Jehanzaib Ltd. is a logistics company operating in Lahore. They have recently bid for a Punjab wide contract of providing medicines to all the health units. This is an excellent opportunity for the company to expand their business. To fulfill this requirement, Areeb, who is the CEO of the company is analyzing, how he should expand his fleet. The basic question in front of him is whether he should buy his own fleet of trucks or lease them. And, the question, whether he should buy them by raising capital through bonds or equities. He needs 100 trucks to fulfill the requirements. He has just finished a call with ORIX Leasing Ltd, who have said, that they would be willing to lease them 100 trucks for PKR 4795845 for 5 years. Instead, if Areeb decides to buy the vehicles he is estimating that he would be spending PKR 189960 per truck. And the question is how to finance. He was checking the debt market rates, and found out that for similar risk companies, the bonds with a face value of 1000 were trading at PKR 960 with 5 years to maturity (annual coupon payment of 5%). Buying the trucks also means that he would be incurring a cost of PKR 850,000 each year for the whole fleet. The company's tax rate is 35%. The tax laws allow straight-line depreciation for 5 years. The cost of capital

Jehanzaib Ltd. is a logistics company operating in Lahore. They have recently bid for a Punjab wide contract of providing medicines to all the health units. This is an excellent opportunity for the company to expand their business. To fulfill this requirement, Areeb, who is the CEO of the company is analyzing, how he should expand his fleet. The basic question in front of him is whether he should buy his own fleet of trucks or lease them. And, the question, whether he should buy them by raising capital through bonds or equities. He needs 100 trucks to fulfill the requirements. He has just finished a call with ORIX Leasing Ltd, who have said, that they would be willing to lease them 100 trucks for PKR 4795845 for 5 years. Instead, if Areeb decides to buy the vehicles he is estimating that he would be spending PKR 189960 per truck. And the question is how to finance. He was checking the debt market rates, and found out that for similar risk companies, the bonds with a face value of 1000 were trading at PKR 960 with 5 years to maturity (annual coupon payment of 5%). Buying the trucks also means that he would be incurring a cost of PKR 850,000 each year for the whole fleet. The company's tax rate is 35%. The tax laws allow straight-line depreciation for 5 years. The cost of capital

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 2CDQ

Related questions

Question

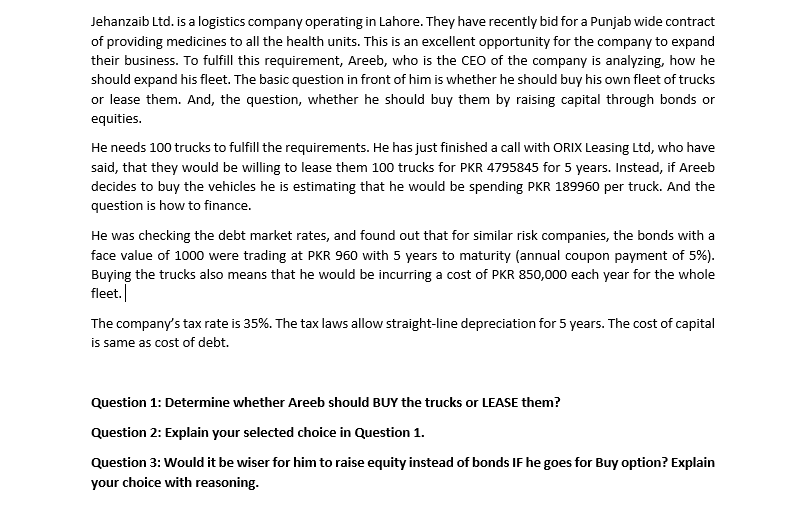

Transcribed Image Text:Jehanzaib Ltd. is a logistics company operating in Lahore. They have recently bid for a Punjab wide contract

of providing medicines to all the health units. This is an excellent opportunity for the company to expand

their business. To fulfill this requirement, Areeb, who is the CEO of the company is analyzing, how he

should expand his fleet. The basic question in front of him is whether he should buy his own fleet of trucks

or lease them. And, the question, whether he should buy them by raising capital through bonds or

equities.

He needs 100 trucks to fulfill the requirements. He has just finished a call with ORIX Leasing Ltd, who have

said, that they would be willing to lease them 100 trucks for PKR 4795845 for 5 years. Instead, if Areeb

decides to buy the vehicles he is estimating that he would be spending PKR 189960 per truck. And the

question is how to finance.

He was checking the debt market rates, and found out that for similar risk companies, the bonds with a

face value of 1000 were trading at PKR 960 with 5 years to maturity (annual coupon payment of 5%).

Buying the trucks also means that he would be incurring a cost of PKR 850,000 each year for the whole

fleet.

The company's tax rate is 35%. The tax laws allow straight-line depreciation for 5 years. The cost of capital

is same as cost of debt.

Question 1: Determine whether Areeb should BUY the trucks or LEASE them?

Question 2: Explain your selected choice in Question 1.

Question 3: Would it be wiser for him to raise equity instead of bonds IF he goes for Buy option? Explain

your choice with reasoning.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub