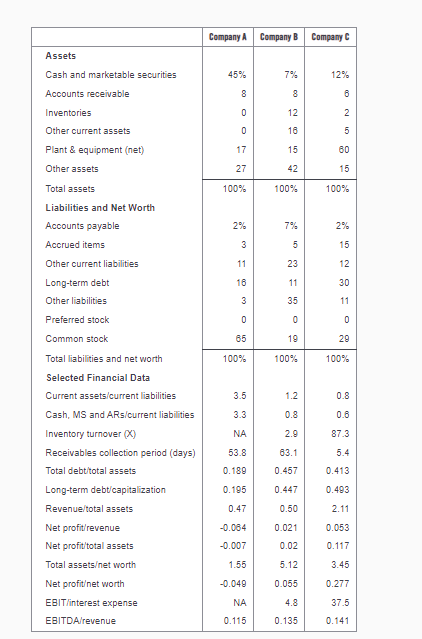

One of these companies is LinkedIn (the social network), one is Panera (the food and beverage company), and one is Caterpillar (the manufacturing company). Which is which? Give reasons for why you think so.

One of these companies is LinkedIn (the social network), one is Panera (the food and beverage company), and one is Caterpillar (the manufacturing company). Which is which? Give reasons for why you think so.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter4: Balance Sheet: Presenting And Analyzing Resources And Financing

Section: Chapter Questions

Problem 14E

Related questions

Question

One of these companies is LinkedIn (the social network), one is Panera (the food and beverage company), and one is Caterpillar (the manufacturing company). Which is which? Give reasons for why you think so.

Transcribed Image Text:Assets

Cash and marketable securities

Accounts receivable

Inventories

Other current assets

Plant & equipment (net)

Other assets

Total assets

Liabilities and Net Worth

Accounts payable

Accrued items

Other current liabilities

Long-term debt

Other liabilities

Preferred stock

Common stock

Total liabilities and net worth

Selected Financial Data

Current assets/current liabilities

Cash, MS and ARs/current liabilities

Inventory turnover (X)

Receivables collection period (days)

Total debt/total assets

Long-term debt/capitalization

Revenue/total assets

Net profit/revenue

Net profit/total assets

Total assets/net worth

Net profit/net worth

EBIT/interest expense

EBITDA/revenue

Company A

45%

8

0

0

17

27

100%

2%

3

11

16

3

0

65

100%

3.5

3.3

NA

53.8

0.189

0.195

0.47

-0.084

-0.007

1.55

-0.049

NA

0.115

Company B

7%

8

12

16

15

42

100%

7%

5

23

11

35

0

19

100%

1.2

22

0.8

2.9

63.1

0.457

0.447

0.50

0.021

0.02

5.12

0.055

4.8

0.135

Company C

12%

6

2

5

60

15

100%

2%

15

12

30

11

0

29

100%

0.8

0.6

87.3

5.4

0.413

0.493

2.11

0.053

0.117

3.45

0.277

37.5

0.141

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,