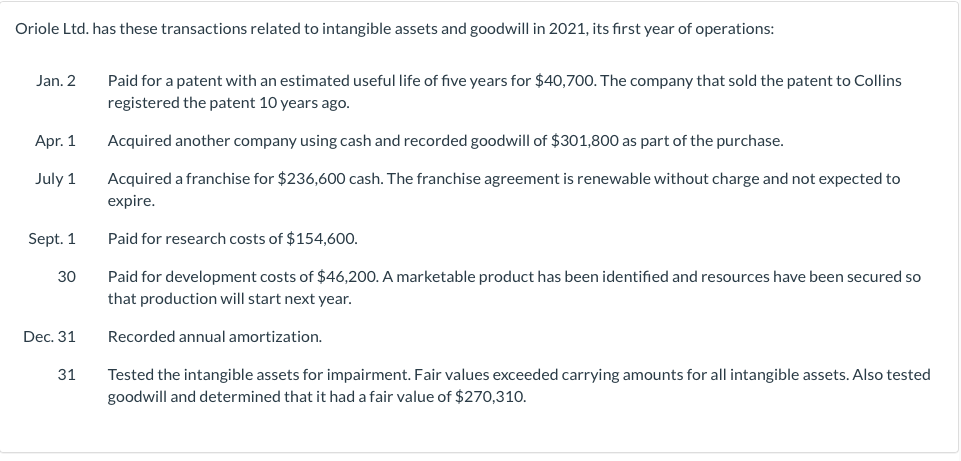

Oriole Ltd. has these transactions related to intangible assets and goodwill in 2021, its first year of operations: Paid for a patent with an estimated useful life of five years for $40,700. The company that sold the patent to Collins registered the patent 10 years ago. Jan. 2 Apr. 1 Acquired another company using cash and recorded goodwill of $301,800 as part of the purchase. Acquired a franchise for $236,600 cash. The franchise agreement is renewable without charge and not expected to expire. July 1 Sept. 1 Paid for research costs of $154,600. 30 Paid for development costs of $46,200. A marketable product has been identified and resources have been secured s that production will start next year. Dec. 31 Recorded annual amortization. 31 Tested the intangible assets for impairment. Fair values exceeded carrying amounts for all intangible assets. Also test goodwill and determined that it had a fair value of $270,310.

Oriole Ltd. has these transactions related to intangible assets and goodwill in 2021, its first year of operations: Paid for a patent with an estimated useful life of five years for $40,700. The company that sold the patent to Collins registered the patent 10 years ago. Jan. 2 Apr. 1 Acquired another company using cash and recorded goodwill of $301,800 as part of the purchase. Acquired a franchise for $236,600 cash. The franchise agreement is renewable without charge and not expected to expire. July 1 Sept. 1 Paid for research costs of $154,600. 30 Paid for development costs of $46,200. A marketable product has been identified and resources have been secured s that production will start next year. Dec. 31 Recorded annual amortization. 31 Tested the intangible assets for impairment. Fair values exceeded carrying amounts for all intangible assets. Also test goodwill and determined that it had a fair value of $270,310.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 10PA: Prepare journal entries to record the following transactions. Create a T-account for Interest...

Related questions

Question

Hi there,

I'm not sure how to orgnize and enter this

Transcribed Image Text:Oriole Ltd. has these transactions related to intangible assets and goodwill in 2021, its first year of operations:

Paid for a patent with an estimated useful life of five years for $40,700. The company that sold the patent to Collins

registered the patent 10 years ago.

Jan. 2

Apr. 1

Acquired another company using cash and recorded goodwill of $301,800 as part of the purchase.

July 1

Acquired a franchise for $236,600 cash. The franchise agreement is renewable without charge and not expected to

expire.

Sept. 1

Paid for research costs of $154,600.

30

Paid for development costs of $46,200. A marketable product has been identified and resources have been secured so

that production will start next year.

Dec. 31

Recorded annual amortization.

31

Tested the intangible assets for impairment. Fair values exceeded carrying amounts for all intangible assets. Also tested

goodwill and determined that it had a fair value of $270,310.

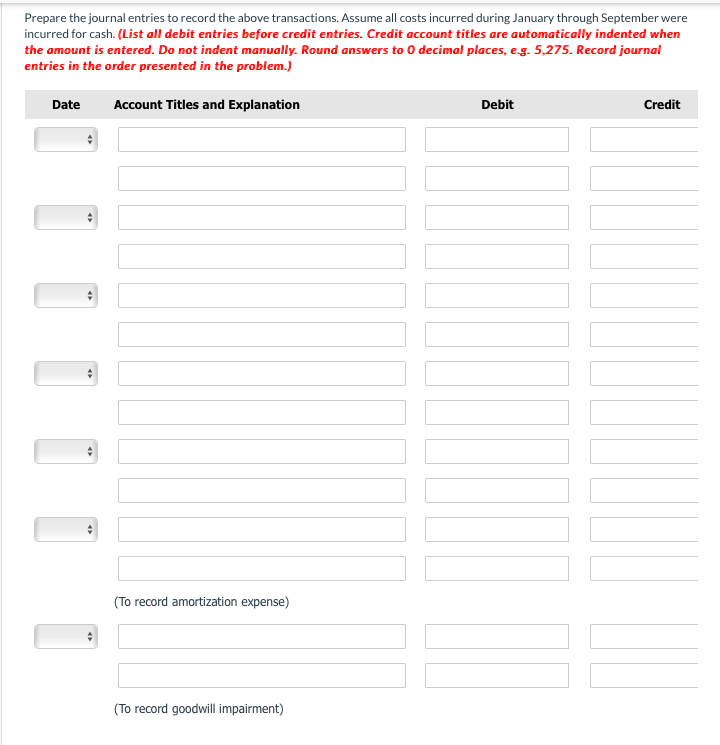

Transcribed Image Text:Prepare the journal entries to record the above transactions. Assume all costs incurred during January through September were

incurred for cash. (List all debit entries before credit entries. Credit account titles are automatically indented when

the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275. Record journal

entries in the order presented in the problem.)

Date

Account Titles and Explanation

Debit

Credit

(To record amortization expense)

(To record goodwill impairment)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage