On August 2, Jun Co. receives a $6,000, 90-day, 12% note from customer Ryan Albany as payment on his $6,000 account receivable. Prepare Jun's journal entry assuming the note is honored by the customer on October 31 of that same year. (Use 360 days a year.) View transaction list

On August 2, Jun Co. receives a $6,000, 90-day, 12% note from customer Ryan Albany as payment on his $6,000 account receivable. Prepare Jun's journal entry assuming the note is honored by the customer on October 31 of that same year. (Use 360 days a year.) View transaction list

Chapter7: Accounting Information Systems

Section: Chapter Questions

Problem 11MC: Your company paid rent of $1,000 for the month with check number 1245. Which journal would the...

Related questions

Question

Seven

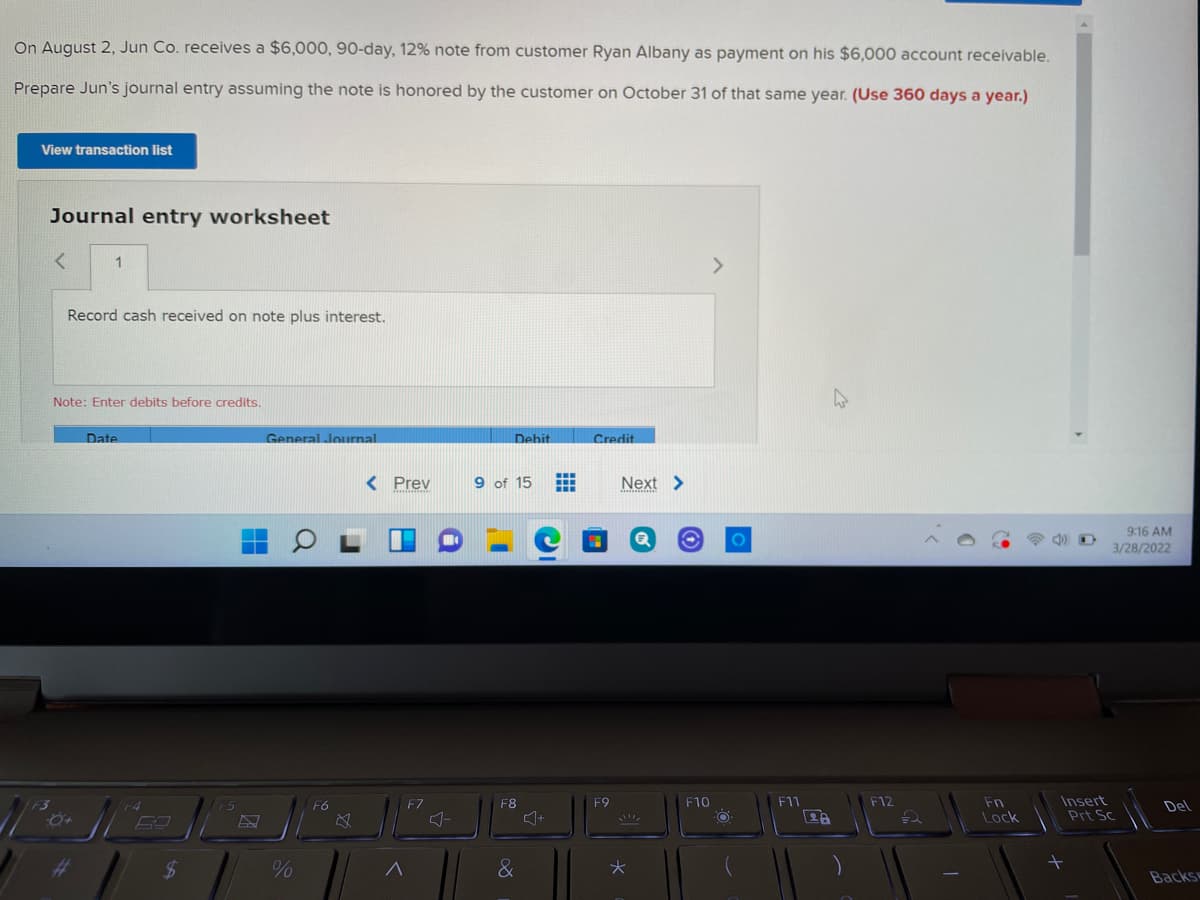

Transcribed Image Text:On August 2, Jun Co. receives a $6,000, 90-day, 12% note from customer Ryan Albany as payment on his $6,000 account receivable.

Prepare Jun's journal entry assuming the note is honored by the customer on October 31 of that same year. (Use 360 days a year.)

View transaction list

Journal entry worksheet

1.

Record cash received on note plus interest.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

< Prev

9 of 15

Next >

9:16 AM

3/28/2022

Insert

Prt Sc

F10

F11

F12

Fn

Lock

F3

F6

F7

F8

F9

Del

%23

$

&

Backs

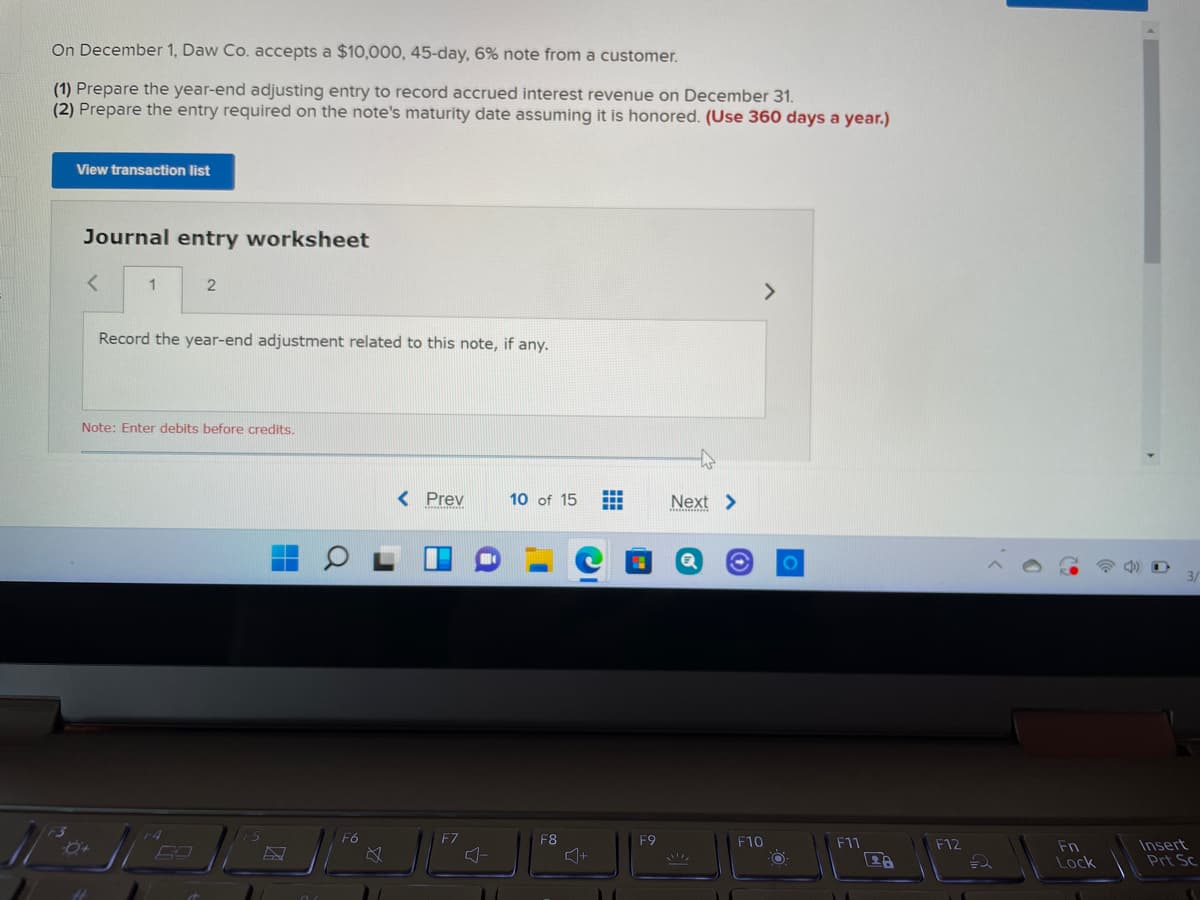

Transcribed Image Text:On December 1, Daw Co. accepts a $10,000, 45-day, 6% note from a customer.

(1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31.

(2) Prepare the entry required on the note's maturity date assuming it is honored. (Use 360 days a year.)

View transaction list

Journal entry worksheet

1

<>

Record the year-end adjustment related to this note, if any.

Note: Enter debits before credits.

< Prev

10 of 15

Next >

3/

F6

F7

F8

F9

F10

F11

Insert

Prt Sc

F12

Fn

+

Lock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,