IV. Ms.Fathima sold exclusive design ware materials to Ms.Aysha OMR 120,000 worth of goods on the 10th of February 2020 by accepting 150 days,8% interest bearing note. For one of them it was a Notes receivable while for the other it was a Notes payable. The accountants of both Ms. Fathima and Ms. Aysha made entries in the account books. Assume that you are the accountant and show by presenting a detailed table the entries you wuld make. Also show your calculations clearly for interests received and paid. Show how the transactions would be treated in the following situations. When the notes are made and accepted by both parties (i) (i) (ii) of April 2020 while Ms. Aysha wants it to be prepared on 2nd of May 2020 Honoring of the notes by the payee on the maturity date Suppose Ms. Fathima asked her accountant to prepare the final accounts on the 4th

IV. Ms.Fathima sold exclusive design ware materials to Ms.Aysha OMR 120,000 worth of goods on the 10th of February 2020 by accepting 150 days,8% interest bearing note. For one of them it was a Notes receivable while for the other it was a Notes payable. The accountants of both Ms. Fathima and Ms. Aysha made entries in the account books. Assume that you are the accountant and show by presenting a detailed table the entries you wuld make. Also show your calculations clearly for interests received and paid. Show how the transactions would be treated in the following situations. When the notes are made and accepted by both parties (i) (i) (ii) of April 2020 while Ms. Aysha wants it to be prepared on 2nd of May 2020 Honoring of the notes by the payee on the maturity date Suppose Ms. Fathima asked her accountant to prepare the final accounts on the 4th

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 33P

Related questions

Question

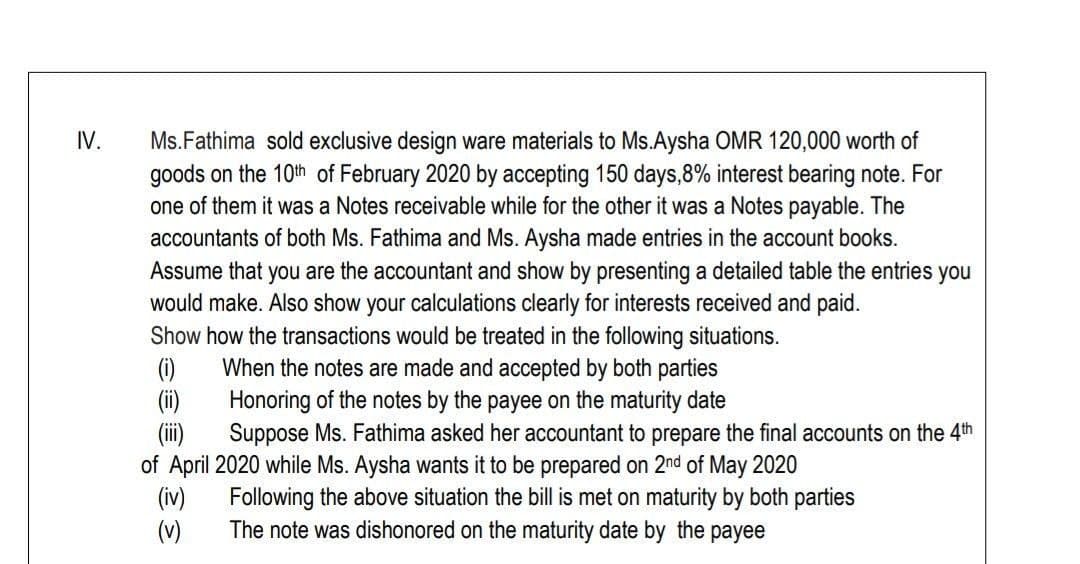

Transcribed Image Text:IV.

Ms.Fathima sold exclusive design ware materials to Ms.Aysha OMR 120,000 worth of

goods on the 10th of February 2020 by accepting 150 days,8% interest bearing note. For

one of them it was a Notes receivable while for the other it was a Notes payable. The

accountants of both Ms. Fathima and Ms. Aysha made entries in the account books.

Assume that you are the accountant and show by presenting a detailed table the entries you

would make. Also show your calculations clearly for interests received and paid.

Show how the transactions would be treated in the following situations.

When the notes are made and accepted by both parties

Honoring of the notes by the payee on the maturity date

(i)

Suppose Ms. Fathima asked her accountant to prepare the final accounts on the 4th

of April 2020 while Ms. Aysha wants it to be prepared on 2nd of May 2020

(iv)

(v)

Following the above situation the bill is met on maturity by both parties

The note was dishonored on the maturity date by the payee

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning