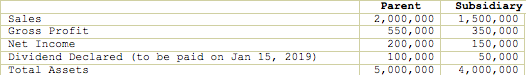

On January 1, 20x8, Parent Company purchased 80% of the outstanding shares of Subsidiary Company for P800,000. On the date of acquisition, Subsidiary Company reported Ordinary Shares of P800,000 and Retained Earnings of P200,000. Subsidiary’s Inventory was understated by P20,000; Equipment with a 5-year life was understated by P20,000, Building with an 8-year life was understated by P80,000 and land was understated by P40,000. The non-controlling interest is to be stated at fair value and the fair value of the non-controlling interest on January 1, 20x8 is P210,000. During the year, Parent sold goods to Subsidiary for P150,000 at a 25% mark-up and in turn purchased P200,000 of Subsidiary’s goods which Subsidiary sold at a 20% mark-up. From the goods purchased, P50,000 remain in Parent’s books at the end of the year, while P20,000 remain in Subsidiary’s books at the end of the year. 30% of the undervalued inventory of Subsidiary still remain unsold by the end of 20x8. The following are taken from the books of Parent and Subsidiary for 20x8. From the given data, determine the: 1. TOTAL ASSETS on December 31, 20x8. 2. consolidated COST OF SALES 3. NON-CONTROLLING INTEREST on December 31, 20x8.

On January 1, 20x8, Parent Company purchased 80% of the outstanding shares of Subsidiary Company for P800,000. On the date of acquisition, Subsidiary Company reported Ordinary Shares of P800,000 and

From the given data, determine the:

1. TOTAL ASSETS on December 31, 20x8.

2. consolidated COST OF SALES

3. NON-CONTROLLING INTEREST on December 31, 20x8.

Step by step

Solved in 4 steps with 6 images