Peggy Lane Corp.., a producer of machine tools, wants to move to a larger site. Two alternative locations have been identified: Bonham and McKinney. Bonham would have fixed costs of $800,000 per year and variable costs of $14,000 per standard unit produced. McKinney would have annual fixed costs of $940,000 and variable costs of $12,800 per standard unit. The finished items sell for $28,000 each. a) The volume of output at which both the locations have the same profit = standard units (round your response to the nearest whole number). b) Básed on the analysis of the volume, after rounding the numbers to the nearest whole number, Bonham is superior below V standard units c) Based on the analysis of the volume, after rounding the numbers to the nearest whole number, McKinney is superior above V standard units

Peggy Lane Corp.., a producer of machine tools, wants to move to a larger site. Two alternative locations have been identified: Bonham and McKinney. Bonham would have fixed costs of $800,000 per year and variable costs of $14,000 per standard unit produced. McKinney would have annual fixed costs of $940,000 and variable costs of $12,800 per standard unit. The finished items sell for $28,000 each. a) The volume of output at which both the locations have the same profit = standard units (round your response to the nearest whole number). b) Básed on the analysis of the volume, after rounding the numbers to the nearest whole number, Bonham is superior below V standard units c) Based on the analysis of the volume, after rounding the numbers to the nearest whole number, McKinney is superior above V standard units

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter13: The Balanced Scorecard: Strategic-based Control

Section: Chapter Questions

Problem 24P: Lander Parts, Inc., produces various automobile parts. In one plant, Lander has a manufacturing cell...

Related questions

Question

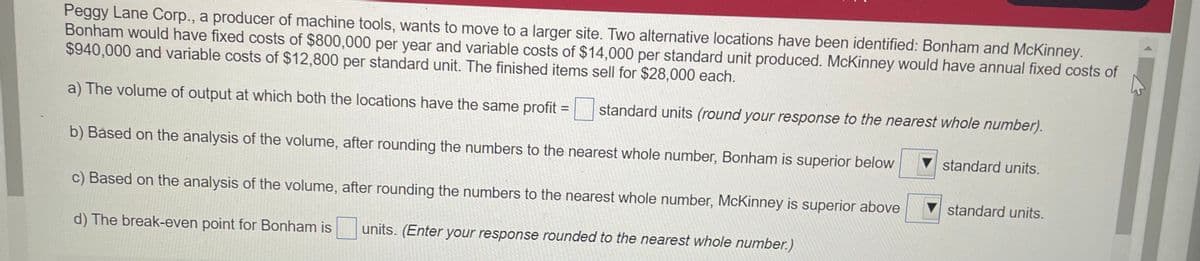

Transcribed Image Text:Peggy Lane Corp., a producer of machine tools, wants to move to a larger site. Two alternative locations have been identified: Bonham and McKinney.

Bonham would have fixed costs of $800,000 per year and variable costs of $14,000 per standard unit produced. McKinney would have annual fixed costs of

$940,000 and variable costs of $12,800 per standard unit. The finished items sell for $28,000 each.

a) The volume of output at which both the locations have the same profit =

standard units (round your response to the nearest whole number).

b) Básed on the analysis of the volume, after rounding the numbers to the nearest whole number, Bonham is superior below

standard units.

c) Based on the analysis of the volume, after rounding the numbers to the nearest whole number, McKinney is superior above

standard units.

d) The break-even point for Bonham is

units. (Enter your response rounded to the nearest whole number.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub