance report for the moving materials activity. 3. Calculate and interpret the volume variance for moving materials. 4. Suppose that a redesign of the plant layout reduces the demand for moving materials to one-third of the original capacity. What would be the budget formula for this new activity level? What is the budgeted cost for this new activity level? Has activity performance improved? How does this activity performance evaluation differ from that described in Requirement 2? Explain.arrow_forwardKeleher Industries manufactures pet doors and sells them directly to the consumer via their web site. The marketing manager believes that if the company invests in new software, they will increase their sales by 10%. The new software will increase fixed costs by $400 per month. Prepare a forecasted contribution margin income statement for Keleher Industries reflecting the new software cost and associated increase in sales. The previous annual statement is as follows:arrow_forwardElliott, Inc., has four salaried clerks to process purchase orders. Each clerk is paid a salary of 25,750 and is capable of processing as many as 6,500 purchase orders per year. Each clerk uses a PC and laser printer in processing orders. Time available on each PC system is sufficient to process 6,500 orders per year. The cost of each PC system is 1,100 per year. In addition to the salaries, Elliott spends 27,560 for forms, postage, and other supplies (assuming 26,000 purchase orders are processed). During the year, 25,350 orders were processed. Required: 1. Classify the resources associated with purchasing as (1) flexible or (2) committed. 2. Compute the total activity availability, and break this into activity usage and unused activity. 3. Calculate the total cost of resources supplied (activity cost), and break this into the cost of activity used and the cost of unused activity. 4. (a) Suppose that a large special order will cause an additional 500 purchase orders. What purchasing costs are relevant? By how much will purchasing costs increase if the order is accepted? (b) Suppose that the special order causes 700 additional purchase orders. How will your answer to (a) change?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,