Market hisk Pvemium= 7/. Treasury B:ll hate - 1.93 %3D GOOG - Alphabet - Beta= 1.07 HO - Home Depot- Beta> 1.02 PG - Protector and Gamble = Beta- 0.45 MO- Altria Group -Beta-O.65

Market hisk Pvemium= 7/. Treasury B:ll hate - 1.93 %3D GOOG - Alphabet - Beta= 1.07 HO - Home Depot- Beta> 1.02 PG - Protector and Gamble = Beta- 0.45 MO- Altria Group -Beta-O.65

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter16: Capital Structure Decisions

Section: Chapter Questions

Problem 3P: Premium for Financial Risk

Ethier Enterprise has an unlevered beta of 1.0. Ethier is Financed with...

Related questions

Question

100%

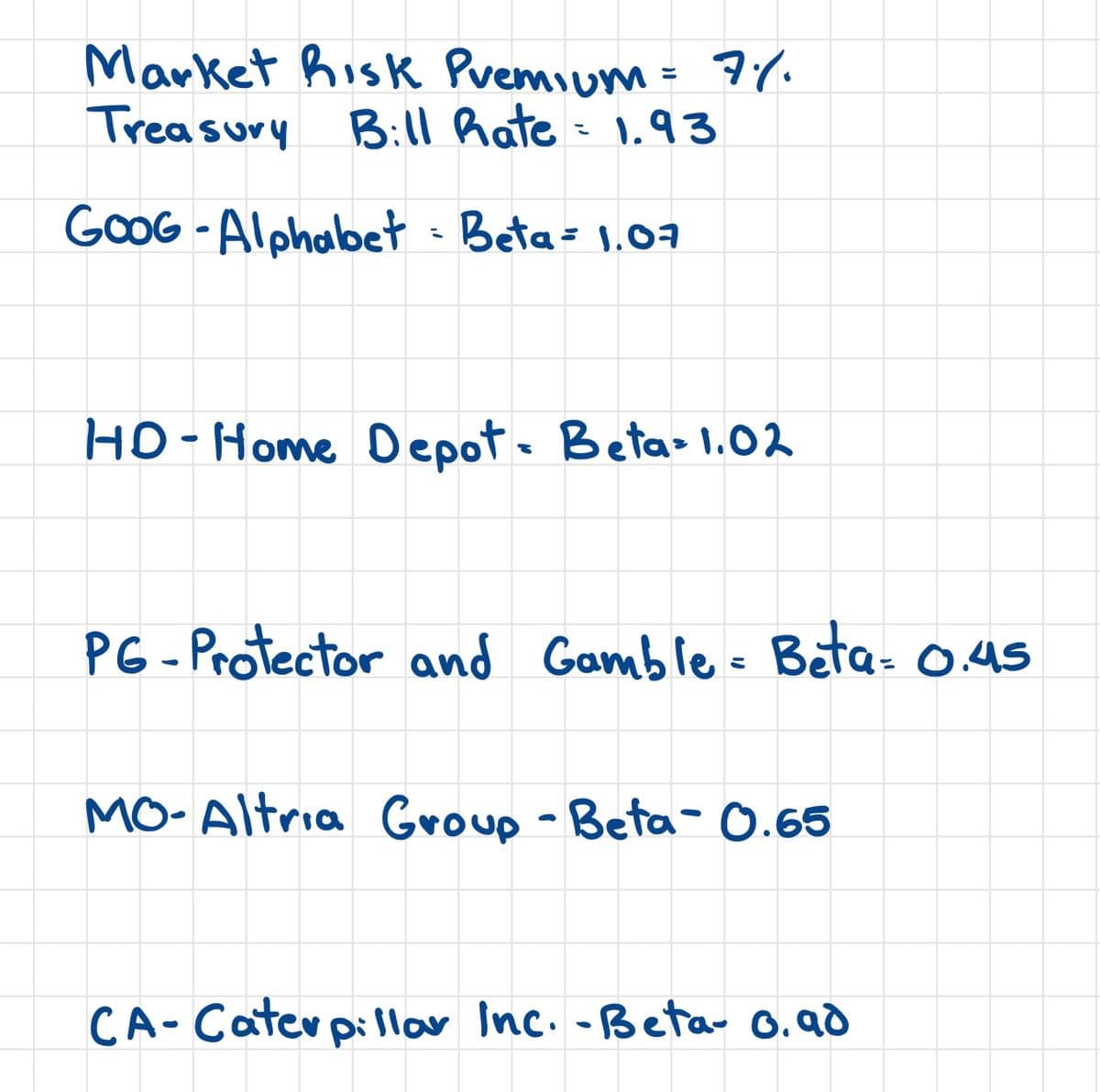

Transcribed Image Text:Market Risk Pvemium = 7.

Treasury Bill hate - 1.93

%3D

GOOG - Alphabet Beta= 1.07

HO-Home Oepot- Beta 1.02

PG - Protector and Gamble= Beta- 0.45

MO- Altria Group - Beta- 0.65

CA-Catevpillar Inc. -Beta- 0.90

![You can find estimates of stock betas by logging on to finance.yahoo.com and looking at a company's

Statistics. Try comparing the stock betas of Alphabet (GOOG), The Home Depot (HD), Procter & Gamble

(PG), Altria Group (MO), and Caterpillar (CAT). Ônce you have read Section 12.3, use the capital asset pricing

model to estimate the expected return for each of these stocks. You will need a figure for the current Treasury

bill rate. You can find this also on finance.yahoo.com by clicking on Bonds-Rates. Assume for your estimates

a market risk premium of 7%.

R

E(R) = RRR = rf + risk premium = r + Bi[E(Rm) – r|]

%3D

%3D

%3D](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fe29127a4-9a97-44ad-8507-d0d1cc98b411%2F6fc9a990-124a-40f6-aa0e-b54d20ded56f%2F41sua99_processed.jpeg&w=3840&q=75)

Transcribed Image Text:You can find estimates of stock betas by logging on to finance.yahoo.com and looking at a company's

Statistics. Try comparing the stock betas of Alphabet (GOOG), The Home Depot (HD), Procter & Gamble

(PG), Altria Group (MO), and Caterpillar (CAT). Ônce you have read Section 12.3, use the capital asset pricing

model to estimate the expected return for each of these stocks. You will need a figure for the current Treasury

bill rate. You can find this also on finance.yahoo.com by clicking on Bonds-Rates. Assume for your estimates

a market risk premium of 7%.

R

E(R) = RRR = rf + risk premium = r + Bi[E(Rm) – r|]

%3D

%3D

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning