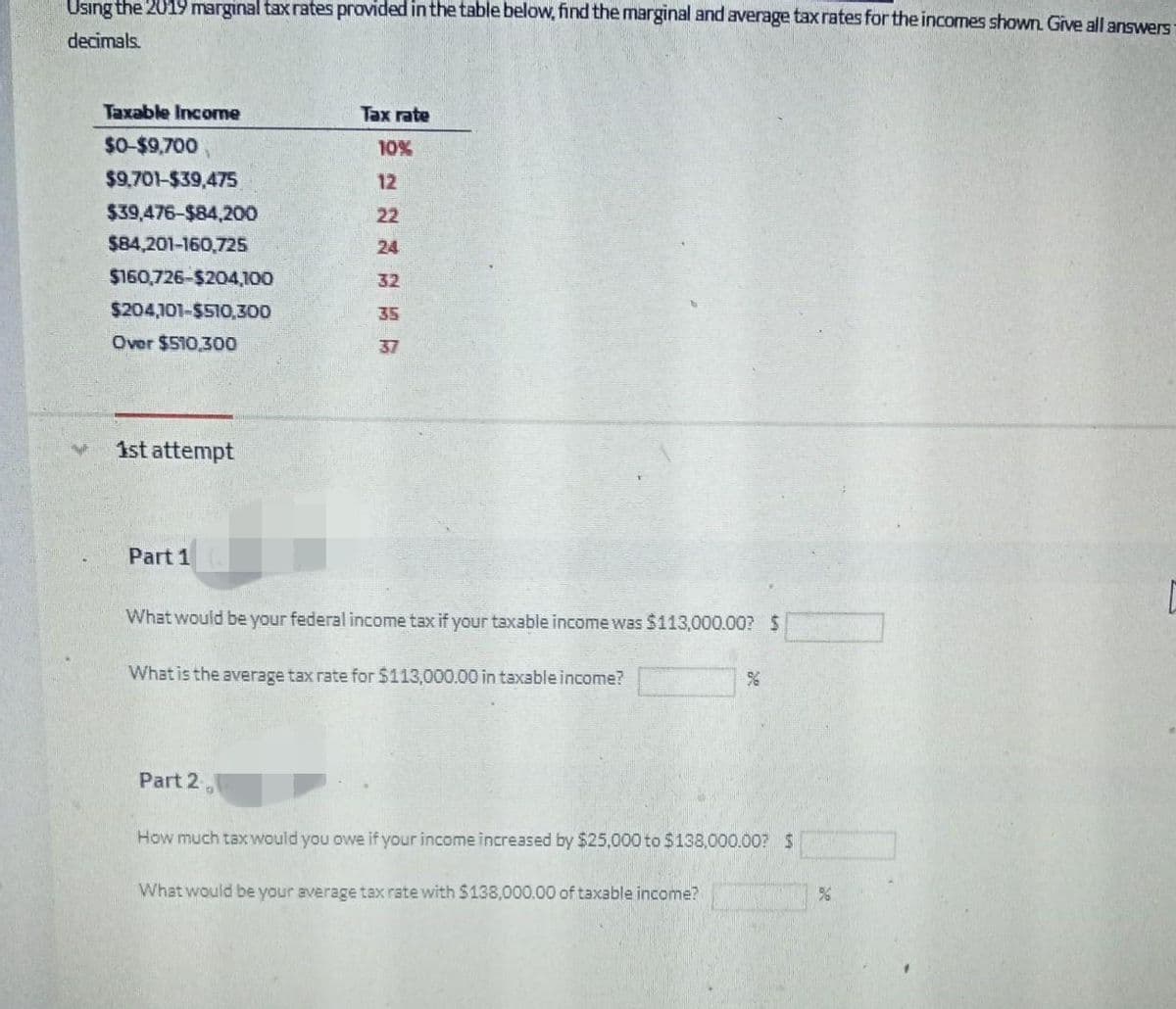

Using the 2019 marginal tax rates provided in the table below, find the marginal and average tax rates for the incomes shown. Give all answers decimals. Taxable Income Tax rate $0-$9,700 10% $9,701-$39,475 12 $39,476-$84,200 22 $84,201-160,725 24 $160,726-$204,100 32 $204,101-$510,300 35 Over $510,300 37 1st attempt Part 1 What would be your federal income tax if your taxable income was $113,000.00? $ What is the average tax rate for $113,000.00 in taxable income? Part 2 How much tax would you owe if your income increased by $25,000 to $138,000.00? $ % What would be your average tax rate with $138,000.00 of taxable income? tyt

Using the 2019 marginal tax rates provided in the table below, find the marginal and average tax rates for the incomes shown. Give all answers decimals. Taxable Income Tax rate $0-$9,700 10% $9,701-$39,475 12 $39,476-$84,200 22 $84,201-160,725 24 $160,726-$204,100 32 $204,101-$510,300 35 Over $510,300 37 1st attempt Part 1 What would be your federal income tax if your taxable income was $113,000.00? $ What is the average tax rate for $113,000.00 in taxable income? Part 2 How much tax would you owe if your income increased by $25,000 to $138,000.00? $ % What would be your average tax rate with $138,000.00 of taxable income? tyt

Chapter2: The Domestic And International Financial Marketplace

Section2.A: Taxes

Problem 3P

Related questions

Question

Transcribed Image Text:Using the 2019 marginal tax rates provided in the table below, find the marginal and average tax rates for the incomes shown. Give all answers

decimals.

Taxable Incorne

Tax rate

$0-$9,700

10%

$9,701-$39,475

12

$39,476-$84,200

22

$84,201-160,725

24

$160,726-$204,100

32

$204,101-$510,300

Over $510,300

37

1st attempt

Part 1

What would be your federal income tax if your taxable income was $113,000.00? $

What is the average tax rate for $113,000.00 in taxable income?

58

Part 2.

How much tax would you owe if your income increased by $25,000 to $138,000.00? $

What would be your average tax rate with $138,000.00 of taxable income?

90

N

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning