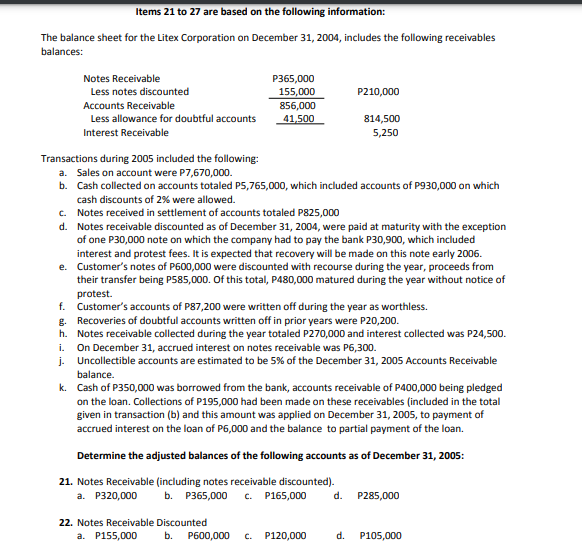

Items 21 to 27 are based on the following information: The balance sheet for the Litex Corporation on December 31, 2004, includes the following receivables balances: Notes Receivable P365,000 155,000 Less notes discounted P210,000 Accounts Receivable 856,000 Less allowance for doubtful accounts 41,500 814,500 Interest Receivable 5,250 Transactions during 2005 included the following: a. Sales on account were P7,670,000. b. Cash collected on accounts totaled P5,765,000, which included accounts of P930,000 on which cash discounts of 2% were allowed. c. Notes received in settlement of accounts totaled P825,000 d. Notes receivable discounted as of December 31, 2004, were paid at maturity with the exception of one P30,000 note on which the company had to pay the bank P30,900, which included interest and protest fees. It is expected that recovery will be made on this note early 2006. e. Customer's notes of P600,000 were discounted with recourse during the year, proceeds from their transfer being P585,000. Of this total, P480,000 matured during the year without notice of protest. f. Customer's accounts of P87,200 were written off during the year as worthless. g. Recoveries of doubtful accounts written off in prior years were P20,200. h. Notes receivable collected during the year totaled P270,000 and interest collected was P24,500. On December 31, accrued interest on notes receivable was P6,300. j. Uncollectible accounts are estimated to be 5% of the December 31, 2005 Accounts Receivable i. balance. k. Cash of P350,000 was borrowed from the bank, accounts receivable of P400,000 being pledged on the loan. Collections of P195,000 had been made on these receivables (included in the total given in transaction (b) and this amount was applied on December 31, 2005, to payment of accrued interest on the loan of P6,000 and the balance to partial payment of the loan. Determine the adjusted balances of the following accounts as of December 31, 2005: 21. Notes Receivable (including notes receivable discounted). b. P365,000 a. P320,000 c. P165,000 d. P285,000 22. Notes Receivable Discounted a. P155,000 b. P600,000 C. P120,000 d. P105,000

Items 21 to 27 are based on the following information: The balance sheet for the Litex Corporation on December 31, 2004, includes the following receivables balances: Notes Receivable P365,000 155,000 Less notes discounted P210,000 Accounts Receivable 856,000 Less allowance for doubtful accounts 41,500 814,500 Interest Receivable 5,250 Transactions during 2005 included the following: a. Sales on account were P7,670,000. b. Cash collected on accounts totaled P5,765,000, which included accounts of P930,000 on which cash discounts of 2% were allowed. c. Notes received in settlement of accounts totaled P825,000 d. Notes receivable discounted as of December 31, 2004, were paid at maturity with the exception of one P30,000 note on which the company had to pay the bank P30,900, which included interest and protest fees. It is expected that recovery will be made on this note early 2006. e. Customer's notes of P600,000 were discounted with recourse during the year, proceeds from their transfer being P585,000. Of this total, P480,000 matured during the year without notice of protest. f. Customer's accounts of P87,200 were written off during the year as worthless. g. Recoveries of doubtful accounts written off in prior years were P20,200. h. Notes receivable collected during the year totaled P270,000 and interest collected was P24,500. On December 31, accrued interest on notes receivable was P6,300. j. Uncollectible accounts are estimated to be 5% of the December 31, 2005 Accounts Receivable i. balance. k. Cash of P350,000 was borrowed from the bank, accounts receivable of P400,000 being pledged on the loan. Collections of P195,000 had been made on these receivables (included in the total given in transaction (b) and this amount was applied on December 31, 2005, to payment of accrued interest on the loan of P6,000 and the balance to partial payment of the loan. Determine the adjusted balances of the following accounts as of December 31, 2005: 21. Notes Receivable (including notes receivable discounted). b. P365,000 a. P320,000 c. P165,000 d. P285,000 22. Notes Receivable Discounted a. P155,000 b. P600,000 C. P120,000 d. P105,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12E: Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120...

Related questions

Question

Please provide me a pro-forma of T-account computation if its possible or if not maybe other pro-forma. Please answer no. 22 correctly. Thank you

Transcribed Image Text:Items 21 to 27 are based on the following information:

The balance sheet for the Litex Corporation on December 31, 2004, includes the following receivables

balances:

Notes Receivable

P365,000

155,000

Less notes discounted

P210,000

Accounts Receivable

856,000

Less allowance for doubtful accounts

41,500

814,500

Interest Receivable

5,250

Transactions during 2005 included the following:

a. Sales on account were P7,670,000.

b. Cash collected on accounts totaled P5,765,000, which included accounts of P930,000 on which

cash discounts of 2% were allowed.

c. Notes received in settlement of accounts totaled P825,000

d. Notes receivable discounted as of December 31, 2004, were paid at maturity with the exception

of one P30,000 note on which the company had to pay the bank P30,900, which included

interest and protest fees. It is expected that recovery will be made on this note early 2006.

e. Customer's notes of P600,000 were discounted with recourse during the year, proceeds from

their transfer being P585,000. Of this total, P480,000 matured during the year without notice of

protest.

f. Customer's accounts of P87,200 were written off during the year as worthless.

g. Recoveries of doubtful accounts written off in prior years were P20,200.

h. Notes receivable collected during the year totaled P270,000 and interest collected was P24,500.

On December 31, accrued interest on notes receivable was P6,300.

j. Uncollectible accounts are estimated to be 5% of the December 31, 2005 Accounts Receivable

i.

balance.

k. Cash of P350,000 was borrowed from the bank, accounts receivable of P400,000 being pledged

on the loan. Collections of P195,000 had been made on these receivables (included in the total

given in transaction (b) and this amount was applied on December 31, 2005, to payment of

accrued interest on the loan of P6,000 and the balance to partial payment of the loan.

Determine the adjusted balances of the following accounts as of December 31, 2005:

21. Notes Receivable (including notes receivable discounted).

b. P365,000

a. P320,000

c. P165,000

d.

P285,000

22. Notes Receivable Discounted

a. P155,000

b.

P600,000

C.

P120,000

d.

P105,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,