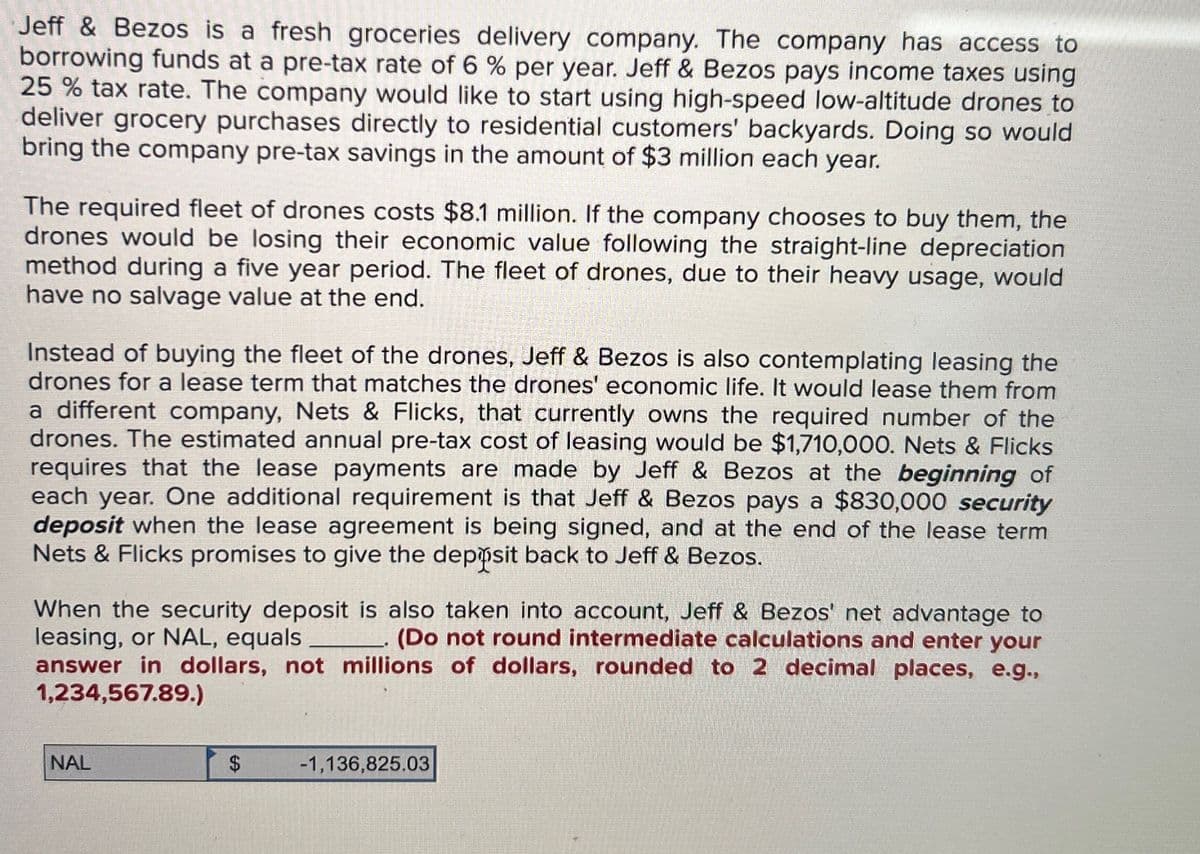

Jeff & Bezos is a fresh groceries delivery company. The company has access to borrowing funds at a pre-tax rate of 6 % per year. Jeff & Bezos pays income taxes using 25 % tax rate. The company would like to start using high-speed low-altitude drones to deliver grocery purchases directly to residential customers' backyards. Doing so would bring the company pre-tax savings in the amount of $3 million each year. The required fleet of drones costs $8.1 million. If the company chooses to buy them, the drones would be losing their economic value following the straight-line depreciation method during a five year period. The fleet of drones, due to their heavy usage, would have no salvage value at the end. Instead of buying the fleet of the drones, Jeff & Bezos is also contemplating leasing the drones for a lease term that matches the drones' economic life. It would lease them from a different company, Nets & Flicks, that currently owns the required number of the drones. The estimated annual pre-tax cost of leasing would be $1,710,000. Nets & Flicks requires that the lease payments are made by Jeff & Bezos at the beginning of each year. One additional requirement is that Jeff & Bezos pays a $830,000 security deposit when the lease agreement is being signed, and at the end of the lease term Nets & Flicks promises to give the deposit back to Jeff & Bezos. When the security deposit is also taken into account, Jeff & Bezos' net advantage to leasing, or NAL, equals. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) NAL -1,136,825.03

Jeff & Bezos is a fresh groceries delivery company. The company has access to borrowing funds at a pre-tax rate of 6 % per year. Jeff & Bezos pays income taxes using 25 % tax rate. The company would like to start using high-speed low-altitude drones to deliver grocery purchases directly to residential customers' backyards. Doing so would bring the company pre-tax savings in the amount of $3 million each year. The required fleet of drones costs $8.1 million. If the company chooses to buy them, the drones would be losing their economic value following the straight-line depreciation method during a five year period. The fleet of drones, due to their heavy usage, would have no salvage value at the end. Instead of buying the fleet of the drones, Jeff & Bezos is also contemplating leasing the drones for a lease term that matches the drones' economic life. It would lease them from a different company, Nets & Flicks, that currently owns the required number of the drones. The estimated annual pre-tax cost of leasing would be $1,710,000. Nets & Flicks requires that the lease payments are made by Jeff & Bezos at the beginning of each year. One additional requirement is that Jeff & Bezos pays a $830,000 security deposit when the lease agreement is being signed, and at the end of the lease term Nets & Flicks promises to give the deposit back to Jeff & Bezos. When the security deposit is also taken into account, Jeff & Bezos' net advantage to leasing, or NAL, equals. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) NAL -1,136,825.03

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 78TPC

Related questions

Question

Raghubhai

Transcribed Image Text:Jeff & Bezos is a fresh groceries delivery company. The company has access to

borrowing funds at a pre-tax rate of 6 % per year. Jeff & Bezos pays income taxes using

25 % tax rate. The company would like to start using high-speed low-altitude drones to

deliver grocery purchases directly to residential customers' backyards. Doing so would

bring the company pre-tax savings in the amount of $3 million each year.

The required fleet of drones costs $8.1 million. If the company chooses to buy them, the

drones would be losing their economic value following the straight-line depreciation

method during a five year period. The fleet of drones, due to their heavy usage, would

have no salvage value at the end.

Instead of buying the fleet of the drones, Jeff & Bezos is also contemplating leasing the

drones for a lease term that matches the drones' economic life. It would lease them from

a different company, Nets & Flicks, that currently owns the required number of the

drones. The estimated annual pre-tax cost of leasing would be $1,710,000. Nets & Flicks

requires that the lease payments are made by Jeff & Bezos at the beginning of

each year. One additional requirement is that Jeff & Bezos pays a $830,000 security

deposit when the lease agreement is being signed, and at the end of the lease term

Nets & Flicks promises to give the deposit back to Jeff & Bezos.

When the security deposit is also taken into account, Jeff & Bezos' net advantage to

leasing, or NAL, equals.

(Do not round intermediate calculations and enter your

answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g.,

1,234,567.89.)

NAL

-1,136,825.03

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you