Johnson & Johnson Corporation has plan to diversify their business. One is to open a fast-food restaurant and the other one is an opening of boutique. Both are located in Kuala Lumpur and both projects are forecast to be opened in June 2022. Fast-food restaurant has been given the name as J&J Restaurant and the initial investment is RM150,000. While the boutique has been given name as Jie & Joe ane the cost involved is about RM100,000. The cost of capital is 12%. As a finance manager you are forecasting both projects on the annual cash flow based on few methods. The cash flow are as follows: J&J Restaurant Annual Cash Flows: 1st year RM40,000, 2nd year increase to RM55,000, 3rd year increase by RM10,000, the 4th year is RM70,000 and the 5th year is RM85,000 Jie & Joe Boutique Annual Cash Flows: 1st year RM30,000, 2nd year increase by RM15,000, 3rd year is RM45,000 and the 4th year is RM50,000 and the 5th year is RM70,000 You determine the above annual cash flows according to: 1) Payback period 2) Discounted payback period 3) NPV 4) Profitability Index (PI) Your requirement as follows: 1) The project should cover at least in Year 3 2) To decide from each of the above methods which are the best project to accept and to reject either they are independent projects or both are mutually exclusive.

Johnson & Johnson Corporation has plan to diversify their business. One is to open a fast-food restaurant and the other one is an opening of boutique. Both are located in Kuala Lumpur and both projects are forecast to be opened in June 2022. Fast-food restaurant has been given the name as J&J Restaurant and the initial investment is RM150,000. While the boutique has been given name as Jie & Joe ane the cost involved is about RM100,000. The cost of capital is 12%. As a finance manager you are forecasting both projects on the annual cash flow based on few methods. The cash flow are as follows: J&J Restaurant Annual Cash Flows: 1st year RM40,000, 2nd year increase to RM55,000, 3rd year increase by RM10,000, the 4th year is RM70,000 and the 5th year is RM85,000 Jie & Joe Boutique Annual Cash Flows: 1st year RM30,000, 2nd year increase by RM15,000, 3rd year is RM45,000 and the 4th year is RM50,000 and the 5th year is RM70,000 You determine the above annual cash flows according to: 1) Payback period 2) Discounted payback period 3) NPV 4) Profitability Index (PI) Your requirement as follows: 1) The project should cover at least in Year 3 2) To decide from each of the above methods which are the best project to accept and to reject either they are independent projects or both are mutually exclusive.

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 1hM

Related questions

Question

Transcribed Image Text:Styles

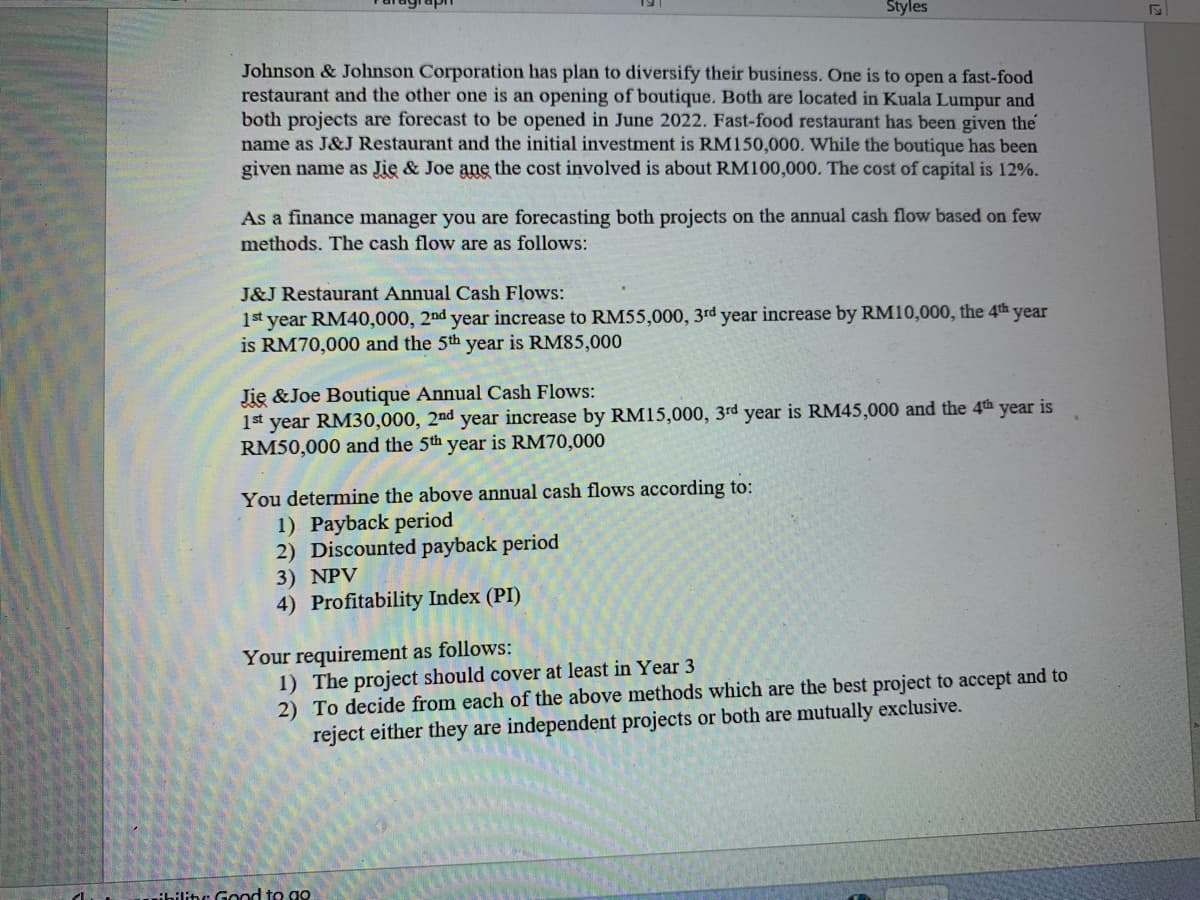

Johnson & Johnson Corporation has plan to diversify their business. One is to open a fast-food

restaurant and the other one is an opening of boutique. Both are located in Kuala Lumpur and

both projects are forecast to be opened in June 2022. Fast-food restaurant has been given the

name as J&J Restaurant and the initial investment is RM150,000. While the boutique has been

given name as Jie & Joe ane the cost involved is about RM100,000. The cost of capital is 12%.

As a finance manager you are forecasting both projects on the annual cash flow based on few

methods. The cash flow are as follows:

J&J Restaurant Annual Cash Flows:

1st year RM40,000, 2nd year increase to RM55,000, 3rd year increase by RM10,000, the 4th year

is RM70,000 and the 5th year is RM85,000

Jie & Joe Boutique Annual Cash Flows:

1st year RM30,000, 2nd year increase by RM15,000, 3rd year is RM45,000 and the 4th year is

RM50,000 and the 5th year is RM70,000

You determine the above annual cash flows according to:

1) Payback period

2) Discounted payback period

3) NPV

4) Profitability Index (PI)

Your requirement as follows:

1) The project should cover at least in Year 3

2) To decide from each of the above methods which are the best project to accept and to

reject either they are independent projects or both are mutually exclusive.

wihilinc Good to go

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning