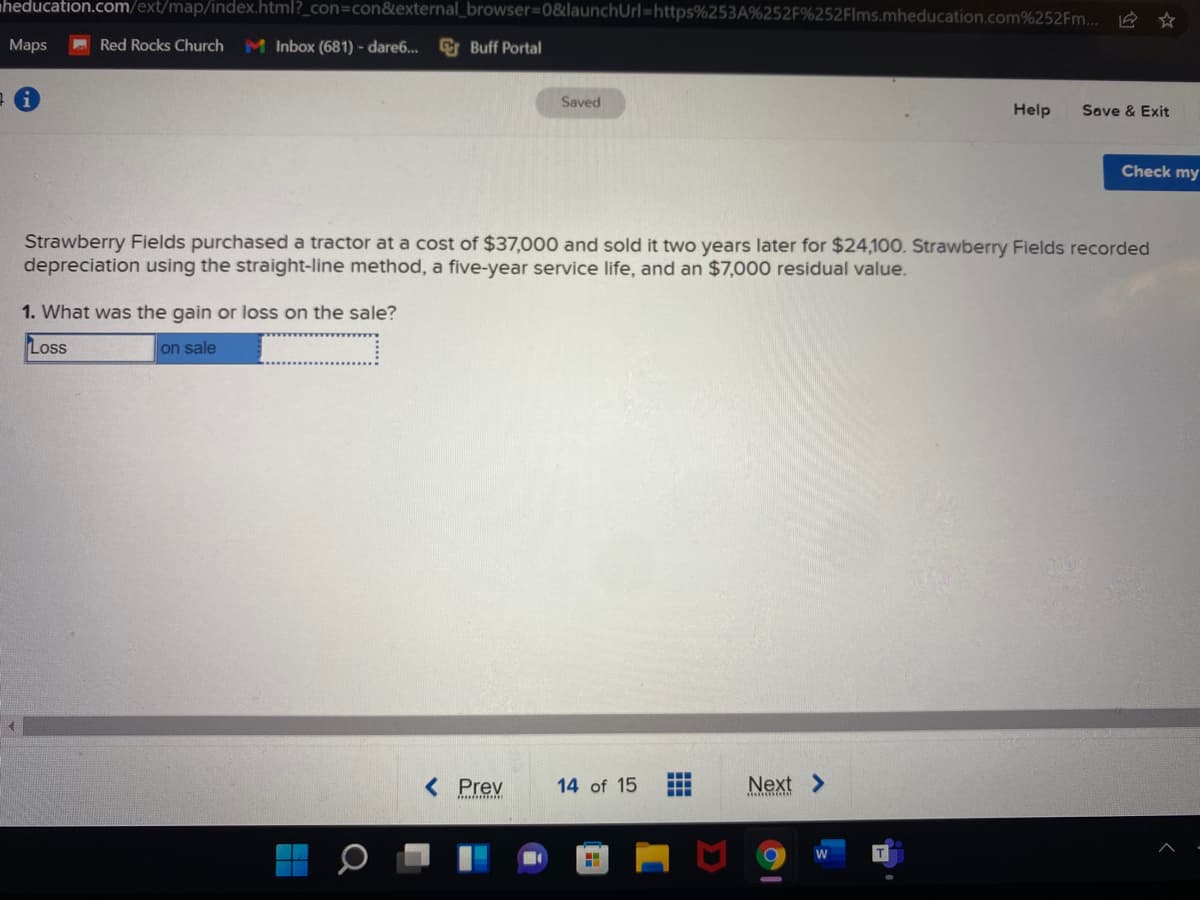

Saved Help Save & Exit Check my Strawberry Fields purchased a tractor at a cost of $37,000 and sold it two years later for $24,10O. Strawberry Fields recorded lepreciation using the straight-line method, a five-year service life, and an $7,000 residual value. .What was the gain or loss on the sale? Loss on sale

Saved Help Save & Exit Check my Strawberry Fields purchased a tractor at a cost of $37,000 and sold it two years later for $24,10O. Strawberry Fields recorded lepreciation using the straight-line method, a five-year service life, and an $7,000 residual value. .What was the gain or loss on the sale? Loss on sale

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

please show me how this is done. not graded

Transcribed Image Text:heducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A%252F%252Flms.mheducation.com%252FM..

它 ☆

Maps

Red Rocks Church

M Inbox (681) - dare6... Buff Portal

Saved

Help

Save & Exit

Check my

Strawberry Fields purchased a tractor at a cost of $37,000 and sold it two years later for $24,100. Strawberry Fields recorded

depreciation using the straight-line method, a five-year service life, and an $7,000 residual value.

1. What was the gain or loss on the sale?

Loss

on sale

<Prev

14 of 15

Next >

W

Expert Solution

Step 1 Introduction

The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage and the passage of time.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you