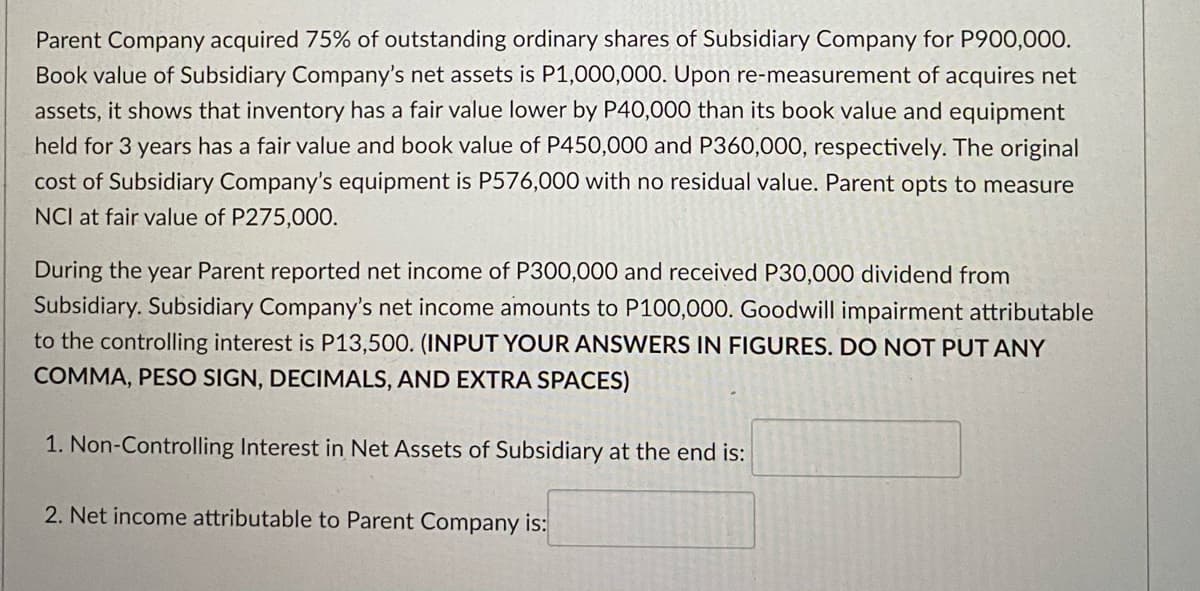

Parent Company acquired 75% of outstanding ordinary shares of Subsidiary Company for P900,000. Book value of Subsidiary Company's net assets is P1,000,000. Upon re-measurement of acquires net assets, it shows that inventory has a fair value lower by P40,000 than its book value and equipment held for 3 years has a fair value and book value of P450,000 and P360,000, respectively. The original cost of Subsidiary Company's equipment is P576,000 with no residual value. Parent opts to measure NCI at fair value of P275,000. During the year Parent reported net income of P300,000 and received P30,000 dividend from Subsidiary. Subsidiary Company's net income amounts to P100,000. Goodwill impairment attributabl to the controlling interest is P13,500. (INPUT YOUR ANSWERS IN FIGURES. DO NOT PUT ANY COMMA, PESO SIGN, DECIMALS, AND EXTRA SPACES) 1. Non-Controlling Interest in Net Assets of Subsidiary at the end is: 2. Net income attributable to Parent Company is:

Parent Company acquired 75% of outstanding ordinary shares of Subsidiary Company for P900,000. Book value of Subsidiary Company's net assets is P1,000,000. Upon re-measurement of acquires net assets, it shows that inventory has a fair value lower by P40,000 than its book value and equipment held for 3 years has a fair value and book value of P450,000 and P360,000, respectively. The original cost of Subsidiary Company's equipment is P576,000 with no residual value. Parent opts to measure NCI at fair value of P275,000. During the year Parent reported net income of P300,000 and received P30,000 dividend from Subsidiary. Subsidiary Company's net income amounts to P100,000. Goodwill impairment attributabl to the controlling interest is P13,500. (INPUT YOUR ANSWERS IN FIGURES. DO NOT PUT ANY COMMA, PESO SIGN, DECIMALS, AND EXTRA SPACES) 1. Non-Controlling Interest in Net Assets of Subsidiary at the end is: 2. Net income attributable to Parent Company is:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

.42

Transcribed Image Text:Parent Company acquired 75% of outstanding ordinary shares of Subsidiary Company for P900,000.

Book value of Subsidiary Company's net assets is P1,000,000. Upon re-measurement of acquires net

assets, it shows that inventory has a fair value lower by P40,000 than its book value and equipment

held for 3 years has a fair value and book value of P450,000 and P360,000, respectively. The original

cost of Subsidiary Company's equipment is P576,000 with no residual value. Parent opts to measure

NCI at fair value of P275,000.

During the year Parent reported net income of P300,000 and received P30,000 dividend from

Subsidiary. Subsidiary Company's net income amounts to P100,000. Goodwill impairment attributable

to the controlling interest is P13,500. (INPUT YOUR ANSWERS IN FIGURES. DO NOT PUT ANY

COMMA, PESO SIGN, DECIMALS, AND EXTRA SPACES)

1. Non-Controlling Interest in Net Assets of Subsidiary at the end is:

2. Net income attributable to Parent Company is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning