issuing at Pl15 per share one-half of the 950,000 ordinary On January 1. 2021, Penn Company began operations by ahares of P10 par value that had been authorized for sa In addition, the entity had 500,000 authorized preference shares of P5 par value. During 2021, the entity had P1,025,000 of net income and declared P230,000 of dividend. During 2022, the entity had the following transactions: - Issued 100,000 ordinary shares for P17 per share. Issued 150,000 preference shares for P8 per share. Authorized the purchase of a custom-made machine to be delivered in January 2023. The entity restricted P300,000 of retained earnings for the purchase of the machine. Issued additional 50,000 preference shares for P9 per share. Reported P1,215,000 of net income and declared on December 31, 2022 a cash dividend of P635,000 to shareholders of record on January 15, 2023 to be paid on February 1, 2023. What amount should be reported as shareholders' equity on December 31, 2021? a. 7,920,000 b. 7,125,000 e. 8,150,000 d. 8,380,000

issuing at Pl15 per share one-half of the 950,000 ordinary On January 1. 2021, Penn Company began operations by ahares of P10 par value that had been authorized for sa In addition, the entity had 500,000 authorized preference shares of P5 par value. During 2021, the entity had P1,025,000 of net income and declared P230,000 of dividend. During 2022, the entity had the following transactions: - Issued 100,000 ordinary shares for P17 per share. Issued 150,000 preference shares for P8 per share. Authorized the purchase of a custom-made machine to be delivered in January 2023. The entity restricted P300,000 of retained earnings for the purchase of the machine. Issued additional 50,000 preference shares for P9 per share. Reported P1,215,000 of net income and declared on December 31, 2022 a cash dividend of P635,000 to shareholders of record on January 15, 2023 to be paid on February 1, 2023. What amount should be reported as shareholders' equity on December 31, 2021? a. 7,920,000 b. 7,125,000 e. 8,150,000 d. 8,380,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 81PSA

Related questions

Question

Answer number 1 only with solution/explanation

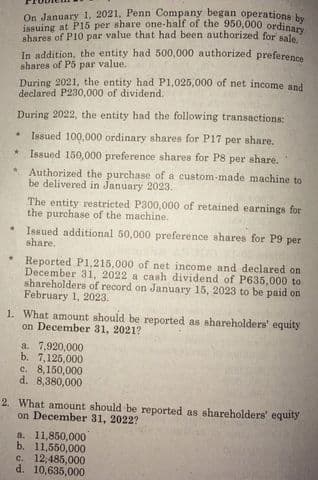

Transcribed Image Text:issuing at P15 per share one-half of the 950,000 ordinary

On January 1, 2021, Penn Company began operations bu

shares of P10 par value that had been authorized for sale

In addition, the entity had 500,000 authorized preference

shares of P5 par value.

During 2021, the entity had P1,025,000 of net income and

declared P230,000 of dividend.

During 2022, the entity had the following transactions

Issued 100,000 ordinary shares for P17 per share.

Issued 150,000 preference shares for P8 per share.

Authorized the purchase of a custom-made machine to

be delivered in January 2023.

The entity restricted P300,000 of retained earnings for

the purchase of the machine.

Issued additional 50,000 preference shares for P9 per

share.

Reported P1,215.000 of net income and declared on

December 31, 2022 a cash dividend of P635,000 to

shareholders of record on January 15, 2023 to be paid on

February 1, 2023.

1. What amount should be reported as shareholders' equity

on December 31, 2021?

a. 7,920,000

b. 7,125,000

e. 8,150,000

d. 8,380,000

2. What amount should be reported as shareholders' equity

on December 31, 2022?

a. 11,850,000

b. 11,550,000

c. 12:485,000

d. 10,635,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning