QUESTION 11 THIS IS A MANDATORY SUBMISSION An ordinary annuity has payments of $1000 made semi-annually with a nominal compound interest rate of 5%/year. n (as is the case for simple annuities). Assume the total length of the annuity is 4 years. Determine a) A cash flow diagram for the annuity from the initial start of the loan until the end of the 4 years b) The present value of the 2nd payment only c) The future value of the 3rd payment at the end of year 4 d) The present value of the entire annuity

QUESTION 11 THIS IS A MANDATORY SUBMISSION An ordinary annuity has payments of $1000 made semi-annually with a nominal compound interest rate of 5%/year. n (as is the case for simple annuities). Assume the total length of the annuity is 4 years. Determine a) A cash flow diagram for the annuity from the initial start of the loan until the end of the 4 years b) The present value of the 2nd payment only c) The future value of the 3rd payment at the end of year 4 d) The present value of the entire annuity

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 12E

Related questions

Question

solve question 11 with complete explanation asap

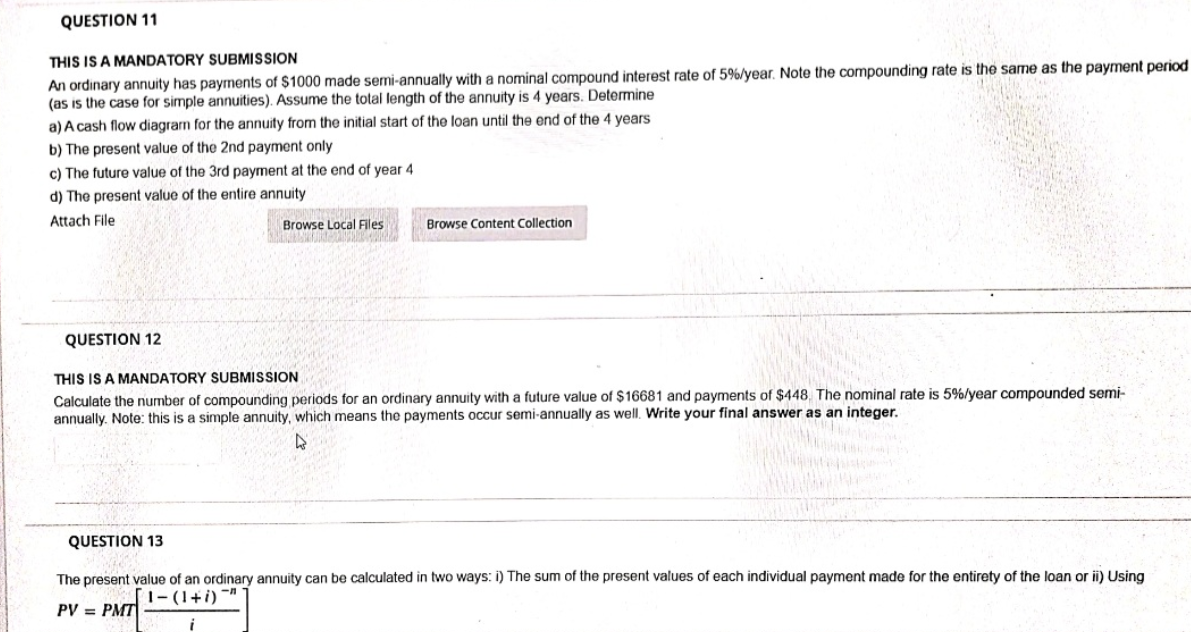

Transcribed Image Text:QUESTION 11

THIS IS A MANDATORY SUBMISSION

An ordinary annuity has payments of $1000 made semi-annually with a nominal compound interest rate of 5%/year. Note the compounding rate is the same as the payment period

(as is the case for simple annuities). Assume the total length of the annuity is 4 years. Determine

a) A cash flow diagran for the annuity from the initial start of the loan until the end of the 4 years

b) The present value of the 2nd payment only

c) The future value of the 3rd payment at the end of year 4

d) The present value of the entire annuity

Attach File

Browse Local Files

Browse Content Collection

QUESTION 12

THIS IS A MANDATORY SUBMISSION

Calculate the number of compounding periods for an ordinary annuity with a future value of $16681 and payments of $448, The nominal rate is 5%/year compounded semi-

annually. Note: this is a simple annuity, which means the payments occur semi-annually as well, Write your final answer as an integer.

QUESTION 13

The present value of an ordinary annuity can be calculated in two ways: i) The sum of the present values of each individual payment made for the entirety of the loan or i) Using

1- (1+i) ¯"

PV = PMT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning