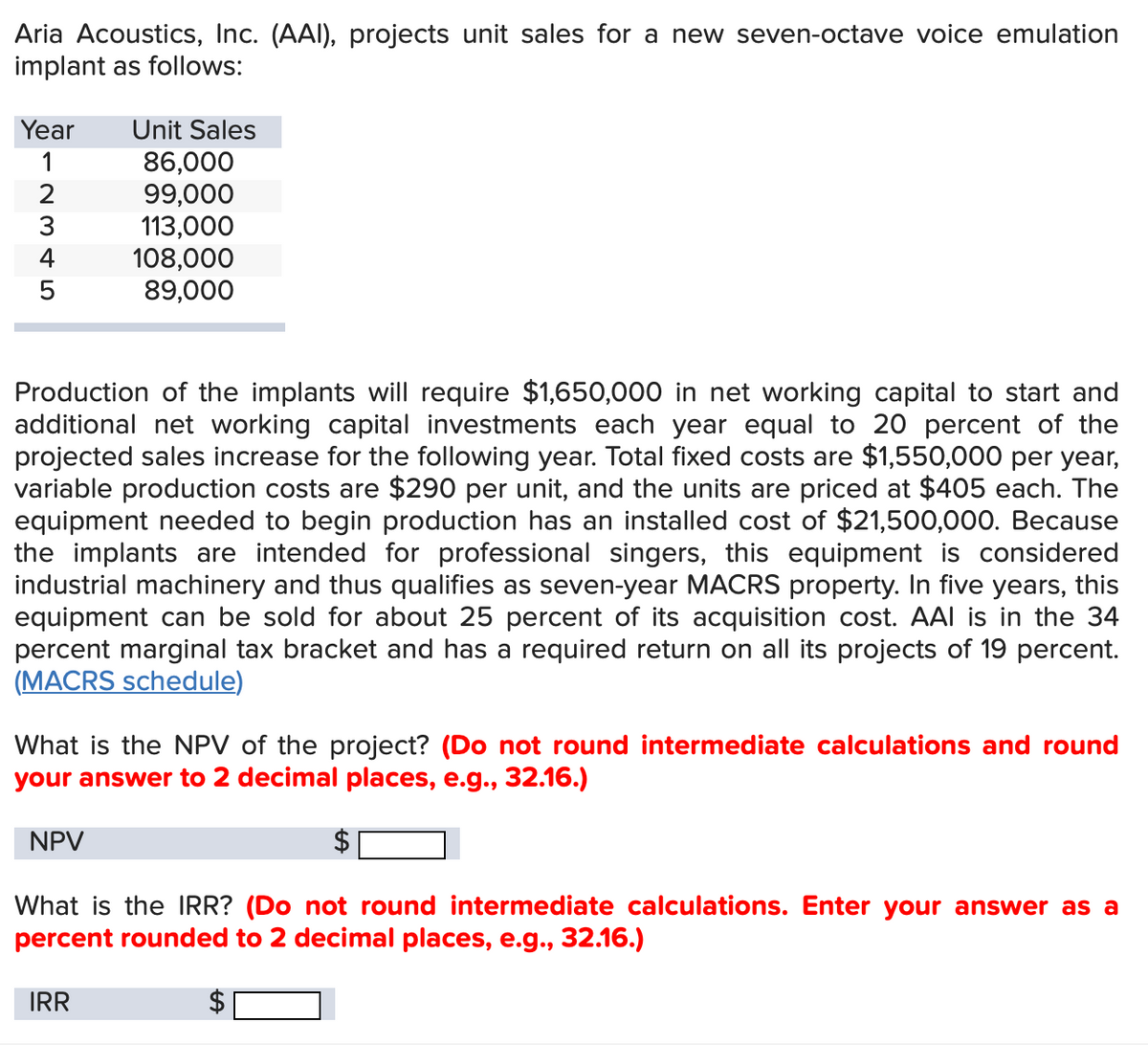

Aria Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation implant as follows: Year Unit Sales 1 86,000 2345 99,000 113,000 108,000 89,000 Production of the implants will require $1,650,000 in net working capital to start and additional net working capital investments each year equal to 20 percent of the projected sales increase for the following year. Total fixed costs are $1,550,000 per year, variable production costs are $290 per unit, and the units are priced at $405 each. The equipment needed to begin production has an installed cost of $21,500,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as seven-year MACRS property. In five years, this equipment can be sold for about 25 percent of its acquisition cost. AAI is in the 34 percent marginal tax bracket and has a required return on all its projects of 19 percent. (MACRS schedule) What is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV What is the IRR? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR

Aria Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation implant as follows: Year Unit Sales 1 86,000 2345 99,000 113,000 108,000 89,000 Production of the implants will require $1,650,000 in net working capital to start and additional net working capital investments each year equal to 20 percent of the projected sales increase for the following year. Total fixed costs are $1,550,000 per year, variable production costs are $290 per unit, and the units are priced at $405 each. The equipment needed to begin production has an installed cost of $21,500,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as seven-year MACRS property. In five years, this equipment can be sold for about 25 percent of its acquisition cost. AAI is in the 34 percent marginal tax bracket and has a required return on all its projects of 19 percent. (MACRS schedule) What is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV What is the IRR? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 2CE

Related questions

Question

Transcribed Image Text:Aria Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation

implant as follows:

Year

Unit Sales

1

86,000

2345

99,000

113,000

108,000

89,000

Production of the implants will require $1,650,000 in net working capital to start and

additional net working capital investments each year equal to 20 percent of the

projected sales increase for the following year. Total fixed costs are $1,550,000 per year,

variable production costs are $290 per unit, and the units are priced at $405 each. The

equipment needed to begin production has an installed cost of $21,500,000. Because

the implants are intended for professional singers, this equipment is considered

industrial machinery and thus qualifies as seven-year MACRS property. In five years, this

equipment can be sold for about 25 percent of its acquisition cost. AAI is in the 34

percent marginal tax bracket and has a required return on all its projects of 19 percent.

(MACRS schedule)

What is the NPV of the project? (Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.)

NPV

What is the IRR? (Do not round intermediate calculations. Enter your answer as a

percent rounded to 2 decimal places, e.g., 32.16.)

IRR

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning