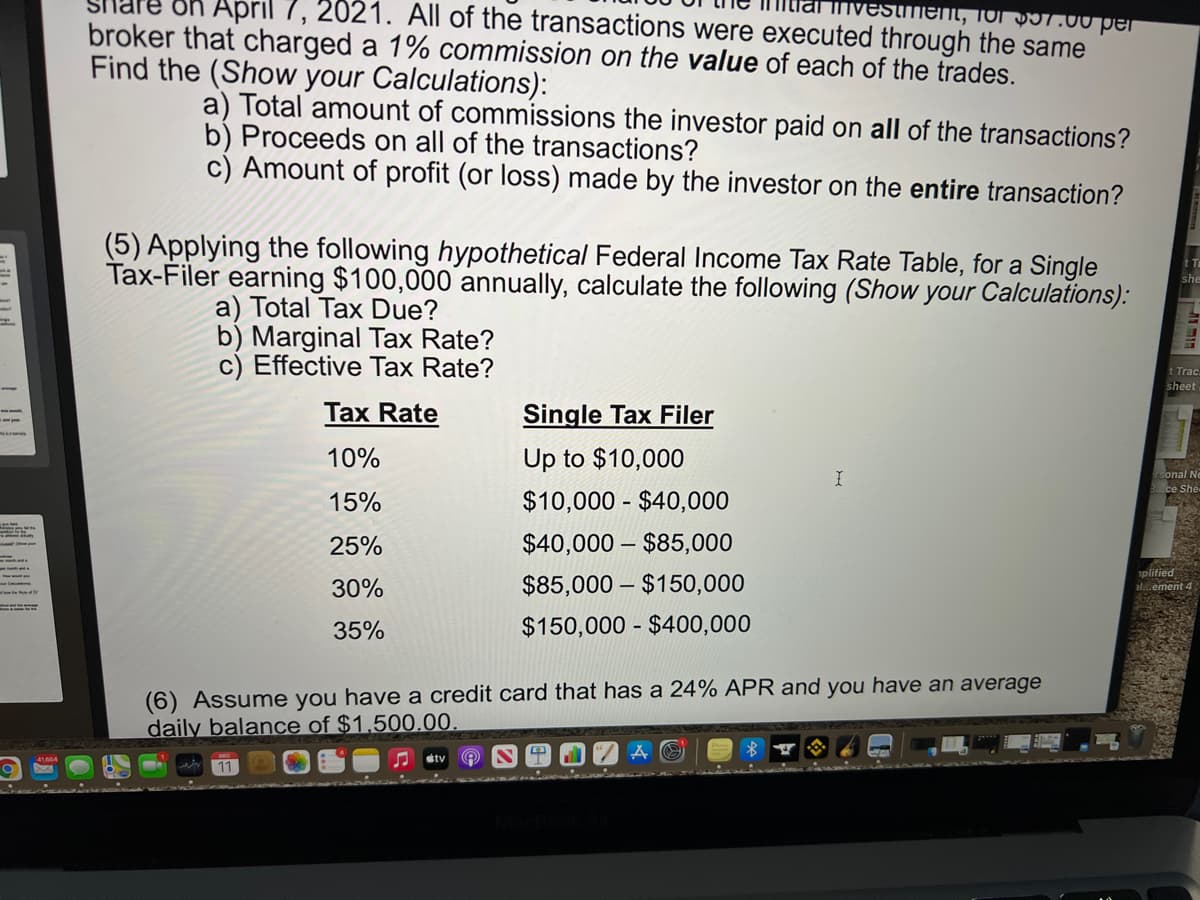

IUSS) made by the investor on the entire transaction? (5) Applying the following hypothetical Federal Income Tax Rate Table, for a Single Tax-Filer earning $100,000 annually, calculate the following (Show your Calculations): a) Total Tax Due? b) Marginal Tax Rate? c) Effective Tax Rate? Tax Rate Single Tax Filer 10% Up to $10,000 15% $10,000 - $40,000 25% $40,000 – $85,000 30% $85,000 – $150,000 35% $150,000 - $400,000 (6) Assume you have a credit card that has a 24% APR and you have an average daily balance of $1.500.00. dtv 11

IUSS) made by the investor on the entire transaction? (5) Applying the following hypothetical Federal Income Tax Rate Table, for a Single Tax-Filer earning $100,000 annually, calculate the following (Show your Calculations): a) Total Tax Due? b) Marginal Tax Rate? c) Effective Tax Rate? Tax Rate Single Tax Filer 10% Up to $10,000 15% $10,000 - $40,000 25% $40,000 – $85,000 30% $85,000 – $150,000 35% $150,000 - $400,000 (6) Assume you have a credit card that has a 24% APR and you have an average daily balance of $1.500.00. dtv 11

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 9MC: On April 1 a company sells a 5-year, $60,000 bond with a 7% stated interest rate. The market...

Related questions

Question

Number 5 a b and c plz

Transcribed Image Text:broker that charged a 1% commission on the value of each of the trades.

Find the (Show your Calculations):

8h April 7, 2021. All of the transactions were executed through the same

vestment, 1OI D57.00 per

a) Total amount of commissions the investor paid on all of the transactions?

b) Proceeds on all of the transactions?

c) Amount of profit (or loss) made by the investor on the entire transaction?

(5) Applying the following hypothetical Federal Income Tax Rate Table, for a Single

Tax-Filer earning $100,000 annually, calculate the following (Show your Calculations):

a) Total Tax Due?

b) Marginal Tax Rate?

c) Effective Tax Rate?

t Trac

sheet

Tax Rate

Single Tax Filer

Up to $10,000

$10,000 - $40,000

10%

sonal No

ce She

15%

25%

$40,000 – $85,000

plified

30%

$85,000 – $150,000

al..ement

35%

$150,000 - $400,000

(6) Assume you have a credit card that has a 24% APR and you have an average

daily balance of $1,500.00.

stv

11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College