James Marbury is the payroll accountant at All's Fair Gifts.

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 2QD

Related questions

Question

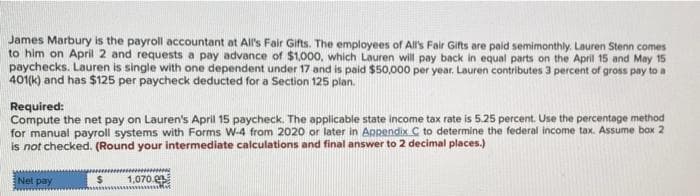

Transcribed Image Text:James Marbury is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Lauren Stenn comes

to him on April 2 and requests a pay advance of $1,000, which Lauren will pay back in equal parts on the April 15 and May 15

paychecks. Lauren is single with one dependent under 17 and is paid $50,000 per year. Lauren contributes 3 percent of gross pay to a

401(k) and has $125 per paycheck deducted for a Section 125 plan.

Required:

Compute the net pay on Lauren's April 15 paycheck. The applicable state income tax rate is 5.25 percent. Use the percentage method

for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine the federal income tax. Assume bOx 2

is not checked. (Round your intermediate calculations and final answer to 2 decimal places.)

ENet pay

1,070.e

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning