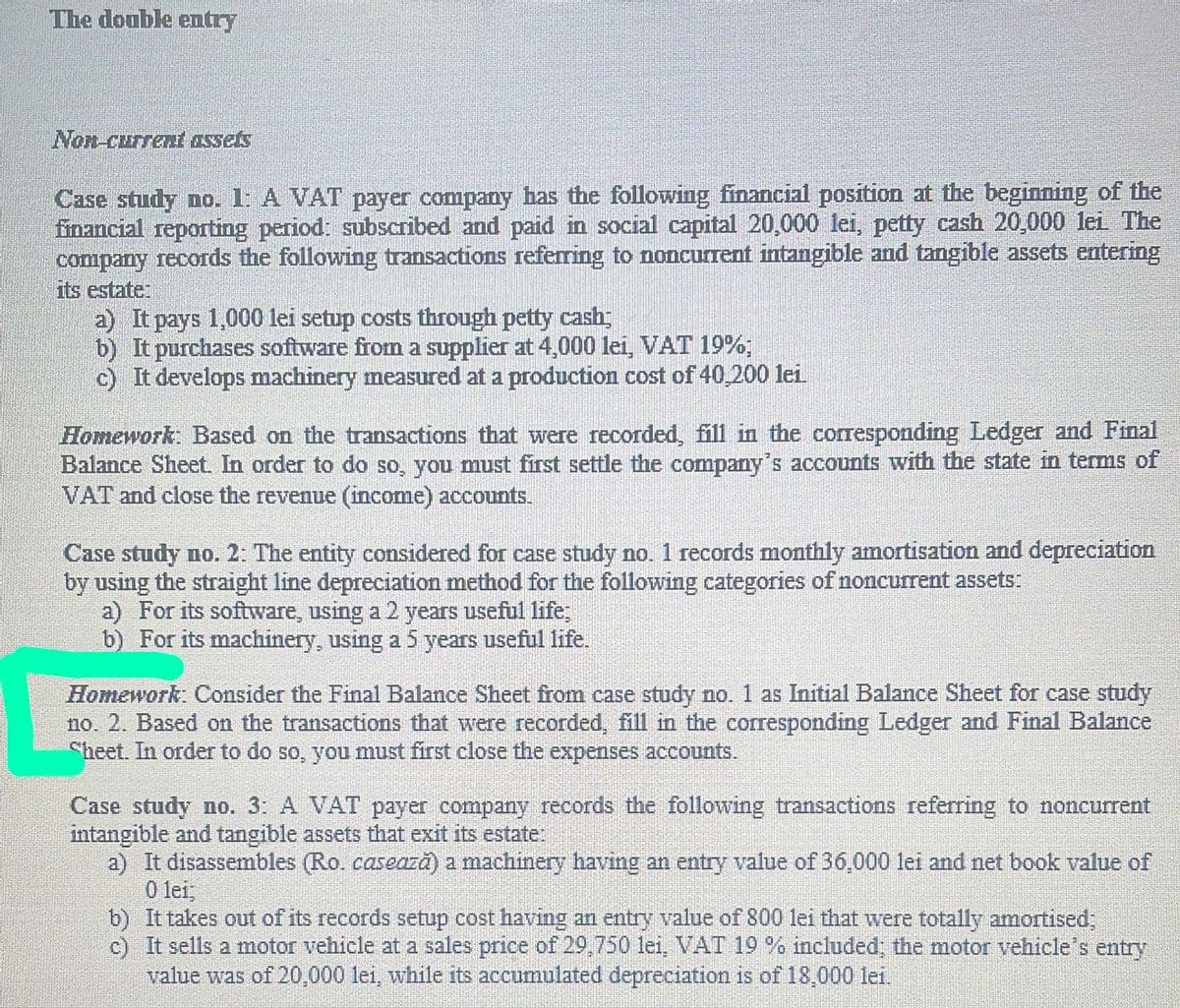

The double entry Non-current assets Case study no. 1: A VAT payer company has the following financial position at the beginning of the financial reporting period: subscribed and paid in social capital 20,000 lei, petty cash 20,000 lei The company records the following transactions referring to noncurrent intangible and tangible assets entering its estate: a) It pays 1,000 lei setup costs through petty cash; b) It purchases software from a supplier at 4,000 lei, VAT 19%; c) It develops machinery measured at a production cost of 40,200 lei Homework: Based on the transactions that were recorded, fill in the corresponding Ledger and Final Balance Sheet. In order to do so, you must first settle the company's accounts with the state in terms of VAT and close the revenue (income) accounts. Case study no. 2: The entity considered for case study no. 1 records monthly amortisation and depreciation by using the straight line depreciation method for the following categories of noncurrent assets: a) For its software, using a 2 years useful life; b) For its machinery, using a 5 years useful life. Homework: Consider the Final Balance Sheet from case study no. 1 as Initial Balance Sheet for case study no. 2. Based on the transactions that were recorded, fill in the corresponding Ledger and Final Balance Sheet. In order to do so, you must first close the expenses accounts.

The double entry Non-current assets Case study no. 1: A VAT payer company has the following financial position at the beginning of the financial reporting period: subscribed and paid in social capital 20,000 lei, petty cash 20,000 lei The company records the following transactions referring to noncurrent intangible and tangible assets entering its estate: a) It pays 1,000 lei setup costs through petty cash; b) It purchases software from a supplier at 4,000 lei, VAT 19%; c) It develops machinery measured at a production cost of 40,200 lei Homework: Based on the transactions that were recorded, fill in the corresponding Ledger and Final Balance Sheet. In order to do so, you must first settle the company's accounts with the state in terms of VAT and close the revenue (income) accounts. Case study no. 2: The entity considered for case study no. 1 records monthly amortisation and depreciation by using the straight line depreciation method for the following categories of noncurrent assets: a) For its software, using a 2 years useful life; b) For its machinery, using a 5 years useful life. Homework: Consider the Final Balance Sheet from case study no. 1 as Initial Balance Sheet for case study no. 2. Based on the transactions that were recorded, fill in the corresponding Ledger and Final Balance Sheet. In order to do so, you must first close the expenses accounts.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section19.6: Buying Intangible Assets And Calculating Amortization Expense

Problem 1OYO

Related questions

Question

Transcribed Image Text:The double entry

Non-current assets

Case study no. 1: A VAT payer company has the following financial position at the beginning of the

financial reporting period: subscribed and paid in social capital 20,000 lei, petty cash 20,000 lei The

company records the following transactions referring to noncurent intangible and tangible assets entering

its estate:

a) It pays 1,000 lei setup costs through petty cash

b) It purchases software from a supplier at 4,000 lei, VAT 19%,

c) It develops machinery measured at a production cost of 40,200 lei

Homework: Based on the transactions that were recorded, fill in the corresponding Ledger and Final

Balance Sheet. In order to do so, you must first settle the company's accounts with the state in terms of

VAT and close the revenue (income) accounts.

Case study no. 2: The entity considered for case study no. 1 records monthly amortisation and depreciation

by using the straight line depreciation method for the following categories of noncurrent assets:

a) For its software, using a 2 years useful life;

b) For its machinery, using a 5 years useful life.

Homework: Consider the Final Balance Sheet from case study no. 1 as Initial Balance Sheet for case study

no. 2. Based on the transactions that were recorded, fill in the corresponding Ledger and Final Balance

Sheet. In order to do so, you must first close the expenses accounts.

Case study no. 3: A VAT payer company records the following transactions referring to noncurrent

intangible and tangible assets that exit its estate:

a) It disassembles (Ro. casează) a machinery having an entry value of 36,000 lei and net book value of

0 lei,

b) It takes out of its records setup cost having an entry value of 800 lei that were totally amortised;

c) It sells a motor vehicle at a sales price of 29,750 lei, VAT 19 % included; the motor vehicle's entry

value was of 20,000 lei, while its accumulated depreciation is of 18,000 lei.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,