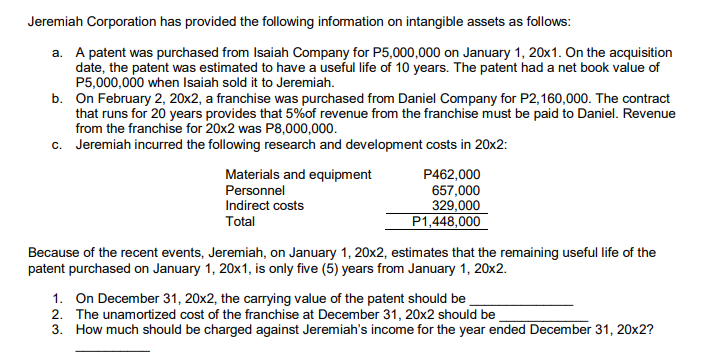

Jeremiah Corporation has provided the following information on intangible assets as follows: a. A patent was purchased from Isaiah Company for P5,000,000 on January 1, 20x1. On the acquisition date, the patent was estimated to have a useful life of 10 years. The patent had a net book value of P5,000,000 when Isaiah sold it to Jeremiah. b. On February 2, 20x2, a franchise was purchased from Daniel Company for P2,160,000. The contract that runs for 20 years provides that 5%of revenue from the franchise must be paid to Daniel. Revenue from the franchise for 20x2 was P8,000,000. c. Jeremiah incurred the following research and development costs in 20x2: Materials and equipment Personnel P462,000 657,000 329,000 P1,448,000 Indirect costs Total Because of the recent events, Jeremiah, on January 1, 20x2, estimates that the remaining useful life of the patent purchased on January 1, 20x1, is only five (5) years from January 1, 20x2. 1. On December 31, 20x2, the carrying value of the patent should be 2. The unamortized cost of the franchise at December 31, 20x2 should be 3. How much should be charged against Jeremiah's income for the year ended December 31, 20x2?

Jeremiah Corporation has provided the following information on intangible assets as follows: a. A patent was purchased from Isaiah Company for P5,000,000 on January 1, 20x1. On the acquisition date, the patent was estimated to have a useful life of 10 years. The patent had a net book value of P5,000,000 when Isaiah sold it to Jeremiah. b. On February 2, 20x2, a franchise was purchased from Daniel Company for P2,160,000. The contract that runs for 20 years provides that 5%of revenue from the franchise must be paid to Daniel. Revenue from the franchise for 20x2 was P8,000,000. c. Jeremiah incurred the following research and development costs in 20x2: Materials and equipment Personnel P462,000 657,000 329,000 P1,448,000 Indirect costs Total Because of the recent events, Jeremiah, on January 1, 20x2, estimates that the remaining useful life of the patent purchased on January 1, 20x1, is only five (5) years from January 1, 20x2. 1. On December 31, 20x2, the carrying value of the patent should be 2. The unamortized cost of the franchise at December 31, 20x2 should be 3. How much should be charged against Jeremiah's income for the year ended December 31, 20x2?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Jeremiah Corporation has provided the following information on intangible assets as follows:

a. A patent was purchased from Isaiah Company for P5,000,000 on January 1, 20x1. On the acquisition

date, the patent was estimated to have a useful life of 10 years. The patent had a net book value of

P5,000,000 when Isaiah sold it to Jeremiah.

b. On February 2, 20x2, a franchise was purchased from Daniel Company for P2,160,000. The contract

that runs for 20 years provides that 5%of revenue from the franchise must be paid to Daniel. Revenue

from the franchise for 20x2 was P8,000,000.

c. Jeremiah incurred the following research and development costs in 20x2:

Materials and equipment

P462,000

657,000

329,000

P1,448,000

Personnel

Indirect costs

Total

Because of the recent events, Jeremiah, on January 1, 20x2, estimates that the remaining useful life of the

patent purchased on January 1, 20x1, is only five (5) years from January 1, 20x2.

1. On December 31, 20x2, the carrying value of the patent should be

2. The unamortized cost of the franchise at December 31, 20x2 should be

3. How much should be charged against Jeremiah's income for the year ended December 31, 20x2?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning