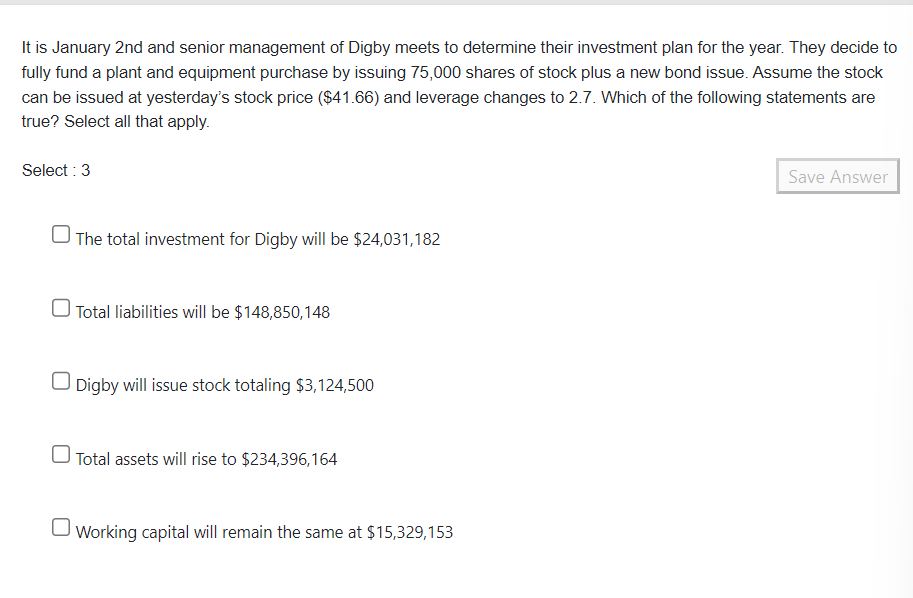

It is January 2nd and senior management of Digby meets to determine their investment plan for the year. They decide to fully fund a plant and equipment purchase by issuing 75,000 shares of stock plus a new bond issue. Assume the stock can be issued at yesterday's stock price ($41.66) and leverage changes to 2.7. Which of the following statements are true? Select all that apply. Select : 3 The total investment for Digby will be $24,031,182 Total liabilities will be $148,850,148 Digby will issue stock totaling $3,124,500 Total assets will rise to $234,396,164 Working capital will remain the same at $15,329,153 Save Answer

It is January 2nd and senior management of Digby meets to determine their investment plan for the year. They decide to fully fund a plant and equipment purchase by issuing 75,000 shares of stock plus a new bond issue. Assume the stock can be issued at yesterday's stock price ($41.66) and leverage changes to 2.7. Which of the following statements are true? Select all that apply. Select : 3 The total investment for Digby will be $24,031,182 Total liabilities will be $148,850,148 Digby will issue stock totaling $3,124,500 Total assets will rise to $234,396,164 Working capital will remain the same at $15,329,153 Save Answer

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 1MC

Related questions

Question

Transcribed Image Text:It is January 2nd and senior management of Digby meets to determine their investment plan for the year. They decide to

fully fund a plant and equipment purchase by issuing 75,000 shares of stock plus a new bond issue. Assume the stock

can be issued at yesterday's stock price ($41.66) and leverage changes to 2.7. Which of the following statements are

true? Select all that apply.

Select : 3

The total investment for Digby will be $24,031,182

Total liabilities will be $148,850,148

Digby will issue stock totaling $3,124,500

Total assets will rise to $234,396,164

Working capital will remain the same at $15,329,153

Save Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT