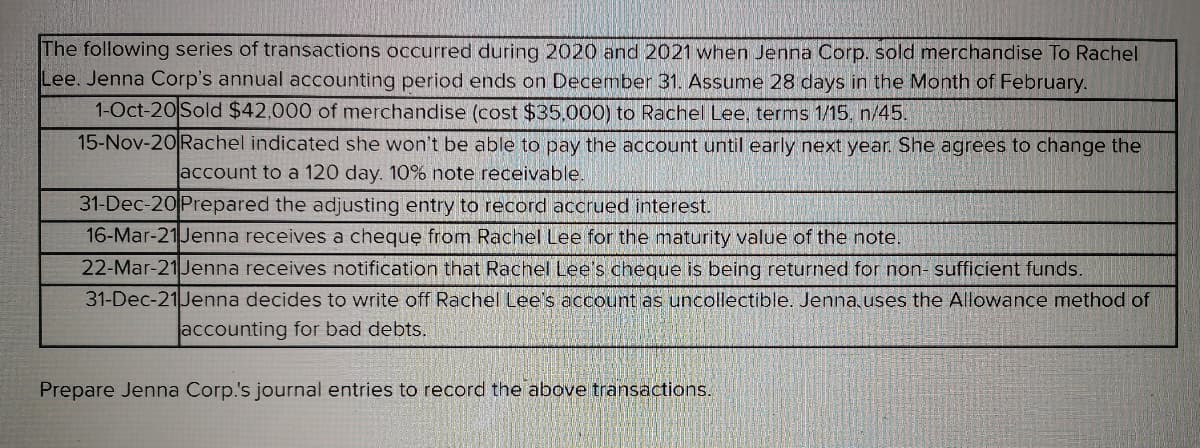

The following series of transactions occurred during 2020 and 2021 when Jenna Corp. sold merchandise To Rachel Lee. Jenna Corp's annual accounting period ends on December 31. Assume 28 days in the Month of February. 1-Oct-20 Sold $42,000 of merchandise (cost $35,000) to Rachel Lee, terms 1/15, n/45. 15-Nov-20 Rachel indicated she won't be able to pay the account until early next year. She agrees to change the account to a 120 day. 10% note receivable. 31-Dec-20 Prepared the adjusting entry to record accrued interest. 16-Mar-21Jenna receives a cheque from Rachel Lee for the maturity value of the note. 22-Mar-21Jenna receives notification that Rachel Lee's cheque is being returned for non- sufficient funds. 31-Dec-21Jenna decides to write off Rachel Lee's account as uncollectible. Jenna.uses the Allowance method of accounting for bad debts. Prepare Jenna Corp.'s journal entries to record the above transactions.

The following series of transactions occurred during 2020 and 2021 when Jenna Corp. sold merchandise To Rachel Lee. Jenna Corp's annual accounting period ends on December 31. Assume 28 days in the Month of February. 1-Oct-20 Sold $42,000 of merchandise (cost $35,000) to Rachel Lee, terms 1/15, n/45. 15-Nov-20 Rachel indicated she won't be able to pay the account until early next year. She agrees to change the account to a 120 day. 10% note receivable. 31-Dec-20 Prepared the adjusting entry to record accrued interest. 16-Mar-21Jenna receives a cheque from Rachel Lee for the maturity value of the note. 22-Mar-21Jenna receives notification that Rachel Lee's cheque is being returned for non- sufficient funds. 31-Dec-21Jenna decides to write off Rachel Lee's account as uncollectible. Jenna.uses the Allowance method of accounting for bad debts. Prepare Jenna Corp.'s journal entries to record the above transactions.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 14E: On January 5, 2019, ShoeKing Corp. sells for cash 500 pairs of volleyball shoes to FootAction, a...

Related questions

Question

Prepare Jenna corp's journal entries to record the above transactions

Transcribed Image Text:The following series of transactions occurred during 2020 and 2021 when Jenna Corp. sold merchandise To Rachel

Lee. Jenna Corp's annual accounting period ends on December 31. Assume 28 days in the Month of February.

1-Oct-20 Sold $42,000 of merchandise (cost $35.000) to Rachel Lee, terms 1/15, n/45.

15-Nov-20 Rachel indicated she won't be able to pay the account until early next year. She agrees to change the

account to a 120 day. 10% note receivable.

31-Dec-20Prepared the adjusting entry to record accrued interest.

16-Mar-21Jenna receives a cheque from Rachel Lee for the maturity value of the note.

22-Mar-21 Jenna receives notification that Rachel Lee's cheque is being returned for non- sufficient funds.

31-Dec-21Jenna decides to write off Rachel Lee's account as uncollectible. Jenna uses the Allowance method of

accounting for bad debts.

Prepare Jenna Corp.'s journal entries to record the above transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT