Recording and Reporting Liabilities The following selected transactions of Johnson Motors Company were completed during the current accounting year ended December 31. 1. March 1, borrowed $55,000 on a two-year, 12% interest-bearing note. Interest is paid annually. 2. April 1, borrowed cash and signed a $44,000, two-year, noninterest-bearing note. The market rate for this level of risk was 12%. 3. June 1, purchased a truck with a list price of $72,600. Paid $6,600 cash and signed a $66,000, one-year, noninterest-bearing note. The market rate for this level of risk was 12%. 4. During the year, sold merchandise for $66,000 cash that carried a two-year warranty for parts and labor. A reasonable estimate of the cost of the warranty is 1.5% of sales revenue. By December 31, actual warranty costs amounted to $550. 5. June 1, Johnson cosigned and guaranteed payment of a $110,000, 14%, one-year note owed by a local supplier to City Bank. The bank required a cosignature; but Johnson believes that default by the debtor is only reasonably possible. 6. Property taxes for the year are recorded monthly. • Prior-year property taxes were $4,591 and were expected to increase by 15% during the year. • December 10 final tax assessment received was $5,500 and was paid on February 1 of the following year. 7. In December a $44,000 cash dividends was declared (not yet paid or issued). 8. For the month of December, sales revenue (excluding sales taxes collected) was $880,000. Sales tax is 5%, applicable to 98% of the sales. No unpaid sales tax carried over from November. 9. On December 31, interest has accrued on outstanding notes. b. List each current liability (account title and the amount) that should be reported on the December 31 balance sheet of the company (this is issued March 1 of the following year). Balance sheet, December 31 Liabilities Note payable, 12% $ 49,107 x Dividends payable Note payable, noninterest-bearing, 12% Estimated warranty liability Property tax payable Sales tax payable Interest payable Total 43,846 x Note payable, truck noninterest-bearing, 12% 5,261 x 0 x 0 × 0 × 0 × 0 x $ 98,214

Recording and Reporting Liabilities The following selected transactions of Johnson Motors Company were completed during the current accounting year ended December 31. 1. March 1, borrowed $55,000 on a two-year, 12% interest-bearing note. Interest is paid annually. 2. April 1, borrowed cash and signed a $44,000, two-year, noninterest-bearing note. The market rate for this level of risk was 12%. 3. June 1, purchased a truck with a list price of $72,600. Paid $6,600 cash and signed a $66,000, one-year, noninterest-bearing note. The market rate for this level of risk was 12%. 4. During the year, sold merchandise for $66,000 cash that carried a two-year warranty for parts and labor. A reasonable estimate of the cost of the warranty is 1.5% of sales revenue. By December 31, actual warranty costs amounted to $550. 5. June 1, Johnson cosigned and guaranteed payment of a $110,000, 14%, one-year note owed by a local supplier to City Bank. The bank required a cosignature; but Johnson believes that default by the debtor is only reasonably possible. 6. Property taxes for the year are recorded monthly. • Prior-year property taxes were $4,591 and were expected to increase by 15% during the year. • December 10 final tax assessment received was $5,500 and was paid on February 1 of the following year. 7. In December a $44,000 cash dividends was declared (not yet paid or issued). 8. For the month of December, sales revenue (excluding sales taxes collected) was $880,000. Sales tax is 5%, applicable to 98% of the sales. No unpaid sales tax carried over from November. 9. On December 31, interest has accrued on outstanding notes. b. List each current liability (account title and the amount) that should be reported on the December 31 balance sheet of the company (this is issued March 1 of the following year). Balance sheet, December 31 Liabilities Note payable, 12% $ 49,107 x Dividends payable Note payable, noninterest-bearing, 12% Estimated warranty liability Property tax payable Sales tax payable Interest payable Total 43,846 x Note payable, truck noninterest-bearing, 12% 5,261 x 0 x 0 × 0 × 0 × 0 x $ 98,214

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 8SPB

Related questions

Question

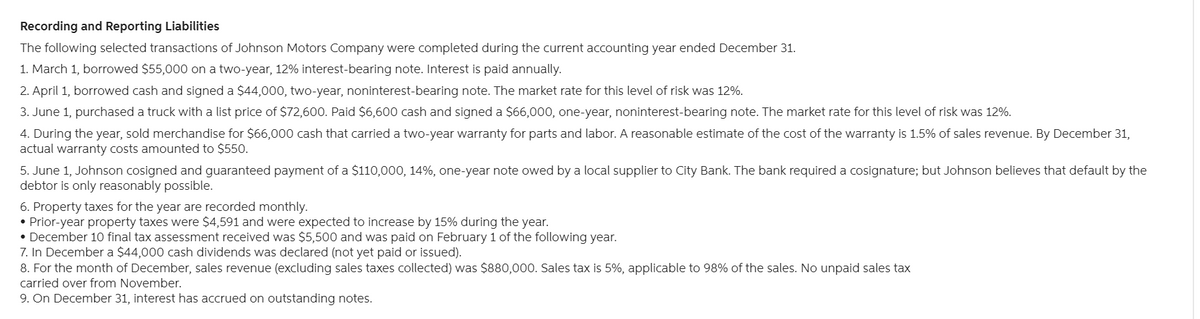

Transcribed Image Text:Recording and Reporting Liabilities

The following selected transactions of Johnson Motors Company were completed during the current accounting year ended December 31.

1. March 1, borrowed $55,000 on a two-year, 12% interest-bearing note. Interest is paid annually.

2. April 1, borrowed cash and signed a $44,000, two-year, noninterest-bearing note. The market rate for this level of risk was 12%.

3. June 1, purchased a truck with a list price of $72,600. Paid $6,600 cash and signed a $66,000, one-year, noninterest-bearing note. The market rate for this level of risk was 12%.

4. During the year, sold merchandise for $66,000 cash that carried a two-year warranty for parts and labor. A reasonable estimate of the cost of the warranty is 1.5% of sales revenue. By December 31,

actual warranty costs amounted to $550.

5. June 1, Johnson cosigned and guaranteed payment of a $110,000, 14%, one-year note owed by a local supplier to City Bank. The bank required a cosignature; but Johnson believes that default by the

debtor is only reasonably possible.

6. Property taxes for the year are recorded monthly.

• Prior-year property taxes were $4,591 and were expected to increase by 15% during the year.

• December 10 final tax assessment received was $5,500 and was paid on February 1 of the following year.

7. In December a $44,000 cash dividends was declared (not yet paid or issued).

8. For the month of December, sales revenue (excluding sales taxes collected) was $880,000. Sales tax is 5%, applicable to 98% of the sales. No unpaid sales tax

carried over from November.

9. On December 31, interest has accrued on outstanding notes.

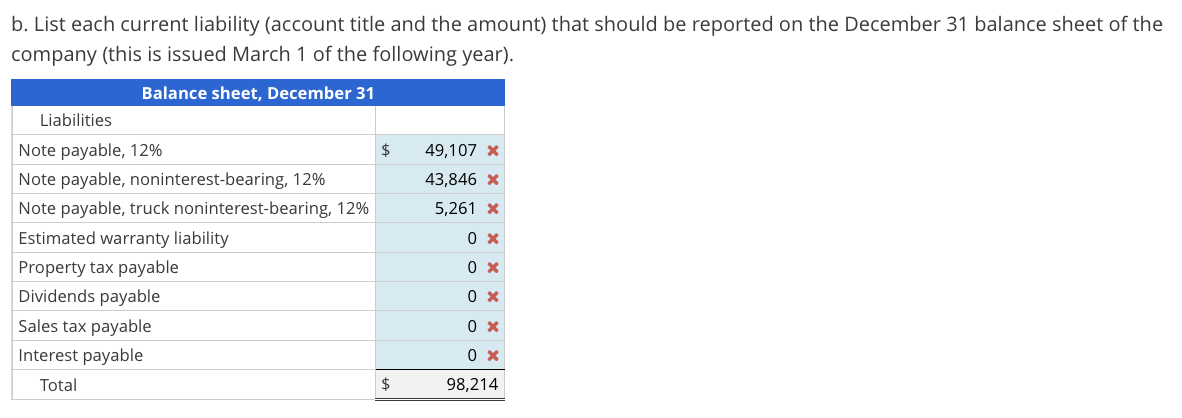

Transcribed Image Text:b. List each current liability (account title and the amount) that should be reported on the December 31 balance sheet of the

company (this is issued March 1 of the following year).

Balance sheet, December 31

Liabilities

Note payable, 12%

$

49,107 x

Dividends payable

Note payable, noninterest-bearing, 12%

Estimated warranty liability

Property tax payable

Sales tax payable

Interest payable

Total

43,846 x

Note payable, truck noninterest-bearing, 12%

5,261 x

0 x

0 ×

0 ×

0 ×

0 x

$

98,214

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College