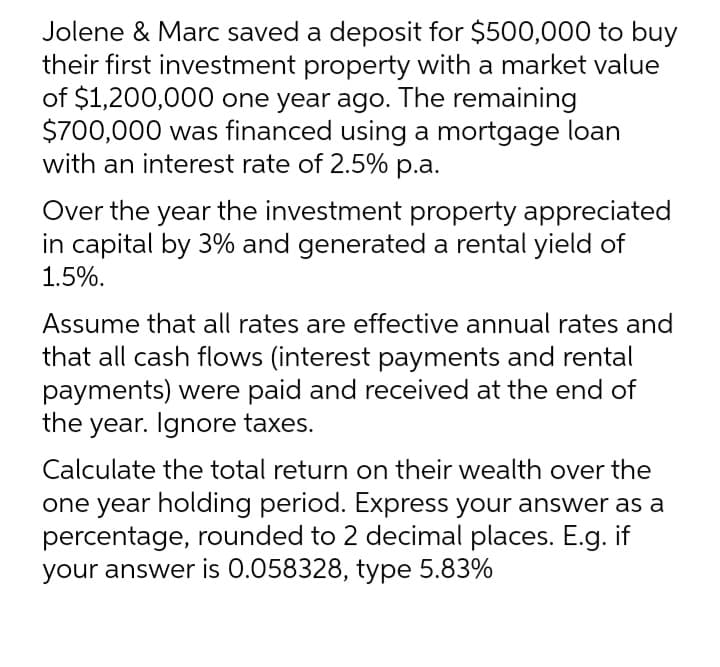

Jolene & Marc saved a deposit for $500,000 to buy their first investment property with a market value of $1,200,000 one year ago. The remaining $700,000 was financed using a mortgage loan with an interest rate of 2.5% p.a. Over the year the investment property appreciated in capital by 3% and generated a rental yield of 1.5%. Assume that all rates are effective annual rates and that all cash flows (interest payments and rental payments) were paid and received at the end of the year. Ignore taxes. Calculate the total return on their wealth over the one year holding period. Express your answer as a percentage, rounded to 2 decimal places. E.g. if your answer is 0.058328, type 5.83%

Jolene & Marc saved a deposit for $500,000 to buy their first investment property with a market value of $1,200,000 one year ago. The remaining $700,000 was financed using a mortgage loan with an interest rate of 2.5% p.a. Over the year the investment property appreciated in capital by 3% and generated a rental yield of 1.5%. Assume that all rates are effective annual rates and that all cash flows (interest payments and rental payments) were paid and received at the end of the year. Ignore taxes. Calculate the total return on their wealth over the one year holding period. Express your answer as a percentage, rounded to 2 decimal places. E.g. if your answer is 0.058328, type 5.83%

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 22E

Related questions

Question

M4

Transcribed Image Text:Jolene & Marc saved a deposit for $500,000 to buy

their first investment property with a market value

of $1,200,000 one year ago. The remaining

$700,000 was financed using a mortgage loan

with an interest rate of 2.5% p.a.

Over the year the investment property appreciated

in capital by 3% and generated a rental yield of

1.5%.

Assume that all rates are effective annual rates and

that all cash flows (interest payments and rental

payments) were paid and received at the end of

the year. Ignore taxes.

Calculate the total return on their wealth over the

one year holding period. Express your answer as a

percentage, rounded to 2 decimal places. E.g. if

your answer is 0.058328, type 5.83%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College