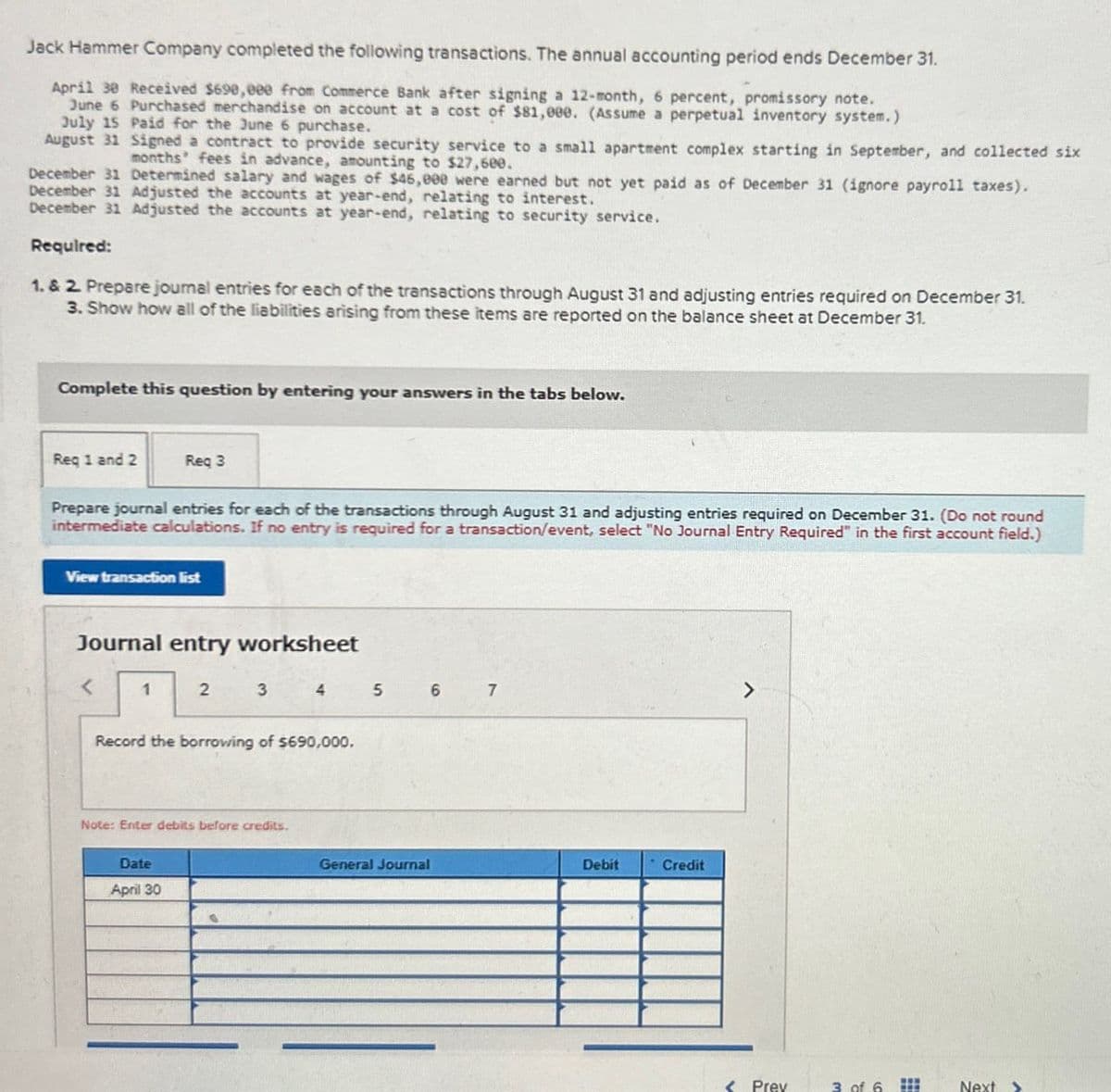

Jack Hammer Company completed the following transactions. The annual accounting period ends December 31. April 30 Received $690,000 from Commerce Bank after signing a 12-month, 6 percent, promissory note. June 6 Purchased merchandise on account at a cost of $81,000. (Assume a perpetual inventory system.) July 15 Paid for the June 6 purchase. August 31 Signed a contract to provide security service to a small apartment complex starting in September, and collected six months' fees in advance, amounting to $27,600. December 31 Determined salary and wages of $46,000 were earned but not yet paid as of December 31 (ignore payroll taxes). December 31 Adjusted the accounts at year-end, relating to interest. December 31 Adjusted the accounts at year-end, relating to security service. Required: 1. & 2. Prepare journal entries for each of the transactions through August 31 and adjusting entries required on December 31. 3. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Prepare journal entries for each of the transactions through August 31 and adjusting entries required on December 31. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 Record the borrowing of $690,000. Note: Enter debits before credits. Date April 30 General Journal Debit Credit Prev 3 of 6 Next

Jack Hammer Company completed the following transactions. The annual accounting period ends December 31. April 30 Received $690,000 from Commerce Bank after signing a 12-month, 6 percent, promissory note. June 6 Purchased merchandise on account at a cost of $81,000. (Assume a perpetual inventory system.) July 15 Paid for the June 6 purchase. August 31 Signed a contract to provide security service to a small apartment complex starting in September, and collected six months' fees in advance, amounting to $27,600. December 31 Determined salary and wages of $46,000 were earned but not yet paid as of December 31 (ignore payroll taxes). December 31 Adjusted the accounts at year-end, relating to interest. December 31 Adjusted the accounts at year-end, relating to security service. Required: 1. & 2. Prepare journal entries for each of the transactions through August 31 and adjusting entries required on December 31. 3. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Prepare journal entries for each of the transactions through August 31 and adjusting entries required on December 31. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 4 5 6 7 Record the borrowing of $690,000. Note: Enter debits before credits. Date April 30 General Journal Debit Credit Prev 3 of 6 Next

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 8PA: Serene Company purchases fountains for its inventory from Kirkland Inc. The following transactions...

Related questions

Question

please answer in text form and in proper format answer with must explanation , calculation for each part and steps clearly

Transcribed Image Text:Jack Hammer Company completed the following transactions. The annual accounting period ends December 31.

April 30 Received $690,000 from Commerce Bank after signing a 12-month, 6 percent, promissory note.

June 6 Purchased merchandise on account at a cost of $81,000. (Assume a perpetual inventory system.)

July 15 Paid for the June 6 purchase.

August 31 Signed a contract to provide security service to a small apartment complex starting in September, and collected six

months' fees in advance, amounting to $27,600.

December 31 Determined salary and wages of $46,000 were earned but not yet paid as of December 31 (ignore payroll taxes).

December 31 Adjusted the accounts at year-end, relating to interest.

December 31 Adjusted the accounts at year-end, relating to security service.

Required:

1. & 2. Prepare journal entries for each of the transactions through August 31 and adjusting entries required on December 31.

3. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31.

Complete this question by entering your answers in the tabs below.

Req 1 and 2

Req 3

Prepare journal entries for each of the transactions through August 31 and adjusting entries required on December 31. (Do not round

intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

< 1

2

3

4

5

6

7

Record the borrowing of $690,000.

Note: Enter debits before credits.

Date

April 30

General Journal

Debit

Credit

Prev

3 of 6

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage