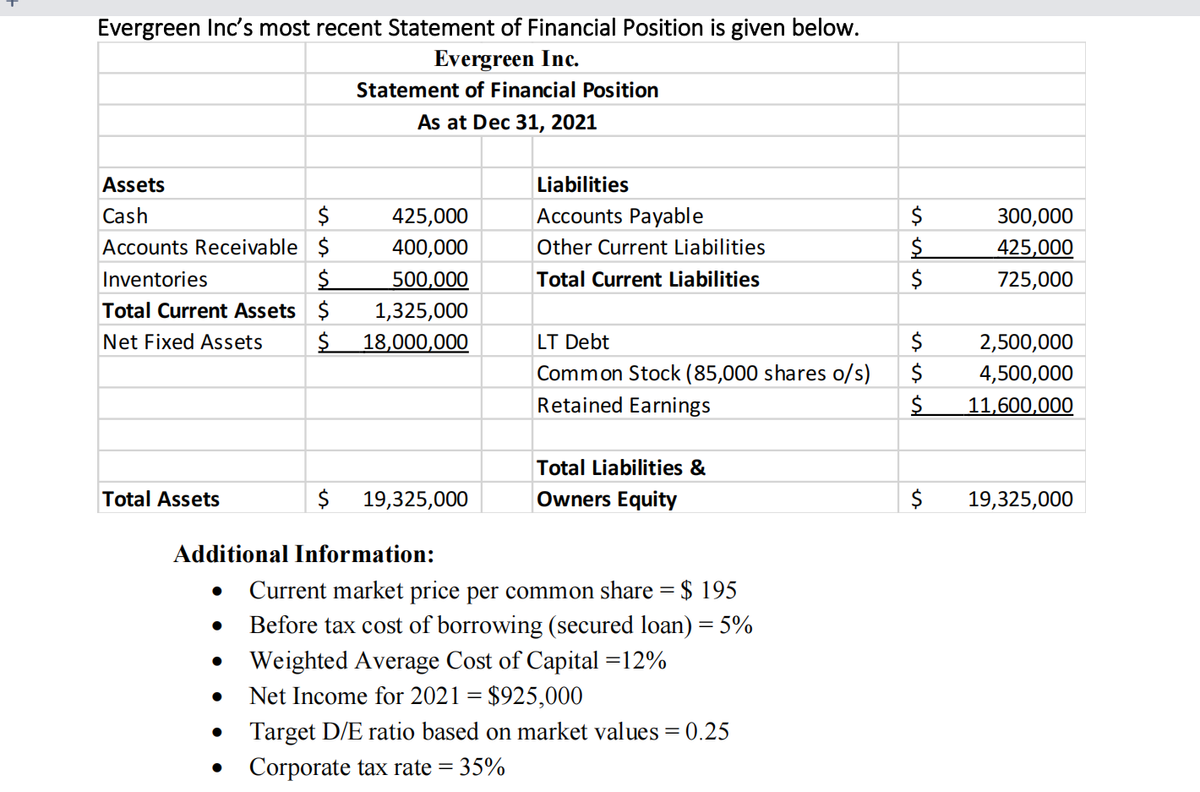

Suppose instead, Evergreen uses a retention ratio of 30%. Their capital budget for the upcoming year = $1,600,000. Calculate the debt, external equity financing required and the dividends per share.

Q: Harper takes out a loan of $126,500,000, which is to be repaid by annual payments for 25 years. The…

A: Loan (L) = $126,500,000 n = 25 years Growth rate (g) = 20% r = 11% First payment = P

Q: An investor, Liam, bought a 91-day $25,000 Canadian Treasury Bill. Liam later sold the T-bill 40…

A: Solution : Liam was purchased the T-Bill for 91 days $ 25000 & Current Interest rate was 3.25%…

Q: CCC Co issues a bond today that will pay a coupon of 8%, twice a year. The yield to maturity for…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Q: Kevin takes out a home loan for $250,000. Payments are made at the end of every month for 30 years.…

A: Amortized Loan: Amortized loan is a type of loan in which the borrower would pay periodic payments…

Q: An entrepreneur needs thousand of dollars to launch the global to lend him the money today (n=0) at…

A: Effective rate is the rate of interest considering the impact of the compounding of the interest…

Q: Consider the following cash flows on two mutually exclusive projects: Year Project A Project B 0…

A: Present worth (NPV) is one of the techniques of capital budgeting analysis. NPV will be the…

Q: A firm wishes to bid on a contract that is expected to yield the following after-tax net cash flows…

A: Present worth (NPV) will be the difference between total present worth of cash inflows and total…

Q: net investment

A: Cash flow represents the inflow and outflow of cash in a particular period of time for the company.

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery…

A: Given, Investment = $100 million plant and machinery = $80 million Net working capital = $20…

Q: 6. A P10,000, 8% bond pays dividends semi-annually and will be redeemed at 110% on April 29, 2027.…

A: Face value (F) = P 10000 Coupon (C) = (8% of F) / 2 = P 400 Redemption amount (R) = 110% of F = P…

Q: A certain project has a payback of 8 years. The project will generate cash earnings after taxes as…

A: Pay back period is the amount of time required to recover Cost of investment. Payback period =Cost…

Q: F asked money amounting to P 9,000 from his parents on the first month 2020 and 12,000 on 2022. He…

A: Present value includes the money without the interest and future value includes the payment with…

Q: A small bridge can be constructed for $ 20,000 with a life of 30 years, after which it can be…

A: Initial cost = $20000 n = 30 years Annual cost = $1000 for 5 years, $1500 thereafter r = 12%

Q: Discuss the efficiency of capital markets and focus specifically on the stock market. Describe your…

A: A financial sector is a place where buyers and sellers trade financial securities including such…

Q: Dr. Sheldon Lee Cooper plans to purchase an equipment for his small physics display museum amounting…

A: The equivalent annual receipts and costs throughout the period of a project are known as equivalent…

Q: Harper takes out a loan of $126 for 25 years. The payments will form a constant growth annuity with…

A: The loan that is discharged by making equal payments having two components as interest amount and…

Q: You need a quick loan and decide to use the local "payday" loan office. The loan is for $800 and you…

A: FV = PV*(1+r)^n, Where, Given that Loan obtained (PV) = $ 800 Loan amount paid (FV) = $ 1025…

Q: This question is based on the following information: Each of the three independent investments below…

A: Present worth (NPV) is one of the techniques of capital budgeting analysis. NPV will be the…

Q: 1. Why do we study financial management? Enumerate its benefits to the success of a business.

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Which statement best describe subprime loans? a.Loan issued to high-risk borrowers with poor credit…

A: Subprime loans are the types of loans which carries interest rate of more than prime rate. These are…

Q: tfolio P has a beta of 1.0.

A: The beta of the portfolio refers to the weighted sum of the assets of the company according to the…

Q: To go on a summer trip, Bob borrows s700. He makes no payments until the end of 4 years, when he…

A: The total interest to be paid is calculated as simple interest amount for 4 years whereas total…

Q: This question is based on the following information: Pitts Company’s common stock is selling at P…

A: Cost of new common stock is defined as the minimum rate that is needed to be earned in order to…

Q: Suppose the economy contains two risk factors: the GDP growth rate and the interest rate. Experts…

A: Three factor model to calculate rate of return on a stock Under this model, risk free rate is…

Q: g) Based on the findings above, which alternatives is the best for Aisyah to choose? Justify your…

A: The investment in a combination of different stocks is known as a portfolio. The purpose behind…

Q: Suppose that you took out a mortgage loan and should repay $500 per month in the next 20 years. In…

A: Interest rate is the amount the lender charges the borrower and is the percentage of principal, or…

Q: 4. Mike wants to invest money every month for 30 years. He would like to have $500000 at the end of…

A: “Since you have asked multiple questions, we will solve the one question for you. If you want any…

Q: Cross-Ocean Boats Ltd. is in the 30% tax bracket. It is interested in determining the minimum return…

A: Data given: 1. 6% semi-annual coupon Bonds outstanding=3000. Mature = 12 years Sale price of…

Q: A stock has a required return of 11% and a dividend yield of 4%. The price of the stock is $90 and…

A: SOLUTION : GIVEN, Required return = 11% Dividend yield = 4% Stock price = $90 Now, Firsty we have…

Q: Triangular Chemicals has total assets of $95 million, a return on equity of 37 percent, a net…

A: The sales can be calculated for by using the DuPont equation

Q: 2. Suppose the Investment Yield on a 182-day T bill is 4%. What is its discount-basis yield?

A: Given, n= 182 days T bill = 4% Investment Yield = ? Discount-basis yield= ?

Q: ABC Company acquired all of XYZ Corporation's assets and liabilities on June 30, 20X1. XYZ reported…

A: Book value and fair value Book value is based on the original old purchase price where annual…

Q: Explain whether the following statement is true: “Duress is an unlawful threat of harm or injury…

A: A void contract is a formal agreement that is voidable from the moment it is signed. Although both…

Q: 3. Why is the initial value of a futures contract zero? a. impossible to tell b. the futures…

A: Answer:- c. You do not pay anything for it. EXPLANATION:- A futures contract is an agreement between…

Q: Lei Materials' balance sheet lists total assets of $1.05 billion, $127 million in current…

A: Market to book ratio is calculated as market value of equity divided by book value of equity

Q: The Mitchem Marble Company has a target current ratio of 2.1 but has experienced some difficulties…

A: The current ratio is calculated as ratio of current assets and current liabilities. Any increase in…

Q: The least risky capital market security is a. preferred stock. b. common stock. c. corporate bonds.…

A: As per Bartleby Honor Code, when multiple questions are asked, the expert is required only to solve…

Q: Although the Chen Company's milling machine is old, it is still in relatively good working order and…

A: Here, Cost of Machine is $106,000 Life of Equipment is 10 years After Tax Cash flows is $19,600 Cost…

Q: professionals review the existing accounts at least once a

A: Step 1 A debt analyst examines and evaluates a person's financial or corporate financial history to…

Q: A parcel of land can be leased for a period of 10 years. Initial development costs for clearing,…

A: The annual revenue grow by geometric sequence and present value of that can be found out from that…

Q: sells 500 shares of Gold Mine Corp. short at $80 per share. The margin requirement is 50 percent.…

A: When you short sell the stock than you will make profit when prices goes down from your purchase…

Q: An industrial plant bought a generator set for P120, 000. Other expenses including installation…

A: Here the amount to be depreciated will include the installation cost. This is because without the…

Q: Here and After Corporation plans a new issue of preferred stock. Similar risk stock currently offers…

A: Solution:- Preferred stock is the stock issued by the corporate which get preference over the common…

Q: In terms of Porfolio Variance calculation/formula of 0.02819 your computation is different than mine…

A: As per the given information in the question, we need to consider the standard deviation and weights…

Q: The citizens of a geographic area of the National City authorized a special assessment to be imposed…

A: Given is the information regarding the people of an area of the National city.

Q: 1. Help Prof. White on the following questions he has. Assume $1,000 has been deposited into Prof.…

A: Amount deposited per month us $1,000 Time period is 25 years for deposit and 25 years for…

Q: At a certain interest rate compounded semiannually, 5000 pesos will amount to 20 000 pesos after 10…

A: Future Value: The future value is the amount that will be received at the end of a certain period.…

Q: Given all else equal, if the yield to maturity of a Treasury bond decreases substantially, generally…

A: Yield to maturity the rate of return that bond hider will get if they hold such bond till maturity…

Q: You are thinking about buying a stock and holding it for 3 years. You expect that the stock will pay…

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal…

Q: Instruction: Show complete solution including the cash flow diagram if not given, Formula function,…

A: Given, Units = 125000 Sunk cost for Design A = $5000 Sunk cost for Design B = $9000

Suppose instead, Evergreen uses a retention ratio of 30%. Their capital budget

for the upcoming year = $1,600,000. Calculate the debt, external equity

financing required and the dividends per share.

Step by step

Solved in 6 steps

- Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)

- Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and state mcnt of cash flows: Long-term debt S 4,400 Interest expense S 398 Total liabilities 8,972 Net income 559 Total assets 38,775 Interest payments 432 Total equity 29,803 Cash flows from operations 1.015 Operating income 1.223 Income tax expenses 266 Income taxes paid 150 Required: Calculate the following ratios for Rising Stars: (a) debt to equity, (b) debt to total assets, (c) long-term debt to equity, (d) times interest earned (accrual basis), and (e) times interest earned (cash basis). (Note: Round answers to three decimal places.) CONCEPTUAL CONNECTION Interpret these results. 3.What does it mean if a bond is callableTwenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Ratio of fixed assets to long-term liabilities

- Balance Sheet Calculations Cornerstone Development Companys balance sheet information at the end of 2019 and 2020 is provided in random order, as follows: Additional information: At the end of 2019, (a) the amount of long-term liabilities is twice the amount of current liabilities and (b) there are 2,900 shares of common stock outstanding. During 2020, the company (a) issued 100 shares of common stock for 25 per share, (b) earned net income of 20,600, and (c) paid dividends of 1 per share on the common stock outstanding at year-end. Required: Next Level Fill in the blanks lettered (a) through (p). All of the necessary information is provided. (Hint: It is not necessary to calculate your answers in alphabetical order.)Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.Jamison Corp.'s balance sheet accounts as of December 31, 2021 and 2020 and information relating to 2021 activities are presented below. December 31, 2021 2020 AssetsCash $ 440,000 $ 200,000Short-term investments 600,000 —Accounts receivable (net) 1,020,000 1,020,000Inventory 1,380,000 1,200,000Long-term investments 400,000 600,000Plant assets 3,400,000 2,000,000Accumulated depreciation (900,000)…

- The following are the summarised financial information of Ting Ltd for the two financial years ended 31 October 2020 are as follows:2019 2020£ million £ millionEquity 2,460.8 1,732.8 Non-current liabilities (Loans) 640.0 800.0 Current liabilities 654.4 1,020.5 Non-current assets 2,804.8 2,367.2 Current assets 950.4 962.4 Revenue 1,601.6 1,509.6 Total expenses 1,444.0 1,492.8 Required:(a) Calculate the following financial ratios for the two years: 2019 and 2020:(i) Current ratio (ii) Capital gearing ratio (iii) Profit margin (b) Comment briefly on the ratios of the company, computed in part (a) over the two year period from 2019 to 2020. (c) Provide any two (2) recommendations on how the company may improve these ratios in the futur.Purrfect, Inc., reports the following statement of financial position amounts as of June 30,2020 Current asset P 2,440,500 Noncurrent assets 6,285,500 Current liabilities 1,386,000 Noncurrent liabilities 900,000 Owner’s equity 6,440,000 A review of account balances reveals the following data An analysis of current assets discloses the following: Cash P 422,500 Investment securities-trading 600,000 Trade accounts receivable 568,000 Inventories, including advertising supplies of P20,000 850,000 2,440,500 Noncurrent assets include the following: Property, plant and equipment: Depreciated book value (cost P 6,560,000) 5,490,000 Deposit with a supplier for merchandise ordered for August…Purrfect, Inc., reports the following statement of financial position amounts as of June 30,2020 Current asset P 2,440,500 Noncurrent assets 6,285,500 Current liabilities 1,386,000 Noncurrent liabilities 900,000 Owner’s equity 6,440,000 A review of account balances reveals the following data An analysis of current assets discloses the following: Cash P 422,500 Investment securities-trading 600,000 Trade accounts receivable 568,000 Inventories, including advertising supplies of P20,000 850,000 2,440,500 Noncurrent assets include the following: Property, plant and equipment: Depreciated book value (cost P 6,560,000) 5,490,000 Deposit with a supplier for merchandise ordered for August…