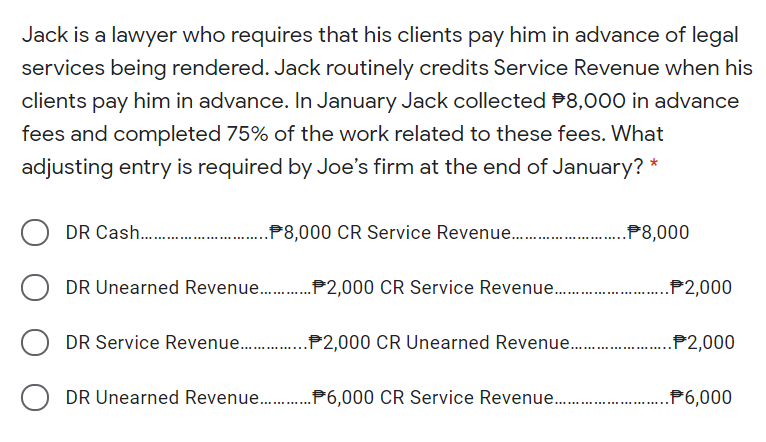

Jack is a lawyer who requires that his clients pay him in advance of legal services being rendered. Jack routinely credits Service Revenue when his clients pay him in advance. In January Jack collected P8,000 in advance fees and completed 75% of the work related to these fees. What adjusting entry is required by Joe's firm at the end of January?

Jack is a lawyer who requires that his clients pay him in advance of legal services being rendered. Jack routinely credits Service Revenue when his clients pay him in advance. In January Jack collected P8,000 in advance fees and completed 75% of the work related to these fees. What adjusting entry is required by Joe's firm at the end of January?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 1SEQ: Assume that a lawyer bills her clients $15000 on June 30, for services rendered during June. The...

Related questions

Question

100%

Transcribed Image Text:Jack is a lawyer who requires that his clients pay him in advance of legal

services being rendered. Jack routinely credits Service Revenue when his

clients pay him in advance. In January Jack collected P8,000 in advance

fees and completed 75% of the work related to these fees. What

adjusting entry is required by Joe's firm at the end of January? *

DR Cash .

.P8,000 CR Service Revenue .

.P8,000

DR Unearned Revenue .P2,000 CR Service Revenue.

..P2,000

DR Service Revenue .P2,000 CR Unearned Revenue..

.P2,000

DR Unearned Revenue .P6,000 CR Service Revenue.

P6,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT