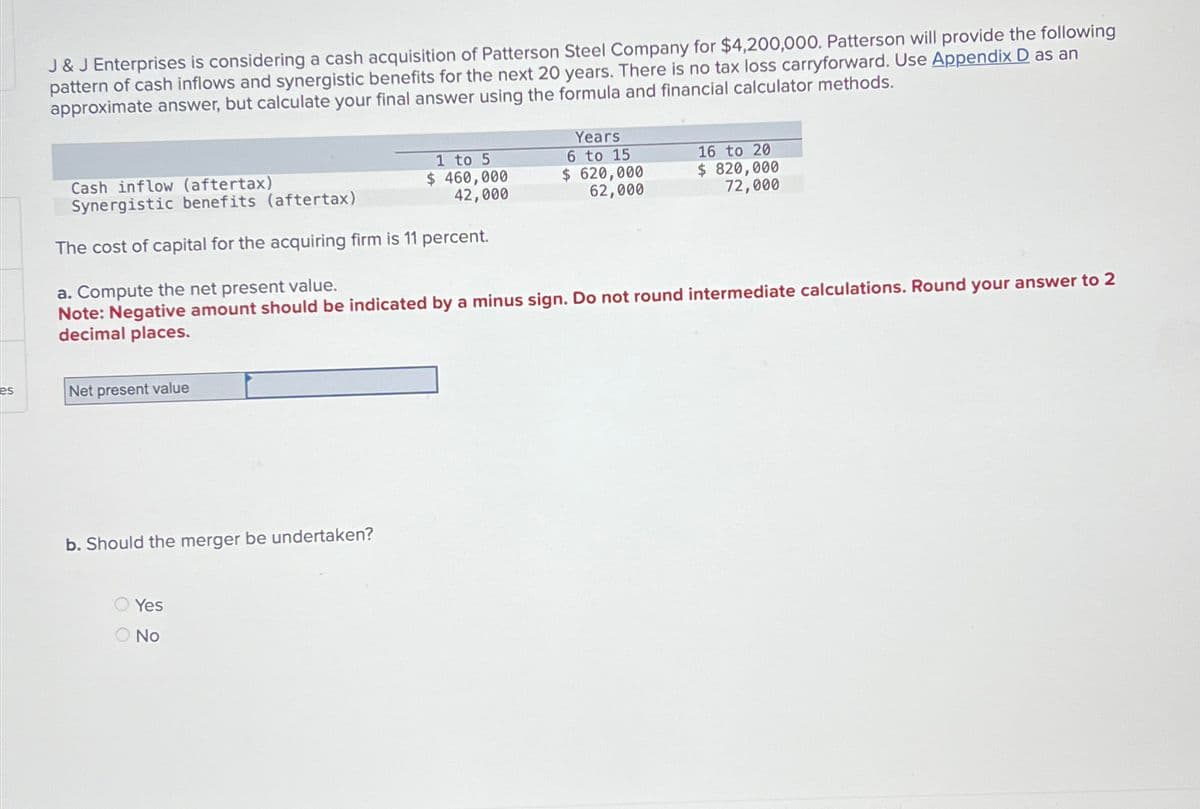

J & J Enterprises is considering a cash acquisition of Patterson Steel Company for $4,200,000. Patterson will provide the following pattern of cash inflows and synergistic benefits for the next 20 years. There is no tax loss carryforward. Use Appendix D as an approximate answer, but calculate your final answer using the formula and financial calculator methods. Cash inflow (aftertax) Synergistic benefits (aftertax) 1 to 5 $ 460,000 42,000 Years 6 to 15 $ 620,000 62,000 16 to 20 $ 820,000 72,000 The cost of capital for the acquiring firm is 11 percent. a. Compute the net present value. Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places. es Net present value b. Should the merger be undertaken? Yes No

J & J Enterprises is considering a cash acquisition of Patterson Steel Company for $4,200,000. Patterson will provide the following pattern of cash inflows and synergistic benefits for the next 20 years. There is no tax loss carryforward. Use Appendix D as an approximate answer, but calculate your final answer using the formula and financial calculator methods. Cash inflow (aftertax) Synergistic benefits (aftertax) 1 to 5 $ 460,000 42,000 Years 6 to 15 $ 620,000 62,000 16 to 20 $ 820,000 72,000 The cost of capital for the acquiring firm is 11 percent. a. Compute the net present value. Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places. es Net present value b. Should the merger be undertaken? Yes No

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:J & J Enterprises is considering a cash acquisition of Patterson Steel Company for $4,200,000. Patterson will provide the following

pattern of cash inflows and synergistic benefits for the next 20 years. There is no tax loss carryforward. Use Appendix D as an

approximate answer, but calculate your final answer using the formula and financial calculator methods.

Cash inflow (aftertax)

Synergistic benefits (aftertax)

1 to 5

$ 460,000

42,000

Years

6 to 15

$ 620,000

62,000

16 to 20

$ 820,000

72,000

The cost of capital for the acquiring firm is 11 percent.

a. Compute the net present value.

Note: Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2

decimal places.

es

Net present value

b. Should the merger be undertaken?

Yes

No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning