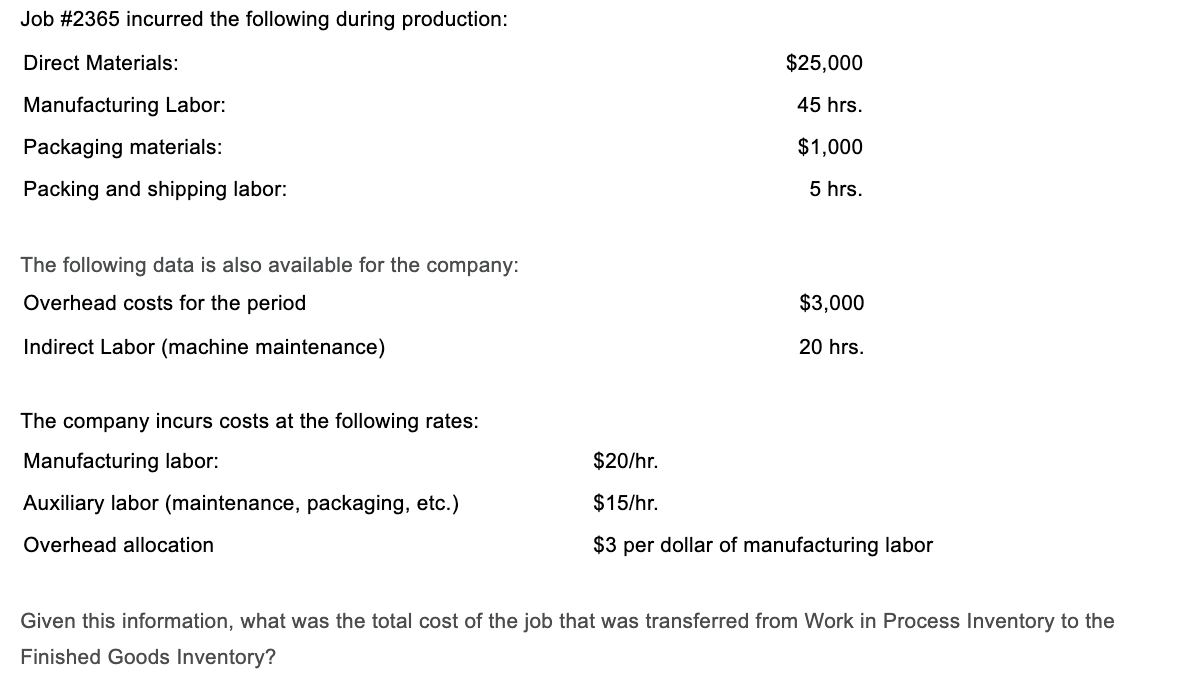

Job #2365 incurred the following during production: Direct Materials: $25,000 Manufacturing Labor: 45 hrs. Packaging materials: $1,000 Packing and shipping labor: 5 hrs. The following data is also available for the company: Overhead costs for the period $3,000 Indirect Labor (machine maintenance) 20 hrs. The company incurs costs at the following rates:

Job #2365 incurred the following during production: Direct Materials: $25,000 Manufacturing Labor: 45 hrs. Packaging materials: $1,000 Packing and shipping labor: 5 hrs. The following data is also available for the company: Overhead costs for the period $3,000 Indirect Labor (machine maintenance) 20 hrs. The company incurs costs at the following rates:

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter3: Process Cost Systems

Section: Chapter Questions

Problem 7BE: In October, the cost of materials transferred into the Rolling Department from the Casting...

Related questions

Question

Transcribed Image Text:Job #2365 incurred the following during production:

Direct Materials:

$25,000

Manufacturing Labor:

45 hrs.

Packaging materials:

$1,000

Packing and shipping labor:

5 hrs.

The following data is also available for the company:

Overhead costs for the period

$3,000

Indirect Labor (machine maintenance)

20 hrs.

The company incurs costs at the following rates:

Manufacturing labor:

$20/hr.

Auxiliary labor (maintenance, packaging, etc.)

$15/hr.

Overhead allocation

$3 per dollar of manufacturing labor

Given this information, what was the total cost of the job that was transferred from Work in Process Inventory to the

Finished Goods Inventory?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,