IS OHly p Cost $9 each. The CO petual inventory system and the FIFO cost method The following transactions occurred during the year Purchased 125.000 additional units at a cost of $10 per unit. Terms of the purchases were 3/10, n/30, and 70% of the were paid for within the 10-day discount period. The company uses the gross method to record purchase discounts, metchandise was purchasedfo.b shipping point and freight charges of $060 per unit were paid by Johnson. 2,500 units purchased during the year were returhed to suppliers for credit Johnson was also given credit for the fre $0.60 per unit it had paid on the original purchase The units were defective and were retuned two days after they w Sales for the year totaled 12O,000 units at $16 per unit. On December 28, Johnsoh purchased 6,500 additional units at $11 each. The goods were shinned fah destination at

IS OHly p Cost $9 each. The CO petual inventory system and the FIFO cost method The following transactions occurred during the year Purchased 125.000 additional units at a cost of $10 per unit. Terms of the purchases were 3/10, n/30, and 70% of the were paid for within the 10-day discount period. The company uses the gross method to record purchase discounts, metchandise was purchasedfo.b shipping point and freight charges of $060 per unit were paid by Johnson. 2,500 units purchased during the year were returhed to suppliers for credit Johnson was also given credit for the fre $0.60 per unit it had paid on the original purchase The units were defective and were retuned two days after they w Sales for the year totaled 12O,000 units at $16 per unit. On December 28, Johnsoh purchased 6,500 additional units at $11 each. The goods were shinned fah destination at

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section: Chapter Questions

Problem 1MP

Related questions

Question

on number 1 I have the ending correct but I'm not getting the correct COG. and I'm stuck on #2 and #4

thank you for your help.

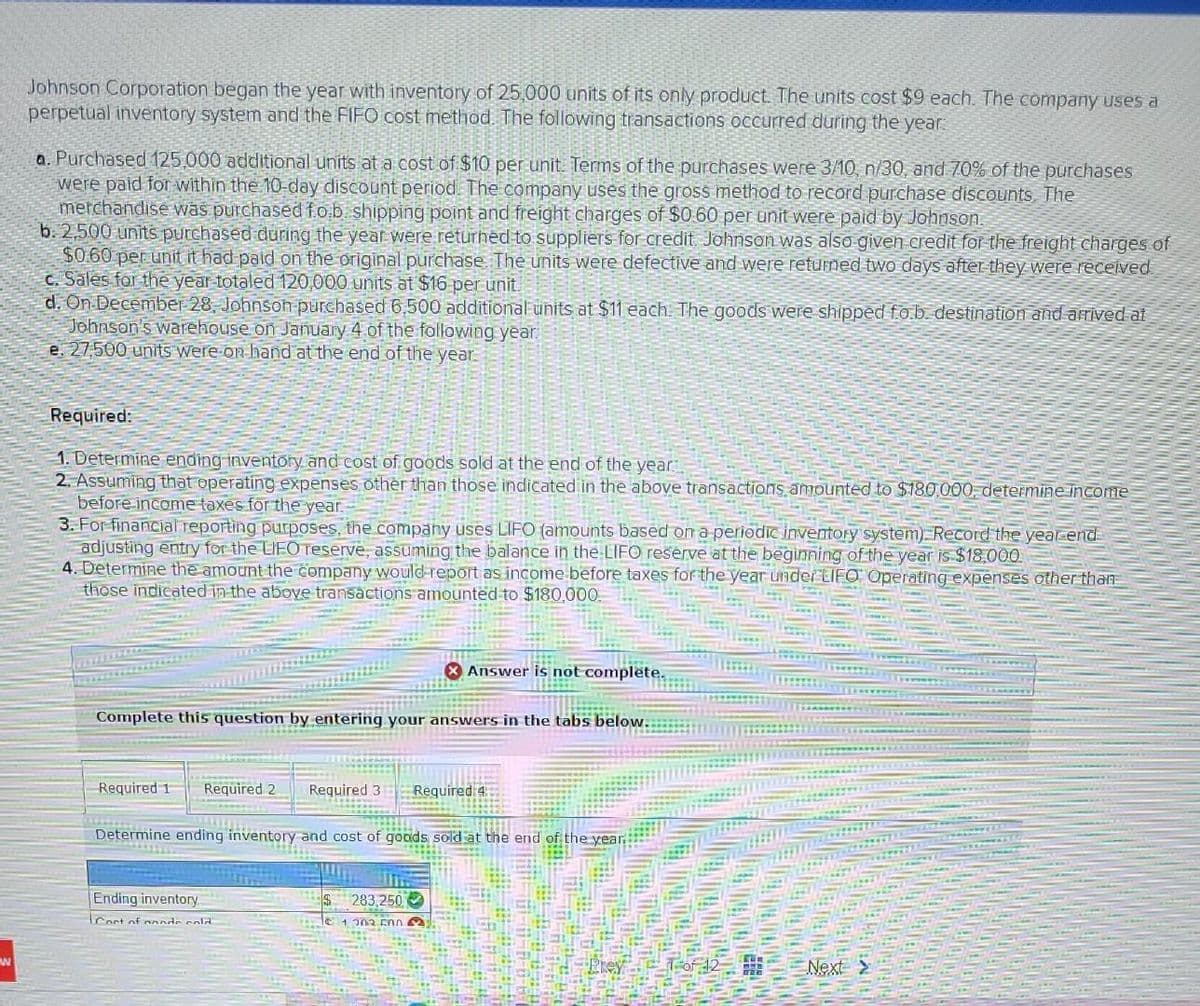

Transcribed Image Text:Johnson Corporation began the year with inventory of 25,000 units of its only product. The units cost $9 each. The company uses a

perpetual inventory system and the FIFO cost method. The following transactions occured during the year

a. Purchased 125,000 additional units at a cost of $10 per unit. Terms of the purchases were 3/10, n/30, and 70% of the purchases

were paid for within the 10-day discount period. The company uses the gross method to record purchase discounts, The

metchandise was purchasedfo.b shipping point and freight charges of $0.60 per unit were paid by Johnson.

b. 2,500 units purehased during the year were returhed to suppliers for credit. Johnson was also given cCredit for the freight charges of

$0.60 per unit it had paid on the original purchase The units were defective and were returned two days after they were received

C. Sales for the year totaled 120,000 units at $16 per unit.

d. On December 28, Johnson purchased 6,500 additional units at $11 each. The goods were shipped fo.b destination and arrived at

Johnson's warehouse on January 4 of the following year.

e. 27,500 units were on hand at the end of the year.

Required:

1. Determine ending inventory and cost of goods sold at the end of the year

2. Assuming that operating expenses other than those indicated in the above transactions amounted to $180,000, determine income

before income taxes for the year.

3. For financial reporting purposes, the company uses LIFO (amounts based on a periodic inventory system). Record the year end

adjusting entry for the LIFO Teserve, assuming the balance in the LIFO reserve at the beginning of the year is $18,00.

4. Determine the amount the company would report as income before taxes for the year underLIFO Operating expenses other than

those indicated in the above transactions amounted to $180,000

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Determine ending inventory and cost of goads sold at the end of the year

Ending inventory

283,250

ICost of annde cold

1 203 E00

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT