Is it the creditors who can earn the interest, but not the shareholders? Shareholders can only earn dividends. correct? So what does the first sentence mean? "Own a significant interest in the company" and "Siemens is called a parent company?" And the second paragraph says shares? Seems it is talking about dividends instead of interest?

Is it the creditors who can earn the interest, but not the shareholders? Shareholders can only earn dividends. correct? So what does the first sentence mean? "Own a significant interest in the company" and "Siemens is called a parent company?" And the second paragraph says shares? Seems it is talking about dividends instead of interest?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Is it the creditors who can earn the interest, but not the shareholders? Shareholders can only earn dividends. correct? So what does the first sentence mean? "Own a significant interest in the company" and "Siemens is called a parent company?" And the second paragraph says shares? Seems it is talking about dividends instead of interest?

Transcribed Image Text:51125

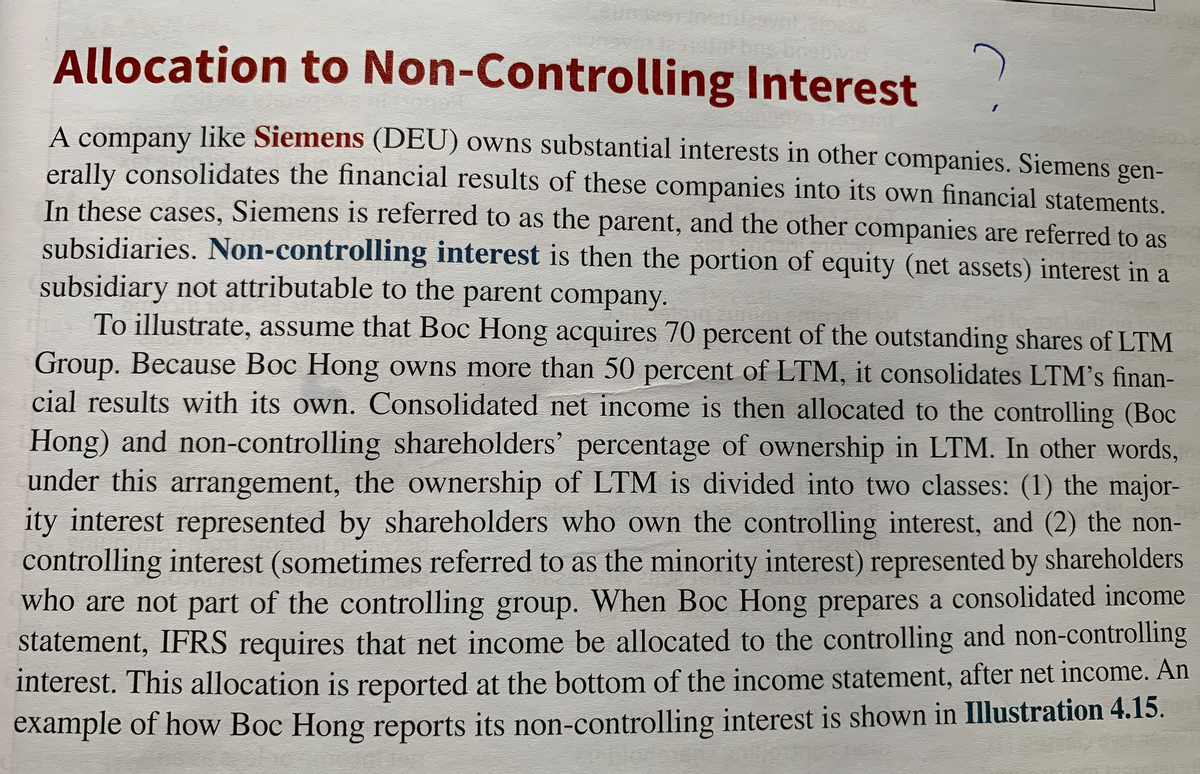

Allocation to Non-Controlling

A company like Siemens (DEU) owns substantial interests in other companies. Siemens gen-

erally consolidates the financial results of these companies into its own financial statements.

In these cases, Siemens is referred to as the parent, and the other companies are referred to as

subsidiaries. Non-controlling interest is then the portion of equity (net assets) interest in a

subsidiary not attributable to the parent company.

To illustrate, assume that Boc Hong acquires 70 percent of the outstanding shares of LTM

Group. Because Boc Hong owns more than 50 percent of LTM, it consolidates LTM's finan-

cial results with its own. Consolidated net income is then allocated to the controlling (Boc

Hong) and non-controlling shareholders' percentage of ownership in LTM. In other words,

under this arrangement, the ownership of LTM is divided into two classes: (1) the major-

ity interest represented by shareholders who own the controlling interest, and (2) the non-

controlling interest (sometimes referred to as the minority interest) represented by shareholders

who are not part of the controlling group. When Boc Hong prepares a consolidated income

statement, IFRS requires that net income be allocated to the controlling and non-controlling

interest. This allocation is reported at the bottom of the income statement, after net income. An

example of how Boc Hong reports its non-controlling interest is shown in Illustration 4.15.

ons brebivo

Interest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education